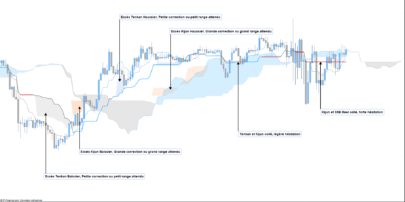

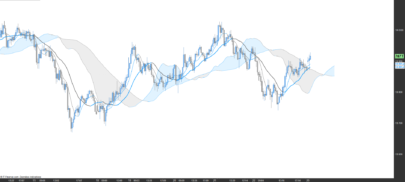

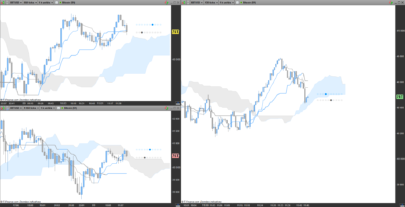

The Kumo Break method is one of the main systems applied by the Ichimoku traders for detecting key reversals. By using the kumo, we can qualify the current reversal, which provides traders with a unique opportunity to either take profits on current positions, or take a new reversal setup.

It is effective in timing trends, reversals and trading strategic reversals when all the elements are in place. Its ability to measure support and resistance enables the Ichimoku to also provide traders with a unique perspective on the markets.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

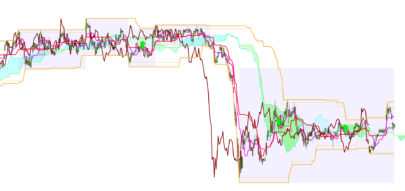

// BREAK OUT KUMO BOK = 0 Tenkansen = (highest[9](high)+lowest[9](low))/2 Kijunsen = (highest[26](high)+lowest[26](low))/2 SSpanA = (tenkansen[26]+kijunsen[26])/2 SSpanB = (highest[52](high[26])+lowest[52](low[26]))/2 IF SSpanB > SSpanA THEN //Kumo vers le bas // BREAK OUT KUMO vers le bas if close < SSpanA and close[1] > SSpanA[1] then BOK = -1 else // BREAK OUT KUMO vers le haut if close > SSpanB and close[1] < SSpanB[1] then BOK = 1 endif endif else //Kumo vers le haut // BREAK OUT KUMO vers le haut if close > SSpanA and close[1] < SSpanA[1] then BOK = 1 else // BREAK OUT KUMO vers le bas if close < SSpanB and close[1] > SSpanB[1] then BOK = -1 endif endif ENDIF return BOK as "BO KUMO" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Nice Job !

Here is my version of the code :

KBO = 0

Tenkansen = (highest[9](high)+lowest[9](low))/2

Kijunsen = (highest[26](high)+lowest[26](low))/2

SSpanA = (tenkansen[26]+kijunsen[26])/2

SSpanB = (highest[52](high[26])+lowest[52](low[26]))/2

// KBO haussier

IF (close crosses over SSpanA and SSpanA > SSpanB) OR (close crosses over SSpanB and SSpanB > SSpanA) THEN

KBO = 1

ENDIF

// KBO baissier

IF (close crosses under SSpanA and SSpanA < SSpanB) OR (close crosses under SSpanB and SSpanB < SSpanA) THEN

KBO = -1

ENDIF

return KBO as \"KUMO BREAKOUT\"

Thanks for this code.

The only thing left missing is the time lapse, otherwise, lots of older signals are generated, some have been triggered months ago. I guess it’s just a line of code to add ?

e.g. Kumo break out for the last X days