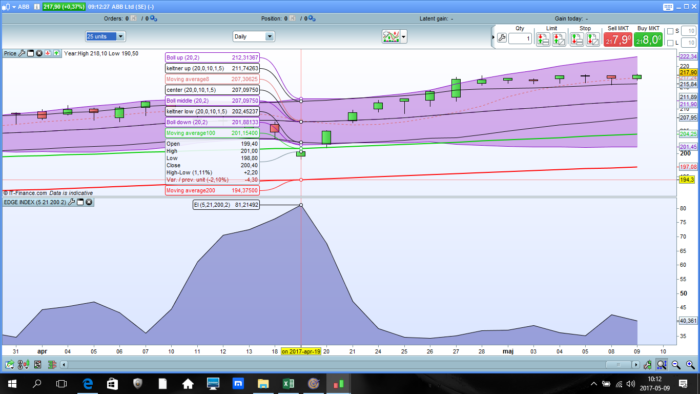

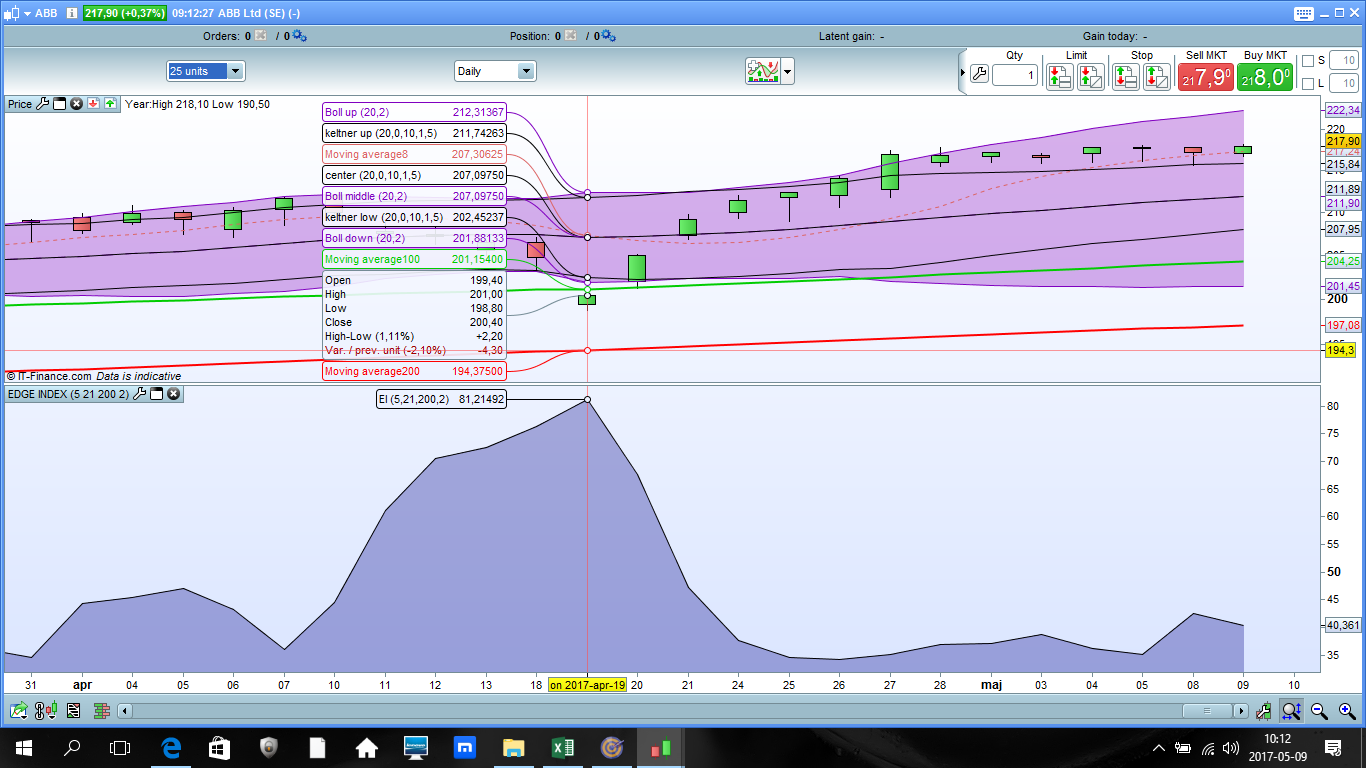

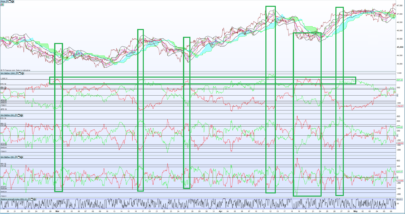

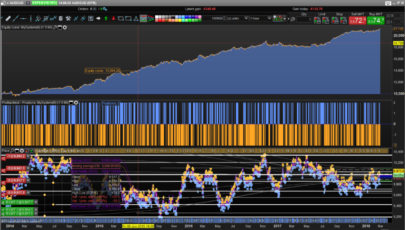

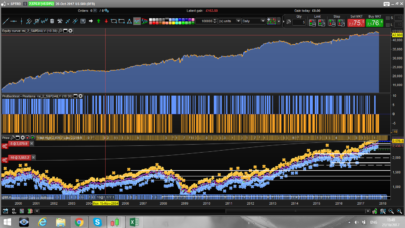

I find Edge Index to be useful in prioritizing mean reversion opportunities like for instance Rikoschett or Close below the lower Bollingerband.

Edge Index is intended for Daily time frames = does not work on intra day, not with the default parameter settings anyway.

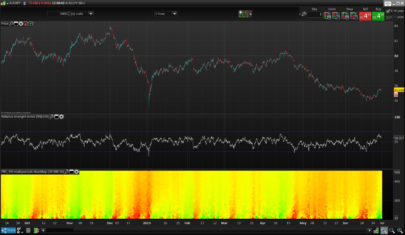

My initial testing is showing that EDGE INDEX works better in a bull market.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 |

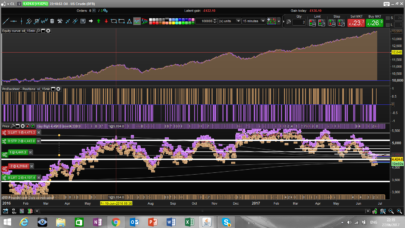

REM Computes the highest and lowest prices Shi = highest[S](high) Slo = lowest[S](low) Mhi = highest[M](high) Mlo = lowest[M](low) Lhi = highest[L](high) Llo = lowest[L](low) REM Building the oscillators StochS = (close - Slo) / (Shi - Slo) * 100 StochM = (close - Mlo) / (Mhi - Mlo) * 100 StochL = (close - Llo) / (Lhi - Llo) * 100 REM We can now compute the EdgeIndex EDGEINDEXRAW = (100 - StochS)/3 + (100-StochM)/3 + StochL/3 EDGEINDEX = EDGEINDEXRAW[0]*0.6 + EDGEINDEXRAW[1]*0.4 RETURN EDGEINDEX as "EI" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour,

A quoi correspondent les données S, M, L ?

Hello,

What do the data S, M, L?

aux paramètres à rentrer : 5 20 et 200…