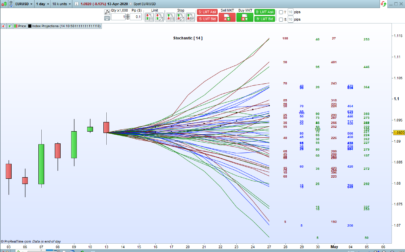

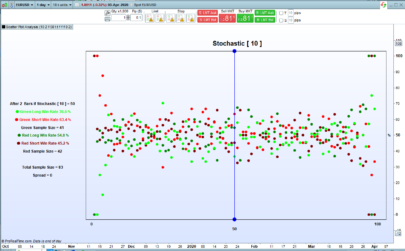

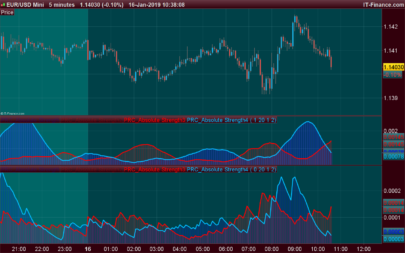

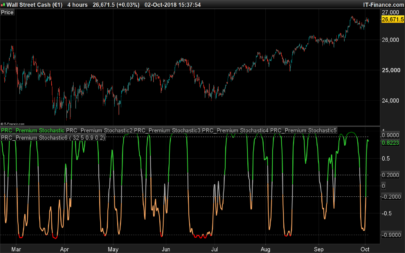

The Double Smoothed Stochastic indicator was proposed by William Blau and Walter Bressert. The calculation of the DSS values is similar to the Stochastic indicator, the difference is the use of the double exponential smoothing.

The interpretation of the DSS values is the same as for Stochastic – the values above 80 indicate the state of overbought market, the values below 20 indicate the state of the oversold market.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 |

//PRC_DSS Bressert | indicator //01.08.2019 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- settings PDS = 10 EMAlen = 9 TriggerLen = 5 Overbought = 80 Oversold = 20 // --- end of settings sto1 = stochastic[PDS,1](close) xPreCalc = average[EMAlen,1](sto1) storange = highest[PDS](xPreCalc)-lowest[PDS](xPrecalc) sto2 = (xPrecalc-lowest[PDS](xPrecalc))/storange*100 //sto2 = stochastic[PDS,1](xPreCalc) xDSS = average[EMAlen,1](sto2) xTrigger = average[TriggerLen,1](xDSS) RETURN overbought coloured(0,255,0) style(dottedline,3), oversold coloured(255,0,0) style(dottedline,3),xDSS coloured(0,0,255),xTrigger coloured(255,0,0) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour Nicolas . Je cherche une strategie pour faire du trading automatisé. J’ai essaye avec Heikin Ashi mais cela ne fonctionne pas. Est ce que tu aurais des recommendations sur des strategies automatisé. Indicateurs…..