This indicator is an update to add lots of new features and improvements to my Break Out Analysis tool that can be found here:

Please read the description in that library post to understand the basics of what the tool can analyse.

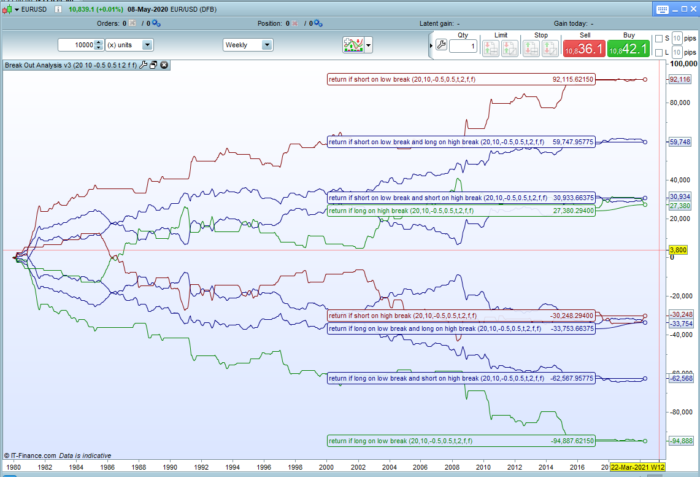

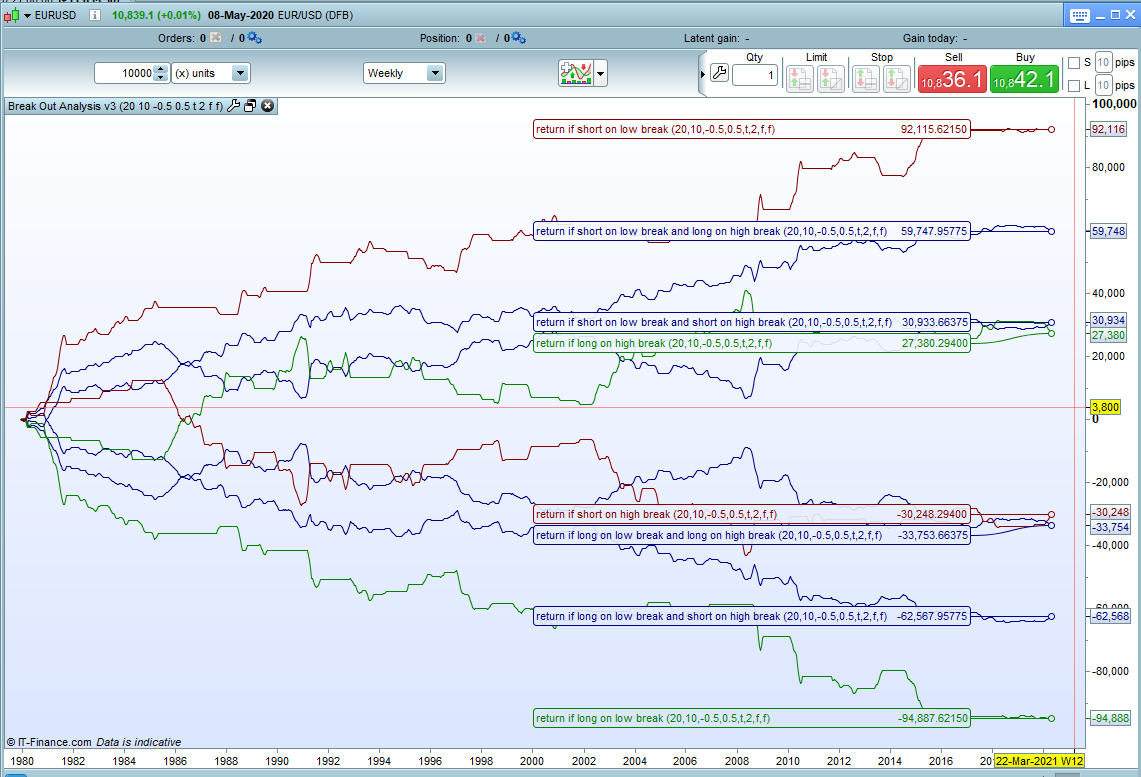

In this new version it is now possible to set the number of bars in the past that we look for our highest high and lowest low breakout levels in and to also set how many bars going forward that we look for a break of those levels in and exit the trade at the end of. ‘p’ and ‘pHold’ are the settings for this.

