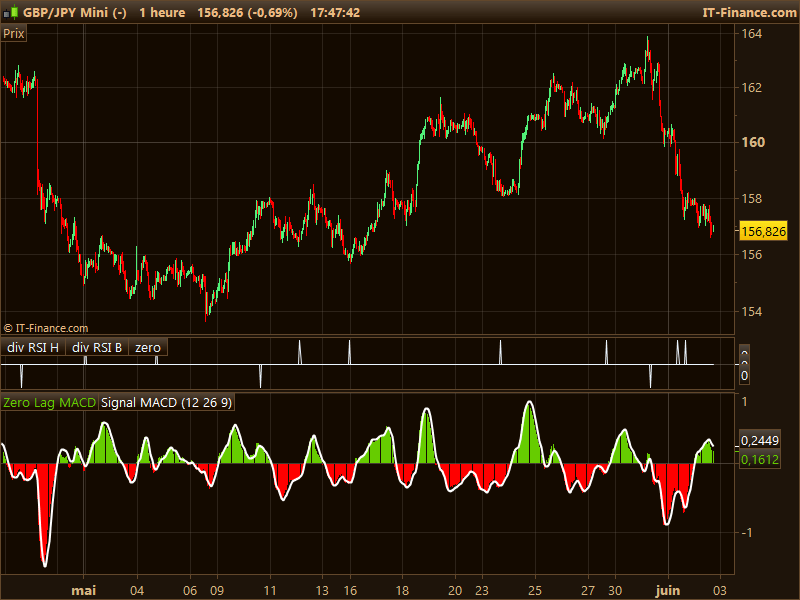

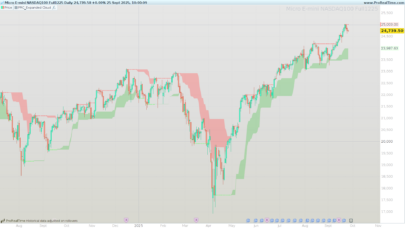

The MACD divergences spot difference between the price and the MACD histogram on recent lower low and highest high.

This indicator use the ZeroLag version of the MACD indicator that can be found on the library here: http://www.prorealcode.com/prorealtime-indicators/zerolag-macd/

Highest and Lowest point of the MACD are saved for divergence spotting only if the signal line of the MACD has crossed its histogram.

This indicator code is not the one of the MACD divergence indicator already embedded in the platform. It may have some differences of results between these two. This one can be used for any automated trading strategy development. The code is adapted from the RSI divergence HK-LISSE one.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 |

// DIVERGENCES ZeroLag MACD adapted from HK-LISSE RSI divergences code //MACD periods short = 12 long = 26 signal = 9 //----------- EMAshort1 = exponentialaverage[short](close) EMAshort2 = exponentialaverage[short](EMAshort1) DifferenceShort = EMAshort1 - EMAshort2 ZeroLagShort = EMAshort1 + DifferenceShort EMAlong1 = exponentialaverage[long](close) EMAlong2 = exponentialaverage[long](EMAlong1) DifferenceLong = EMAlong1 - EMAlong2 ZeroLagLong = EMAlong1 + DifferenceLong ZeroLagMACD = ZeroLagShort - ZeroLagLong signal1=ExponentialAverage[signal](ZEROLAGMACD) signal2=ExponentialAverage[signal](signal1) DIFFERENCE2=signal1-signal2 SignalMACD=signal1+DIFFERENCE2 x = ZeroLagMACD y = SignalMACD // BEARISH DIVERGENCES MACD hi=max(hi,x) hico=max(hico,max(high,high[1])) if x crosses under y then sto2b=sto1b sto1b=hi hi=0 p3b=p1b p2b=max(p1b,hico1) p1b=max(highest[3](high),hico) if p2b=p1b then p2b=max(p3b,p4b) endif hico=0 hico1=0 endif if x<y then p4b=hico1 hico1=max(hico1,high) endif if p1b>p2b and sto1b<sto2b and x crosses under y and x<x[1] then signB= -2 else signB= 0 endif // BULLISH MACD DIVERGENCES lo=min(lo,x) lowco=min(lowco,min(low,low[1])) if x CROSSES OVER y then sto2h=sto1h sto1h=lo lo=100 p3h=p1h p2h=min(p1h,lowco1) p1h=min(lowest[3](low),lowco) if p2h=p1h then p2h=min(p3h,p4h) endif lowco=100000 lowco1=100000 endif if x>y then p4h=lowco1 lowco1=min(lowco1,low) endif if p1h<p2h and sto1h > sto2h and x crosses over y and x>x[1] then signH= 2 else signH= 0 endif //////////////////////////////////////////////// RETURN signH as "Bullish MACD Divergence", signB as "Bearish MACD Divergence" , 0 as " zero " |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thank you as always Nicolas

Works fine, looks good!

I’ll work it into a few Auto-Systems and let you know.

Cheers

GraHal

This is a pretty useful indicator. I know how to identify divergences, but this definitely simplifies the task. I found that it is best used as an early warning signal, and then you open a trade on the next signal (on another indicator of your choice) confirming this one. e.g. every time if I had bought or sold based on this signal, I had a low chance of profit or breakeven. But if on this bullish signal, I waited for the next relative swing low to open my trade, I had about an 80-90% chance of profit or at least breakeven, even when it signaled countertrend during a larger opposite trend.I’m a little new to PRC, so maybe some other newbies will appreciate a minor tip: binary indicators like this one are visually easier when you set to Histogram and set the bullish color to green, bearish to red.

Thanks for your comment about feedback and tips on this indicator. Maybe you could share with us how do you jump into a trade after the divergences signals? A new forum thread would be the best to share ideas around this. Cheers.

Hello can some please help,,, if upload it j dont get the same as the above image

Hello Nicolas, in my opinion a divergence is only valid if between two low points or two high poins, the MACD histogram cross its centerline. Moreover, the bigger the difference between the two low/high points, the more powerfull is the divergence. Taking that into account, I don’t see real divergence in the chart you used as example. What do you think?

Divergences are made from tops and bottoms of MACD spotted when the histogram is crossing its signal line. It is a nice and smart framework developed by someone else, it is very useful because it doesn’t use any loops or arrays!

Hi Nicolas,

>>This indicator code is not the one of the MACD divergence indicator already embedded in the platform…

What’s the name of the indicator embedded in the system?

Hi, I’m not the author of this indicator. The MACD divergence source code of the one embedded in the platform is not available.

I think I’ve found it.

My questions:

1. Do you have the source code?

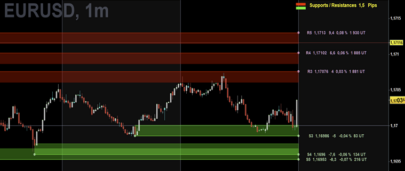

2. The following is a screenshot. It seems sometimes it hasn’t recognized the divergence?