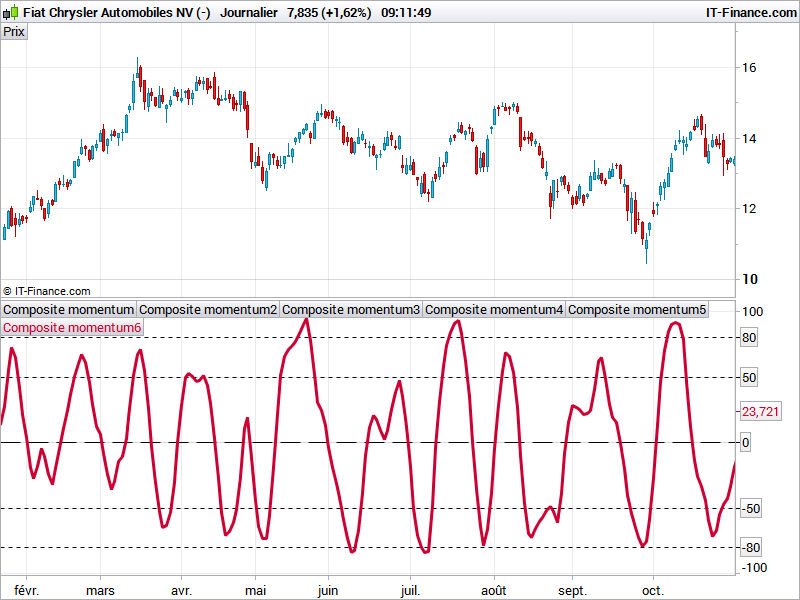

I found this Composite Momentum indicator code in an Italian forum recently. It has raise some interest over years, so that’s why I add it to the Library. This oscillator seems quite interesting for picking stock that show recent momentum raise.

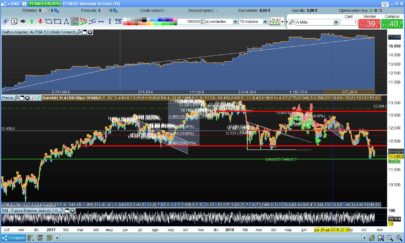

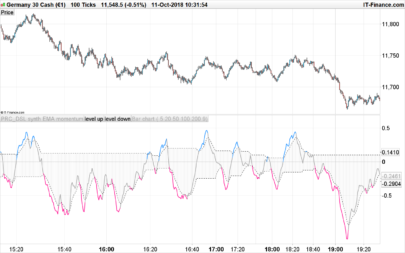

To buy stocks, the author identify the lowest levels of the indicator to be the “opportunity zone”, between -80 to -50, while the highest levels are the dangerous zone to avoid initiate new long orders on market.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 |

k=4 media1=average[3](Close) media2=average[9](close) Mom=exponentialaverage[1]((media1-media2)/media1)*100 diffMOM=MOM-MOM[1] If MOM>MOM[1] then temp1=diffMOM else temp1=0 endif If MOM<MOM[1] then temp2=diffMOM else temp2=0 endif sumtemp1=summation[5](temp1) sumtemp2=summation[5](temp2) abssumdiff=summation[5](abs(diffMOM)) aa=((sumtemp1[1]-(sumtemp1[1]/5)+temp1)/(abssumdiff[1]-(abssumdiff[1]/5)+abs(diffmom))*100) bb=((sumtemp2[1]-(sumtemp2[1]/5)+temp2)/(abssumdiff[1]-(abssumdiff[1]/5)+abs(diffmom))*100) cc=aa-abs(bb) key=ExponentialAverage[3](cc) k=((close-lowest[5](low))/(highest[5](high)-lowest[5](low)))*100 d=average[3](k) xtl=WeightedAverage[3](d)*2-100 Composite=WeightedAverage[2]((2*key+xtl)/3) l1=50 l2=-50 linea1=80 linea2=-80 linea3=0 return linea1,linea2,linea3,l1,l2,Composite |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

bonjour à tous

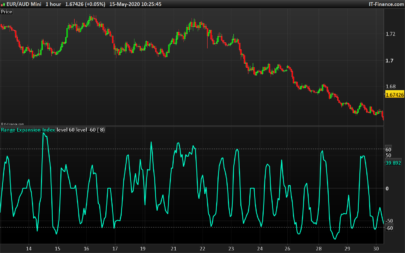

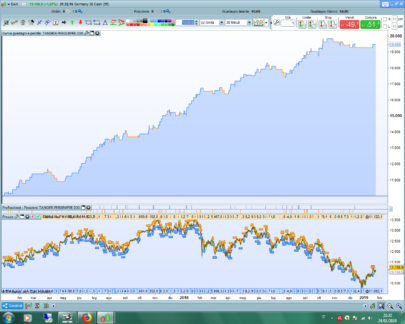

J’utilise cet indicateur depuis plusieurs mois, une fois règlé “K” à sa convenance , on peut en tenir compte car il renvoie de bons signaux. l’Italiano Francesco est un tout bon !

bons trades