Hello everyone. I found this indicator on the internet and I got help with PRT code from the Great Nicolas ,thanks man.

The ROC indicator described here has some advantages as compared to a simple MA – it has smaller lag and is more illustrative.

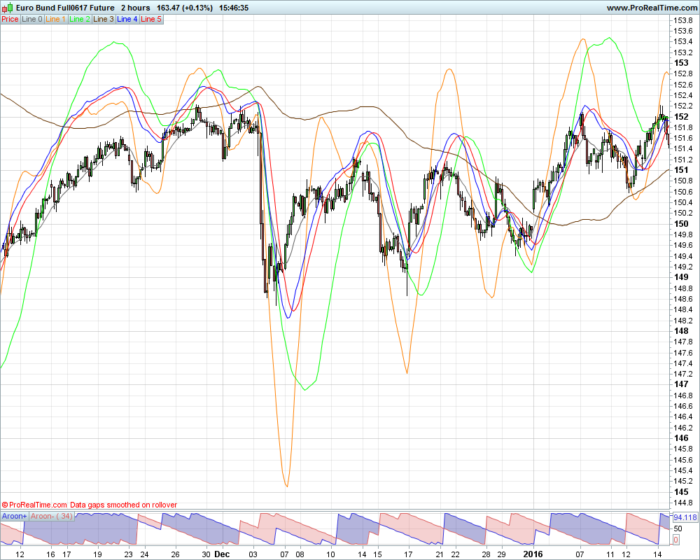

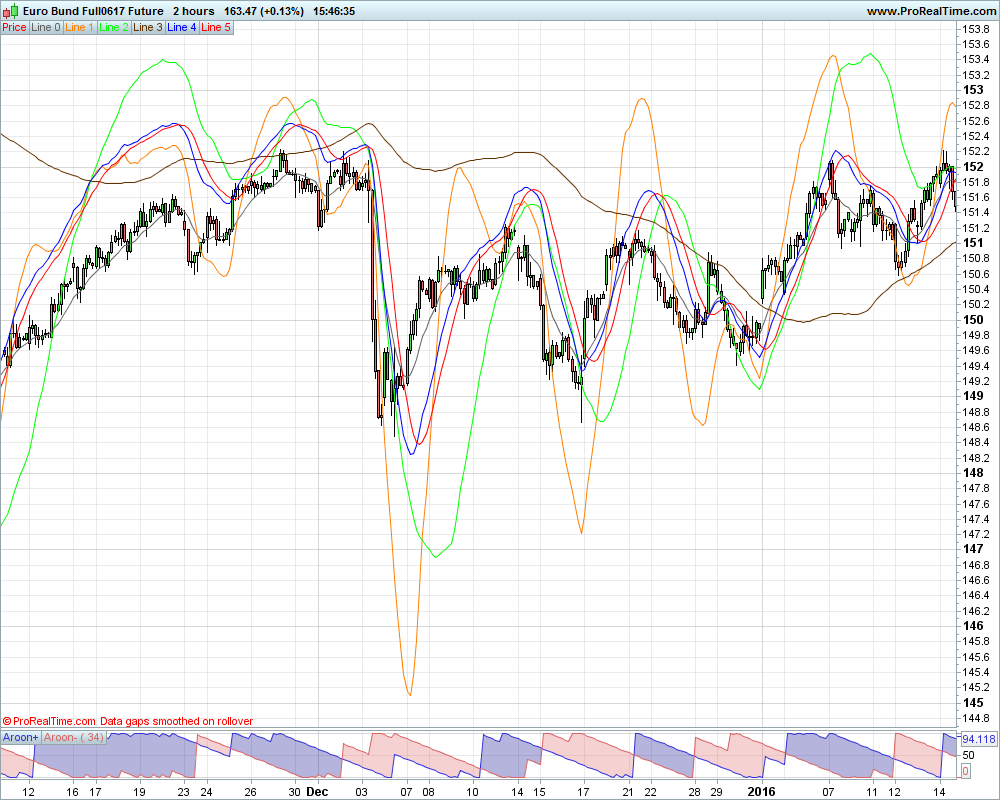

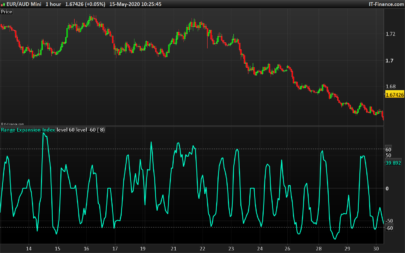

Starting the indicator you will see 6 indicator lines in a chart window:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 |

