Good Day PRT Community

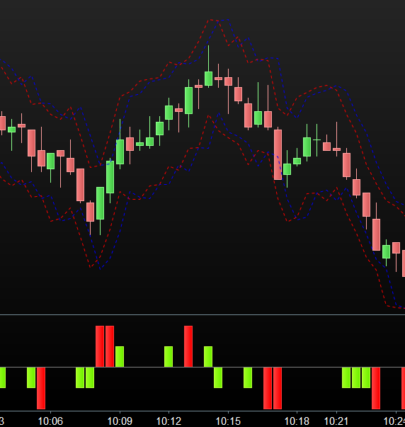

It has been a while since I last shared an indicator to the PRT library so here is something I coded today that might give a more accurate reflection of the Average True Range.

The basic idea was to create an ATR that will adapt to its timeframe by only considering the intraday price movements if a timeframe of smaller than Daily is used or looking only at price data for the week if a Daily timeframe is used. At this stage, Daily is the highest supported timeframe.

The parameters are as follow:

TFMinutes: Enter your timeframe in minutes. All default timeframes are supported up to Daily (i.e. 5m = 5, 1H = 60, 4H = 240, Daily = 1440, etc.)

TFMultiplier1: For those too lazy to work out higher timeframes you can use the multipliers (i.e. to get to 3H timeframe use 60 as TFMinutes and 3 as TFMultiplier1)

TFMultiplier2: Extention to the above functionality

stdDev: standard deviation used to calculate the Relative ATR line

MarketOpenHour: The opening hour of the market

Three different ATR values are calculated:

- The total price range for the intraday trading session (TF < Daily) or total price range of the weekly trading data (TF = Daily)

- Relative ATR calculated using an average and taking into account standard deviation

- Sampled ATR using price data from three different data sets within the evaluation period

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 |

//Dynamic ATR v1.0 (For ProRealTime) //By Juan Jacobs //www.FXautomate.com defparam calculateonlastbars = 1440 //Default Parameters: //TFMinutes = 60 (Integer) //TFMultiplier1 = 1 (Integer) //TFMultiplier2 = 1 (Integer) //stdDev = 1.2 (Decimal) //MarketOpenHour = 8 (Integer) TF = TFMinutes*TFMultiplier1*TFMultiplier2 OpenMin = MarketOpenHour*60 If TF >= 1440 Then per = ((DayofWeek*TF)-(1440-OpenMin)-((24-Hour)*60))/TF ElsIf TF >= 60 Then per = (1440-OpenMin-((24-Hour)*60))/TF Else per = (1440-OpenMin-((24-Hour)*60)+minute)/TF EndIf If per < 1 Then per = 1 Else per = abs(round(per)) EndIf PeriodHigh = Max(Highest[per](close),Highest[per](open)) PeriodLow = Min(Lowest[per](close),Lowest[per](open)) PeriodRange = PeriodHigh - PeriodLow RelativeATR = average[per](range)+stdDev*STD[per](range) If abs(Round(per/5)) < 1 then Sample1 = 1 Else Sample1 = abs(Round(per/5)) //Represents first and last 20% of data EndIf If abs(Round(per/2.5)) < 1 Then Sample2 = 1 Else Sample2 = abs(Round(per/2.5)) //Represents middle 40% of data EndIf Sample3 = Sample1 + Sample2 SampledATR = average[per](((AverageTrueRange[Sample1](close)[Sample3])+(AverageTrueRange[Sample2](close)[Sample1])+(AverageTrueRange[Sample1](close)[1]))/3) Return PeriodRange coloured(0,0,0) style(line,4) as "PeriodRange",RelativeATR coloured(255,0,255) style(line,4) as "ATR", SampledATR coloured(55,255,55) style(line,4) as "SampledATR", per as "Periods Used" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

I have actually completely redesigned this indicator with loads of improvements, so will resubmit to the library as v2.0 (moderators perhaps you can delete this version)