It is now also possible to adjust the high and low break out levels individually using the ‘HighBreakPerc’ and ‘LowBreakPerc’ settings. A positive number is above the level and a negative number below the level. So for example you can now check for breaks 1% lower than the highest high in the last p bars and 0.5% higher than the lowest low in the last p bars with settings of -1.0 and +0.5. The tool ignores any bars where the high break level is set below the open of our starting bar or where a low break level is set above the open of our starting bar. So if you get no results or very few results then you have probably moved the levels too far.

We can also now show the results for combinations of break out. So for example you can now see an equity curve for how much profit or loss you would have made if you’d gone long at every high break and short at every low break combined – and any other combination. Quantities and percentages are also shown for combinations now.

There is a setting ‘LevelStakes’ that reduces the stake size in half when viewing combined profit/loss lines so that we can directly compare them to the single breakout lines on a level playing field.

As always I advise downloading the ITF and importing to ensure that you get full functionality.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 |

//Break Out Analysis v3 //By Vonasi //20200510 //p = 3 //Quantity of bars used to find high break and low break levels //pHold = 10 //Quantity of bars used to look for a break in and close trade at end of //HighBreakPerc = 0 //Percentage above or below highest high to set break level at (+ = above hh and - = below hh) //LowBreakPerc = 0 //Percentage above or below lowest low to set break level at (+ = above ll and - = below ll) //Profitloss = 0 //Turn on and off profit/loss lines //Spread = 0 //Spread to be deducted in profit/loss calculations //LevelStakes = 1 //Use level stakes when combining breakouts //Quantities = 0 //Turn on and off quantity of breaks lines //Percentages = 0 //Turn on and off percentage lines once greenperc = undefined once redperc = undefined once hbperc = undefined once lbperc = undefined once hbciperc = undefined once lbciperc = undefined once hbcblperc = undefined once hbcahperc = undefined once lbcblperc = undefined once lbcahperc = undefined once hbcbhperc = undefined once hbcbhperc = undefined once lbcalperc = undefined once lbcalperc = undefined once hbcahlbcalperc = undefined once hbcahlbcblperc = undefined once hbcbhlbcalperc = undefined once hbcbhlbcblperc = undefined once rlonglb = undefined once rlonghb = undefined once rshortlb = undefined once rshorthb = undefined once rlonglblonghb = undefined once rlonglbshorthb = undefined once rshortlblonghb = undefined once rshortlbshorthb = undefined once rcount = undefined once rhb = undefined once rlb = undefined once rhbci = undefined once rlbci = undefined once rhbcbl = undefined once rhbcah = undefined once rlbcah = undefined once rlbcbl = undefined once rhbcbh = undefined once rlbcal = undefined once rbtot = undefined once rhbcalbca = undefined once rhbcblbca = undefined once rhbcalbcb = undefined once rhbcblbcb = undefined hh = highest[p](high[phold]) * (1 + (highbreakperc/100)) ll = lowest[p](low[phold]) * (1 + (lowbreakperc/100)) myopen = open[phold-1] if (myopen < hh) and (myopen > ll) then hhao = highest[phold](high) llao = lowest[phold](low) if barindex > p + phold then count = count + 1 if hhao > hh then hb = hb + 1 if close < hh and close > ll then hbci = hbci + 1 endif if close > hh then hbcah = hbcah + 1 endif if close < ll then hbcbl = hbcbl + 1 endif if close < hh then hbcbh = hbcbh + 1 endif longhb = longhb + (close - hh)-spread shorthb = shorthb + (hh - close)-spread endif if llao < ll then lb = lb + 1 if close < hh and close > ll then lbci = lbci + 1 endif if close < ll then lbcbl = lbcbl + 1 endif if close > hh then lbcah = lbcah + 1 endif if close > ll then lbcal = lbcal + 1 endif longlb = longlb + (close - ll)-spread shortlb = shortlb + (ll - close)-spread endif if close > myopen then green = green + 1 endif if close < myopen then red = red + 1 endif endif if percentages then greenperc = (green/count)*100 redperc = (red/count)*100 hbperc = (hb/count)*100 lbperc = (lb/count)*100 hbciperc = (hbci/hb)*100 lbciperc = (lbci/lb)*100 hbcblperc = (hbcbl/hb)*100 hbcahperc = (hbcah/hb)*100 lbcblperc = (lbcbl/lb)*100 lbcahperc = (lbcah/lb)*100 hbcbhperc = (hbcbh/hb)*100 hbcbhperc = (hbcbh/hb)*100 lbcalperc = (lbcal/lb)*100 lbcalperc = (lbcal/lb)*100 hbcahlbcalperc = (hbcahperc + lbcalperc)/2 hbcahlbcblperc = (hbcahperc + lbcblperc)/2 hbcbhlbcalperc = (hbcbhperc + lbcalperc)/2 hbcbhlbcblperc = (hbcbhperc + lbcblperc)/2 endif if profitloss then rlonglb = longlb rlonghb = longhb rshortlb = shortlb rshorthb = shorthb rlonglblonghb = (longlb+longhb) rlonglbshorthb = (longlb+shorthb) rshortlblonghb = (shortlb+longhb) rshortlbshorthb = (shortlb+shorthb) if levelstakes then rlonglblonghb = rlonglblonghb/2 rlonglbshorthb = rlonglbshorthb/2 rshortlblonghb = rshortlblonghb/2 rshortlbshorthb = rshortlbshorthb/2 endif endif if quantities then rcount = count rhb = hb rlb = lb rhbci = hbci rlbci = lbci rhbcbl = hbcbl rhbcah = hbcah rlbcal = lbcah rlbcbl = lbcbl rhbcbh = hbcbh rlbcal = lbcal rbtot = hb + lb rhbcalbca = rhbcah + rlbcal rhbcblbca = rhbcbh + rlbcal rhbcalbcb = rhbcah + rlbcbl rhbcblbcb = rhbcbh + rlbcbl endif endif return rlonglblonghb coloured(0,0,128) as "return if long on low break and long on high break", rlonglbshorthb coloured(0,0,128) as "return if long on low break and short on high break", rshortlblonghb coloured(0,0,128) as "return if short on low break and long on high break", rshortlbshorthb coloured(0,0,128) as "return if short on low break and short on high break", greenperc coloured(0,128,0) as "% green datum" , redperc coloured(128,0,0) as "% red datum", hbperc as "% of times there is a high break out", lbperc as "% of times there is a a low break out", hbcahperc as "% of high break outs that close above high", lbcahperc as "% of low break outs that close above high", hbciperc as "% of high break outs that close inside", lbciperc as "% of low break outs that close inside", hbcblperc as "% of high break outs that close below low", lbcblperc as "% of low break outs that close below low", rlonghb coloured(0,128,0) as "return if long on high break", rshorthb coloured(128,0,0) as "return if short on high break", rlonglb coloured(0,128,0) as "return if long on low break", rshortlb coloured(128,0,0) as "return if short on low break", hbcbhperc as "% of high break outs that close below high", lbcalperc as "% of low break outs that close above low", rcount as "total qty analysed", rhb as "qty of high breaks", rlb as "qty of low breaks", rhbci as "qty of high break outs that close inside", rlbci as "qty of low break outs that close inside", rhbcbl as "qty of high break outs that close below low", rhbcah as "qty of high break outs that close above high", rlbcah as "qty of low break outs that close above high", rlbcbl as "qty of low break outs that close below low", rhbcbh as "qty of high breaks that close below high", rlbcal as "qty of low breaks that close above low", rbtot as "qty of break outs", hbcahlbcalperc as "% high breaks that close above high and low breaks that close above low combined", hbcahlbcblperc as "% high breaks that close above high and low breaks that close below low combined", hbcbhlbcalperc as "% high breaks that close below high and low breaks that close above low combined", hbcbhlbcblperc as "% high breaks that close below high and low breaks that close below low combined", rhbcalbca as "qty of high break close above and low break close above", rhbcblbca as "qty of high break close below and low break close above", rhbcalbcb as "qty of high break close above and low break close below", rhbcblbcb as "qty of high break close below and low break close below" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Vonasi, thankx for the indicator I find it very usefel. I am trying to study the breakot analysis, it is a very interesting set of data. I have a doubt, I am not sure if the data of “returns” takes in account if there is an open position in the precedent candle. If not, the analysis would suppose that we have a “pseudoinfinite” amount of capital to face all the breakouts that may occur at the actual candle. For example, if our analysis takes a “p” value of 21 and “pHold” takes a value of 7, it may occur that you have several breakouts inside that pHold period, lets suppose that we have 5 breakouts inside that 7-candle period. The “return” data takes in account only the first breakout or it “opens” position in the 5 breakouts?

