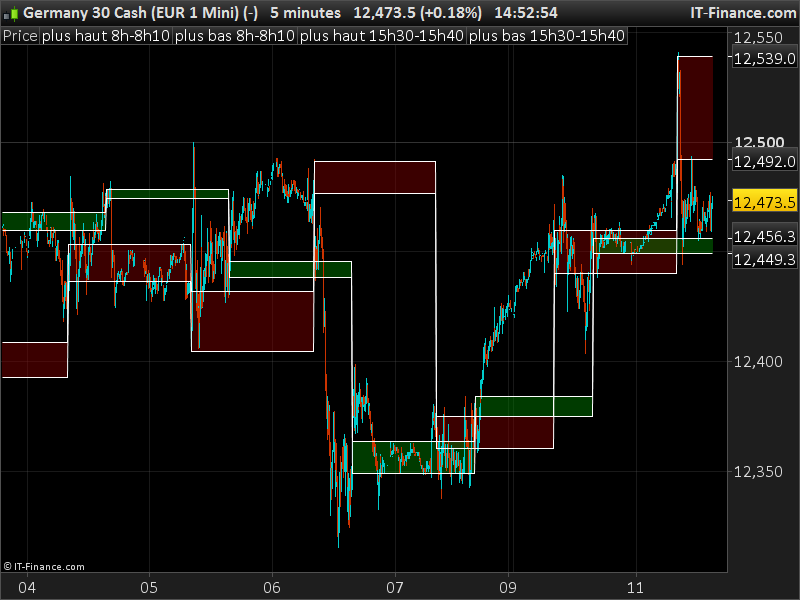

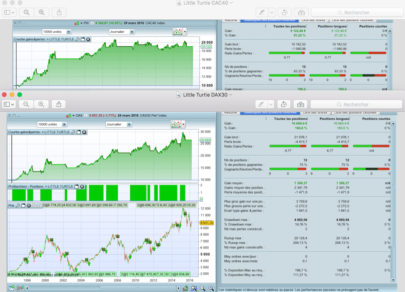

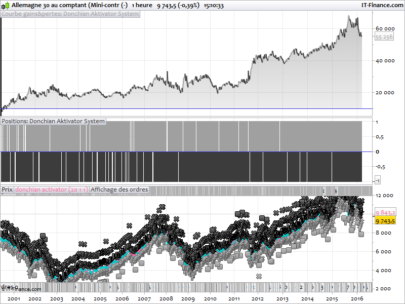

EN/ Here is a very useful indicator for those who practice the intraday. It is marking the first 10 minutes of the DAX and the opening of WALL-STREET (green and blue in the graph) .We noticed that the highest or lowest act of resistance / support and thus break out … able. Do not forget to fill the two indices once installed.

TRADES GOOD

FR/ Voici un indicateur très utile pour ceux qui pratiquent de l’intraday.Il s’agit du marquage des 10 premières minutes du DAX et de l’ouverture de WALL-STREET(en vert et bleu dans le graphe).On remarquera que les plus hauts ou plus bas font office de résistance/support et donc break out…able.Ne pas oublier de faire le remplissage des deux indices une fois installé.

BON TRADES

|

1 2 3 4 5 6 7 8 9 10 |

IF TIME =081000 THEN plushaut=highest[1](high) plusbas = lowest[1](low) ENDIF IF TIME = 154000 THEN plushaut1 = highest[1](high) plusbas1 = lowest[1](low) ENDIF RETURN plushaut AS "plus haut 8h-8h10",plusbas AS "plus bas 8h-8h10",plushaut1 AS "plus haut 15h30-15h40",plusbas1 AS "plus bas 15h30-15h40" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

best with this hour

IF TIME =081000 THEN

plushaut=highest[2](high)

plusbas = lowest[2](low)

mediane = (plushaut+plusbas)/2

ENDIF

IF TIME = 162500 THEN

plushaut1 = highest[2](high)

plusbas1 = lowest[2](low)

mediane1 = (plushaut1+plusbas1)/2

ENDIF

RETURN plushaut AS “plus haut 8h-8h10”,plusbas AS “plus bas 8h-8h10”,plushaut1 AS “plus haut 16h15-15h25”,plusbas1 AS “plus bas 16h15-16h25”,mediane AS “médiane”,mediane1 AS “mediane1”

Hi! I’m trying to put together a similar indicator but struggling. I want to mark the NY Pit session (9:30 AM – 4:00 PM) each day for US500 with a vertical line and the opening 30 second range with a horizontal box. Could you or anyone help with this?

Kind Regards