Warren Buffett, recognized globally as one of the most triumphant investors ever, is a leading figure in the realm of value investing. He is known for his philosophy, “Purchasing an outstanding business at a reasonable price is superior to buying a mediocre business at an attractive price.”

As a beginner in the investing world, large-cap, blue-chip U.S. companies are commonly recommended as ideal starting points. They form the cornerstone of a novice’s portfolio.

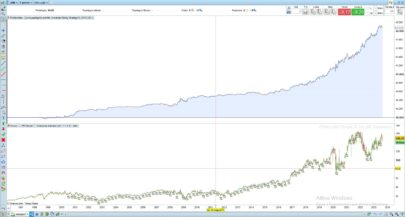

That’s why I created this “blue chips index” formula with the Calculated instruments tool of the platform.

These robust, financially stable corporations have well-established profits, diverse product lines, and have demonstrated their resilience during financial downturns and recessions. Their business growth tends to be consistent, and they often possess significant competitive advantages or ‘moats,’ making them particularly safe investments in the stock market.

For those embarking on the creation of a portfolio, some of the most favorable stock options could include:

- Apple Inc. (NASDAQ: AAPL)

- Alphabet Inc. (NASDAQ: GOOGL)

- Microsoft Corp. (NASDAQ: MSFT)

- McDonald’s Corp. (NYSE: MCD)

- Costco Wholesale Corp. (NASDAQ: COST)

- Coca-Cola Co. (NYSE: KO)

- Verizon Communications Inc. (NYSE: VZ)

This compilation represents a range of different sectors, including technology, software, food, and other consumer necessities, providing diversified exposure.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Josè I can’t load the itf calculated tool. The platform gives me an error “incorrect format”. Thank you