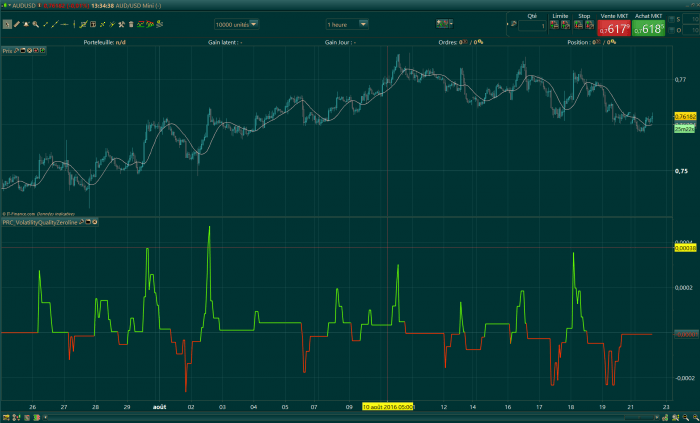

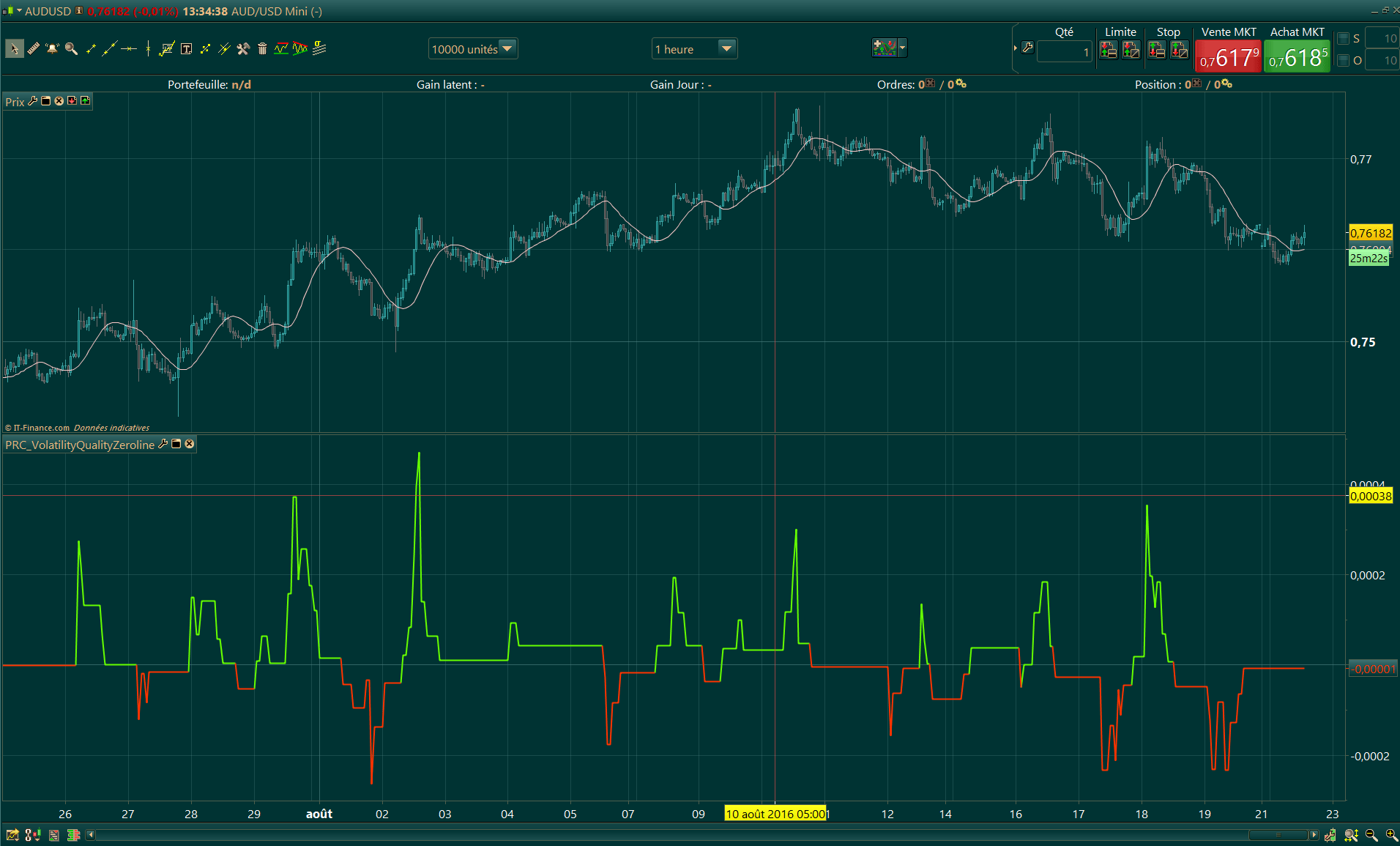

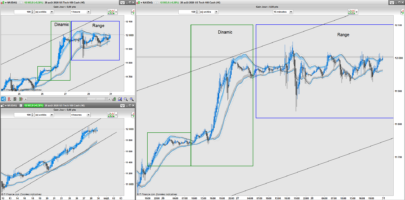

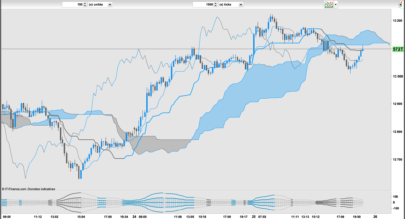

This technical indicator plot the current market volatility with trend direction signals. If the curve is above the zero line, market is bullish, if it is below, market is bearish.

It is calculated with recent market range compounded from the OHLC values of Weighted moving average. The pro of this indicator is that it can’t avoid ranging market because of its embedded volatility filter : when you are already in a trend, no inverse signal will be given unless a new reversal volatility is detected. The con is that because of its smoothing over the last 15 periods (default parameter), trend catching maybe a little late to appear on screen.

I found the idea original and smart enough to be converted to prorealtime code, so enjoy it and make your own idea about it.

Converted from MT4 code.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 |

//---parameters PriceSmoothing = 15 Filter = 5 cHigh = weightedaverage[PriceSmoothing](high) cLow = weightedaverage[PriceSmoothing](low) cOpen = weightedaverage[PriceSmoothing](open) cClose = weightedaverage[PriceSmoothing](close) pClose = cClose[1] trueRange = max(cHigh,cClose) - min(cLow,pClose) rrange = cHigh-cLow if rrange<>0 and trueRange<>0 then vqi = ((cClose-pClose)/trueRange + (cClose-cOpen)/rrange)*0.5 else vqi = vqi[1] endif vqi = abs(vqi)*(cClose-pClose+cClose-cOpen)*0.5 sumVqi = vqi if Filter>0 then if abs(sumVqi-sumVqi[1])<(Filter*ticksize) then sumVqi = sumVqi[1] endif endif if sumVqi > 0 then color = 1 else color = -1 endif return sumVqi coloured by color |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials