Hello all,

This indicator isn’t my idea, it is the code of “Denis O.”, who did sent it to me by email. With his permission, I did post it here.

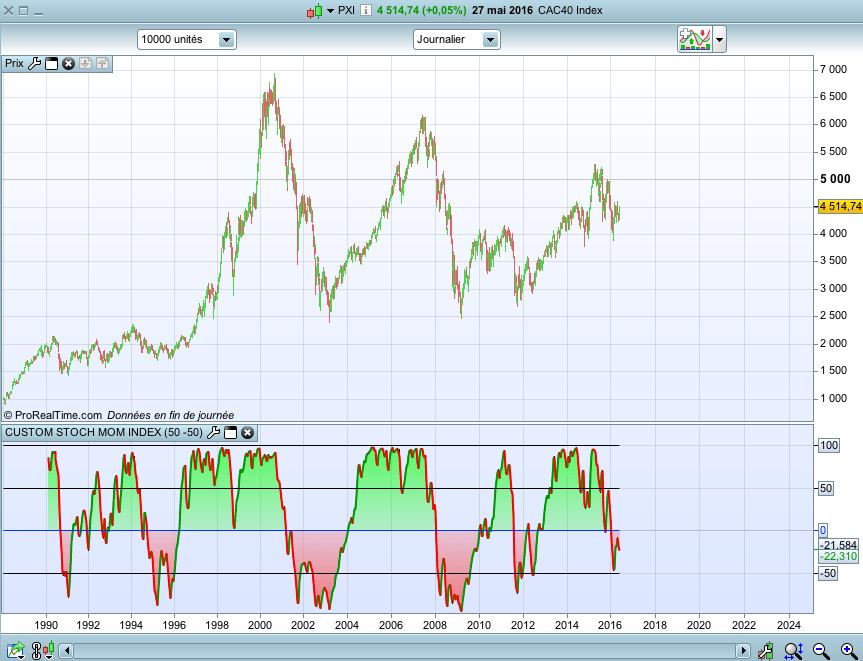

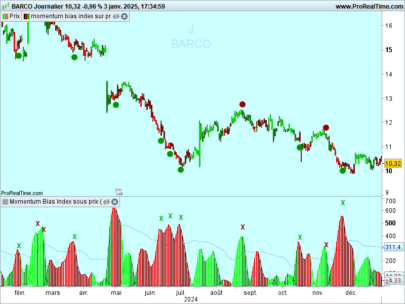

It is not the classical “stochastic momentum index”, but this one is customizable.

We can consider a “buy” signal when the indicator crosses 0, and we go out when it goes < 50 ; of course, you can change this value.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 |

// STOCHASTIC MOMENTUM INDEX // par Denis 0. periodes=500 MMlongue=15 MMcourte=10 MMsignal=3 choix=0 Ligne0=0 BorneSup = 100 BorneInf=-100 seuilsup=a seuilinf=b SMI1=100*(ExponentialAverage[MMCourte](ExponentialAverage[MMLongue](customClose-(0.5*(highest[Periodes](HIGH)+lowest[Periodes](LOW))))) /(0.5*ExponentialAverage[MMCourte](ExponentialAverage[MMLongue](highest[Periodes](HIGH)-lowest[Periodes](LOW))))) Signal=Average[MMSignal,Choix](SMI1) Return BorneSup as " BorneSup " , BorneInf as " BorneInf " , SMI1 as "Signal Trade Long-Short", Signal as "INDICATEUR" , ligne0 as "ligne ZERO", seuilsup as "Sortie de Tendance Haussière", seuilinf as "Sortie de Tendance Baissière" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

I forgot to write at the beginning :

a = 50

b = 50

These are intermediate levels

Sorry

Thank you. This one could be an aid in my current research on stochastics.

it is possible that in line 12 we should put seuilinf=-b, thaks for all