Thanks for the work done!

Hi @Vonasi, this is an excellent tool!

I noticed you times by 180 and was wondering why? When I set a Dow chart to 10k units and set percent to unlikely figures like 200% it still gives a a probability of 67% long and 110% short?

I also added an anchordate to get a specific lookback period (eg 10 years) using this:

Please note, I am having trouble getting the Insert PRT Code not to insert html instructions within my post using Safari, (because Chrome won’t let me edit posts once posted).

—————————————————————————

“Lookback Period”

AnchorDate = 20111130 //Date anchor YYYYMMDD format

if date=anchordate then

startbar=barindex

endif

lookback = max(1,barindex-startbar)

if lookback>0 and date>=AnchorDate then

—————————————————————————

Is it possible to make that as a variable integer so it can be changed easily in Settings. I added 20111130 but it’s not updating the indicator when values are changed in Settings (although it works fine editing the date from within the indicator code)?

I also wondered with the HighBreakPerc and LowBreakPerc feature if it will return the probability percent of, for example, the likelihood of the Dow making a 5% fall over a 15 day period? You wrote:

“A positive number is above the level and a negative number below the level. So for example you can now check for breaks 1% lower than the highest high in the last p bars and 0.5% higher than the lowest low in the last p bars with settings of -1.0 and +0.5.”

So can it calculate breaks 6.1% higher than the highest high in the last 15 bars and also 5.1% lower than the lowest low in the last 15 bars with settings of +6.1 and -5.1 or am I misinterpreting the bit about “adjust(ing) the high and low break out levels individually?”

Cheers,

Bard

I have no idea what is wrong with the posting on this website. I have problems editing posts clearly as can be seen above. Pls delete it. I only added two small paragraphs in my edit. I also cannot get the edit feature to work on other parts of this forum using either Chrome or Safari as Im using today? The add PRT code buttons has also disappeared on both browers in the last week?

Hi @Vonasi, this is an excellent tool!

I noticed you times by 180 and was wondering why? When I set a Dow chart to 10k units and set percent to unlikely figures like 200% it still gives a a probability of 67% long and 110% short?

I also added an anchordate to get a specific lookback period (eg 10 years) using this:

Please note, I am having trouble getting the Insert PRT Code not to insert html instructions within my post using Safari, (because Chrome won’t let me edit posts once posted).

—————————————————————————

“Lookback Period”

AnchorDate = 20111130 //Date anchor YYYYMMDD format

if date=anchordate then

startbar=barindex

endif

lookback = max(1,barindex-startbar)

if lookback>0 and date>=AnchorDate then

—————————————————————————

Is it possible to make that as a variable integer so it can be changed easily in Settings. I added 20111130 but it’s not updating the indicator when values are changed in Settings (although it works fine editing the date from within the indicator code)?

I also wondered with the HighBreakPerc and LowBreakPerc feature if it will return the probability percent of, for example, the likelihood of the Dow making a 5% fall over a 15 day period? You wrote:

“A positive number is above the level and a negative number below the level. So for example you can now check for breaks 1% lower than the highest high in the last p bars and 0.5% higher than the lowest low in the last p bars with settings of -1.0 and +0.5.”

So can it calculate breaks 6.1% higher than the highest high in the last 15 bars and also 5.1% lower than the lowest low in the last 15 bars with settings of +6.1 and -5.1 or am I misinterpreting the bit about “adjust(ing) the high and low break out levels individually?”

Cheers,

Bard

And now my first post displays okay? It literally had copies of my orig post all added together about ten times in a really long comment when I edited it to add two paragraphs. Now that huge long post has gone? And now it looks like a double post! I’ve no idea why this has happened!?