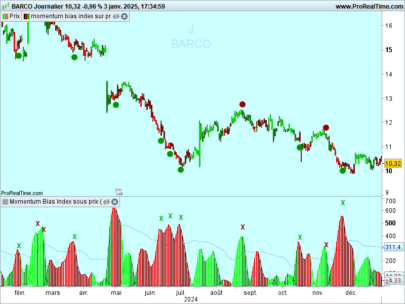

The DeMarker (DM) is a very good indicator to spot divergencies with price. In the way the DeMarker is computed it gives, often, even better signal than the RSI.

The way I use it. Once I find the divergence I wait until the DM crosses above the peak between the two bottom and enter long. The opposite for shorts.

Blue skies!!

|

1 2 3 4 5 6 7 8 |

//DeMarker Indicator period=14 up=max(0,high-high[1]) down=max(0,low[1]-low) ratio=100*average[period](up)/(average[period](up)+average[period](down)) return ratio as "DeMarker",20,80 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Gabri;

thank you for your interresting indicator. Is it possible to give different names to the lines 20, 80 and price line? it can allow integration of your indicator in a auto strategy.

Regards,

Rogers.

Rogers,

if I understood correctly your question you can write a line like this:

return ratio as \"Line\",20 as \"20\",80 as \"80\"

Thank you Gabri for your reply. it is ok now for me. thanks again 🙂

How do you spot the divergences? Do you use an divergence-finder indicator?

HeikinAshi, you can use this divergency finder https://www.prorealcode.com/prorealtime-indicators/rsi-divergences-finder/ and set the variable a in the first line with a call function for the demarker.

Thanks Gabri, I thought in this direction. I’ll check it out, thanks!