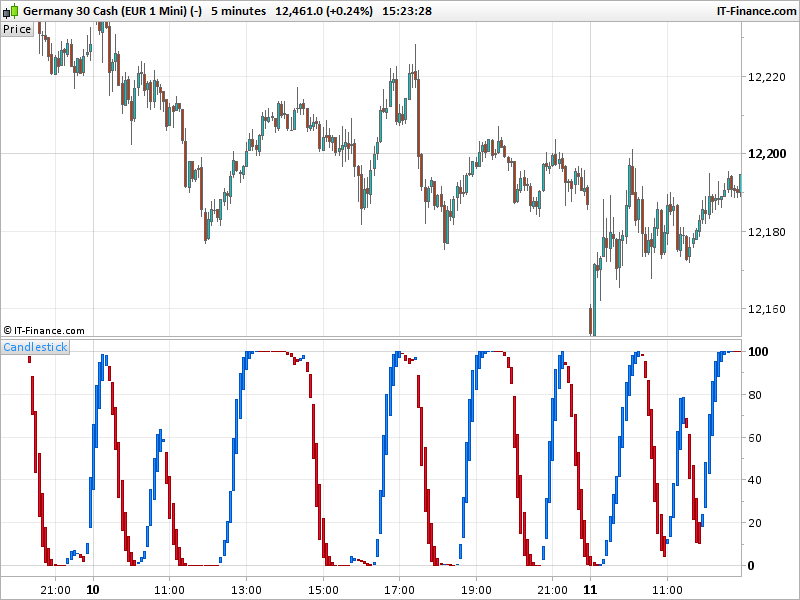

The Alf Winner indicator oscilllates between 0.00 (oversold) and 105 (overbought) values depending upon market conditions. Red bars suggest bearish pressure and green bars bullish pressure. It’s recommended to use this oscillator in conjunction with trend following indicators to trade in the direction of the overall trend.

Up trends: look to buy near the 0.00 level at the first green bar. Down trends: look to sell near the 105 level at the first red bar.

(description found on the web).

This indicator use a conjunction of price action (average of 2 times Close + High + Low) and Volumes in its formula, it results an oscillation between the 2 oversold and overbought zones. The curve is double smoothed with Weighted Moving Average, periods can be changed in the settings.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 |

//PRC_AFL Winner | indicator //27.04.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //Translated from MT4 version //---Settings //PERIOD = 10 //AVG = 5 //---end of settings if barindex>period then period=max(period,2) avg=max(avg,2) pa = (2*close+high+low)/4 scost5=summation[avg](volume*pa) svolume5=summation[avg](volume) pa5=scost5/svolume5 mmin=lowest[period](pa5) mmax=highest[period](pa5) rsv=((pa5-mmin)/max(mmax-mmin,pointsize))*100 pak = average[avg,2](rsv) pad = average[avg,2](pak) if pak>pad then drawcandle(pad,pak,pad,pak) coloured(30,144,255) else drawcandle(pak,pad,pak,pad) coloured(220,20,60) endif endif return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour Nicolas,

Merci infiniment pour cet indicateur mais je constate qu’il ne s’affiche pas sur le PRT plateform.

It needs Volume to calculate correctly. Please use it on a security which have Volumes!

OK, Merci encore

Dear Nicolas,

Thanks for this indicator!!I would like to set an alarm on this indicator (prc-afi-winner.itf) to let me know every time a candle changes color (to blue to red to red to blue). Is this possible in any way? Thanks in advance!!

It’s not possible to give alerts with the code sorry. You have to set an alarm yourself with the dedicated platform tool for this purpose.

Thanks Nicolas for youy fast response!!

Hi Nicolas it’s not related I’m sorry but I’m trying to learn coding and am a complete novice. I have a strategy I want to back test based on round numbers, pin bars and moving averages does this sound easy for me to learn or should I not bother? Any help you can offer would be massively appreciated.

Many thanks

Pete

I believe you will find all these informations (code snippets) on our forums already. If you have time to spend looking for those terms and compile all of them together in a strategy, it would be a very good exercise!

Thanks Nicolas I’ll give it a go. Computers and coding is not my thing but who knows. If all else fails would you be interested in coding the strategy and if so how much would you charge?

For personal assistance, you can submit your request with the form on this page: https://www.prorealcode.com/trading-programming-services/

Great stuff thanks Nicolas.

Hi!

I´m trying the indicator on dax but i only get it to work between 17:30 and 22:00. During the actual tradinghuors theres just a black gap.

Can you help me Nicolas?

Depends of your timezone, but this indicator needs Volume to compute correctly, so there might be no Volumes between those schedules.

Hi, I find your very useful indicator for my strategy. Can you also have a code for the proscreener?

bonjour pourquoi il fonctionne pas sur mon PRT ?

sa me fait rien du tout

L’indicateur a besoin de Volume pour se calculer, vérifier que l’instrument en question en possède.

Merci Nicolas pour cet indicateur

Hi Nicolas,

Its fair to say i’m a relative novice with ProRealtime and as such i am not sure how to use this code in my strategies. As a layman’s example with RSI;

“Indicator1 = RSI[14](Close)

RSIBuy = (Indicator1 70) ”

What would the syntax be for this code though? Do i have to call it first and if so, how do i then reference it?

Many thanks in advance,

James

You can use assisted creation in probacktest, you’ll get a quick overview on how to call a personal indicator. You can also find examples in our online Probuilder documentation, look at CALL instruction.

Thanks Nicolas, i’ll take a look