// ---^paremeters^--- PeriodMA0=13 // Period of supporting MA for cur. timefr. PeriodMA1=21 // Period of calculated MA BarsV =13 // Amount of bars for calc. rate AverBars =5 // Amount of bars for smoothing K =2 // Amplifier gain // Calculating coefficient for different timeframes // case 1: K2=5;K3=15; Timeframe M1 // case 5: K2=3;K3= 6; Timeframe M5 // case 15: K2=2;K3= 4; Timeframe M15 // case 30: K2=2;K3= 8; Timeframe M30 // case 60: K2=4;K3=24; Timeframe H1 // case 240: K2=6;K3=42; Timeframe H4 // case 1440: K2=7;K3=30; Timeframe D1 // case 10080: K2=4;K3=12; Timeframe W1 // case 43200: K2=3;K3=12; Timeframe MN K2 = 2 K3 = 12 // ---^paremeters^--- Sh1=BarsV // Period of rate calcul. (bars) Sh2=K2*Sh1 // Calc. period for nearest TF Sh3=K3*Sh1 // Calc. period for next TF PeriodMA2 =K2*PeriodMA1 // Calc. period of MA for nearest TF PeriodMA3 =K3*PeriodMA1 // Calc. period of MA for next TF PeriodMA02=K2*PeriodMA0 // Period of supp. MA for nearest TF PeriodMA03=K3*PeriodMA0 // Period of supp. MA for next TF //-------------------------------------------------------- 12 -- MA0=weightedaverage[PeriodMA0](typicalprice) Line0=MA0 // Value of supp. MA //-------------------------------------------------------- 13 -- MAc=weightedaverage[PeriodMA1](typicalprice) MAp=weightedaverage[PeriodMA1](typicalprice)[Sh1] Line1=MA0+K*(MAc-MAp) // Value of 1st rate line //-------------------------------------------------------- 14 -- MAc=weightedaverage[PeriodMA2](typicalprice) MAp=weightedaverage[PeriodMA2](typicalprice)[Sh2] MA02= weightedaverage[PeriodMA02](typicalprice) Line2=MA02+K*(MAc-MAp) // Value of 2nd rate line //-------------------------------------------------------- 15 -- MAc=weightedaverage[PeriodMA3](typicalprice) MAp=weightedaverage[PeriodMA3](typicalprice)[Sh3] MA03= weightedaverage[PeriodMA03](typicalprice) Line3=MA03+K*(MAc-MAp) // Value of 3rd rate line //-------------------------------------------------------- 16 -- Line4=(Line1+Line2+Line3)/3 // Summary array Sum=0 // Technical means for n=0 to AverBars do // Summing last values Sum=Sum + Line4[n] // Accum. sum of last values Line5= Sum/(AverBars+1) // Indic. array of smoothed line next RETURN Line0 coloured(100,100,100) as "Line 0",Line1 coloured(255,128,0) as "Line 1",Line2 coloured(0,255,0) as "Line 2",Line3 coloured(102,51,0) as "Line 3",Line4 coloured(0,0,255) as "Line 4", Line5 coloured(255,0,0) as "Line 5" |

- black line – supporting MA for building a price rate line on the current timeframe;

- orange line – price rate of change on the current timeframe;

- green line – price rate of change on the nearest higher timeframe;

- brown line – price rate of change on the next higher timeframe;

- blue line – average line of the rate of price change;

- red line – smoothed average line of the rate of price change.

Parameters can be set in the code from line 2 to 21. For the coefficient applied to the current timeframe, you’ll need to adapt them yourself (settings are in code from line 10 to 18), because PRT code can’t retrieve that is the current timeframe.

By default, I set the K2 and K3 coefficients to 2 hour timeframe.

And K2 and K3 need to be changed dependent on which timeframe you are using

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials