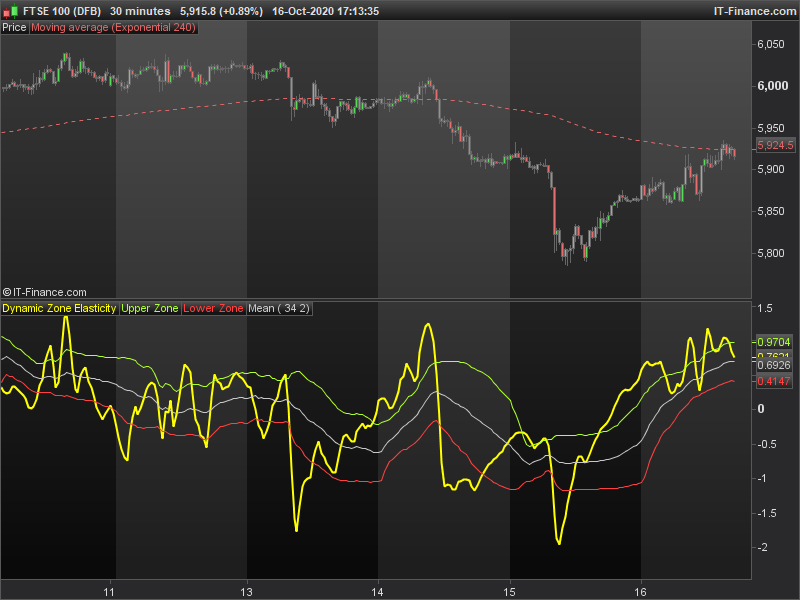

Dynamic Zone Elasticity indicator is an oscillator to predict short term direction. It is best used for scalping or automated trading. It comprises a signal line and dynamic lower and upper zones, as well as a mid-level.

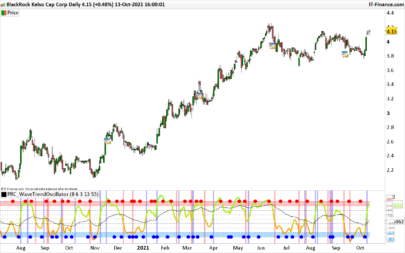

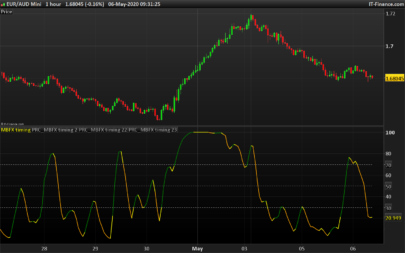

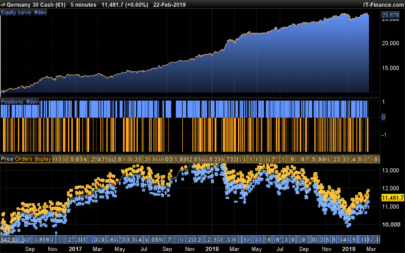

Screenshots:

There are three screen shots attached with this indicator: Two are showing very different indicator settings on different markets, and a third screen shot shows an indicator test. The indicator test is not a trading strategy – it is simply a back-test placing a long and short at every (typical) buy and sell signal, being in the market 100% of the time. An indicator an be considered potentially useful if taking every signal generates a better return than the underlying market.

Parameters:

- Period – the number of candles to look back on, this adjusts the “speed” of the indicator.

- Smoothing – Reduces signal noise, adding delay

Interpretation:

Short term trading signals are generated when the signal line crosses through the various zone lines. A rising signal-line implies an upward continuation in price whilst a falling signal-line implies a downward continuation.

Typical interpretation would be as follows: A buy-signal may be generated as the signal line crosses above the lower zone, with a sell-signal generated as the signal line crosses below the upper zone. There are no strict rules dictating which zone crosses generate a signal – the user should derive their own conclusion based on the chosen market and indicator parameters.

The indicator can be used with a wide range of values to give different types of signals. Further filters can be derived by taking note of the hemisphere (position from zero) and direction of the zone lines, with respect to the signal line.

Credits

Author: Maz @ PRC

Release date: 16th October 2020

Inspiration: This study is inspired by “Elasticity of price” indicator, as first published by Nicolas of PRC, here: https://www.prorealcode.com/prorealtime-indicators/elasticity-of-price/

Thank you Nicolas for the original version.

Further research

Automated strategies can be derived from this study, particularly in conjunction with other indicators or filters. I hope this is helpful and welcome any discussion on subsequent strategies.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

Period = 20 smoothing = 2 // ---------------- once smoothing = max(1, smoothing+1) once period = max(1, Period) // Coeficient, change if required once coef = 0.8 // Signal line x = std[Period](close) signam = 1 + (-1* ( ((average[period](close) + (x*2)) - close) / x ) / 2) // Dynamic Zones sq = square(signam) mean = average[period](signam) vsqrt = sqrt( average[period](sq) - square(mean) ) top = mean + coef * vsqrt btm = mean - coef * vsqrt result = average[smoothing](signam) return result coloured(255,255,0) style(line, 2) AS "Dynamic Zone Elasticity", top coloured(173,255,47) AS "Upper Zone", btm coloured(255,64,64) AS "Lower Zone", mean coloured(200,200,200) AS "Mean" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Im trying to use this indicator with another indicator but i cant get it to work. I want to take trades when yellow line crosses the red or green. Im trying to code it like this, very simple: result crosses over top / result crosses under btm.

Could you just give me an example of how to code that?

Im a new and right now im just trying out stuff for fun to learn.

Thanks in advance and great work!

think i found a solution!

Can you please share how you made it work? I cant seem to make it work in a strategy

Thanks for the indicator. Very interesting!