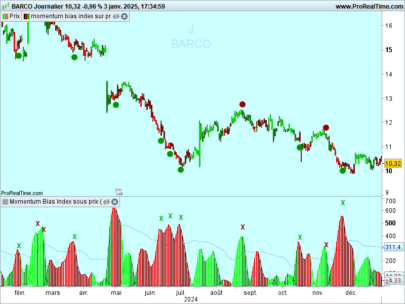

RVI – Relative Volatility Index

I have programmed one of the scarce indicators still missing in this wonderful workstation.

RVI is a basic tool to trade on volatility, a very profitable strategy over recent years.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 |

REM RVI (Relative Volatility Index) is in fact a RSI REM calculated on the standard deviation over the closing prices of 10 days REM instead of being calculated over daily variations REM RTLudo's "BuilderRSI" inspired me this code: upward = (CLOSE > CLOSE[1]) * STD[10] downward = (CLOSE < CLOSE[1]) * STD[10] REM Calculating the average profits of upward days REM and the average losses on downward days upwardMA = wilderAverage[p](upward) downwardMA = wilderAverage[p](downward) REM RS is deducted RV = upwardMA / downwardMA REM And finally, the RSI myRVI = 100 - 100 / (1 + RV) RETURN myRVI AS"Relative Volatility Index" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials