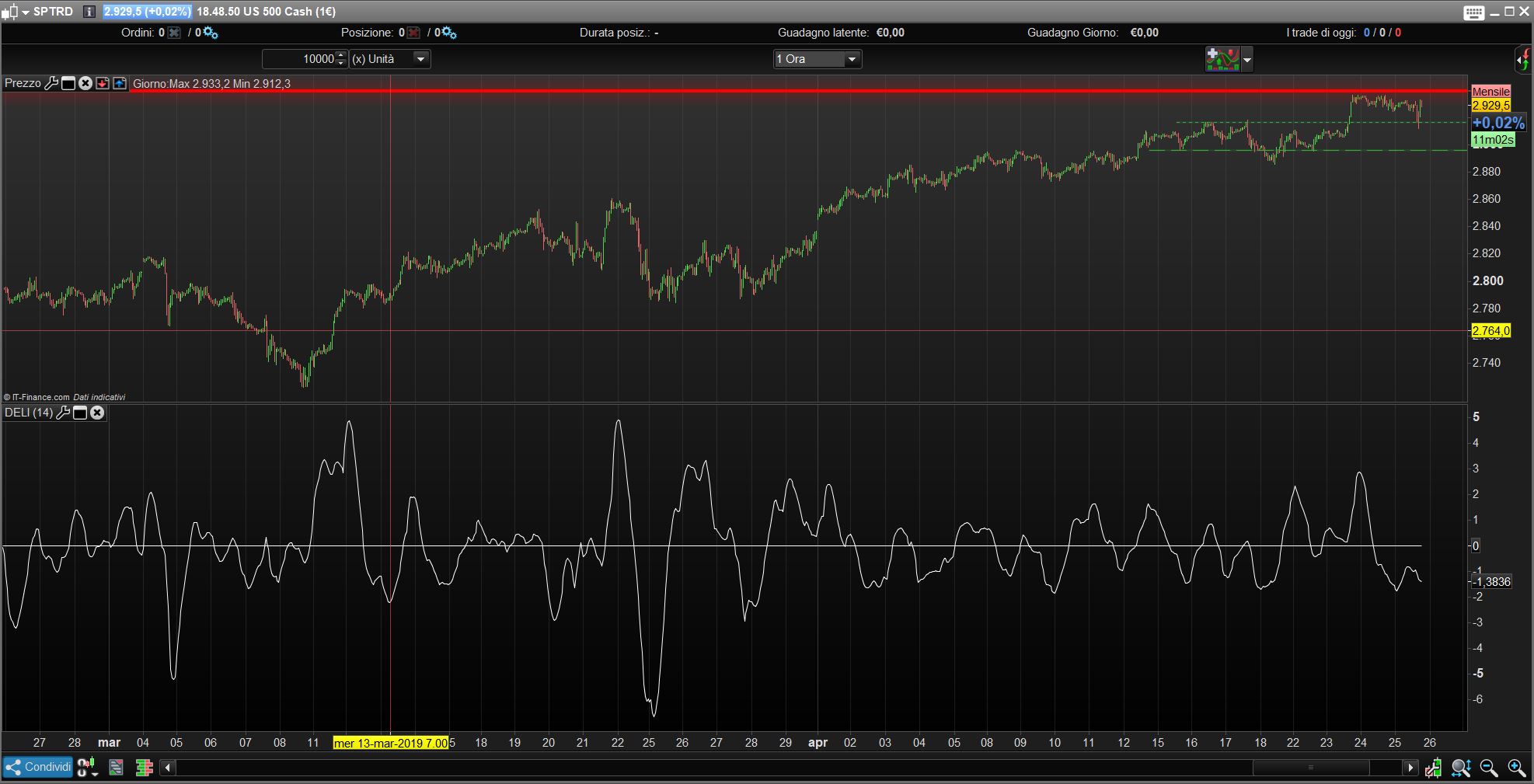

The Detrended Ehlers Leading Indicator(DELI) was authored by Jon Ehlers (See “MESA and Trading Market Cycles” by John Ehlers).

Detrended Synthetic Price is a function that is in phase with the dominant cycle of real price data. This one is computed by subtracting a 3 pole Butterworth filter from a 2 Pole Butterworth filter. Ehlers Leading Indicator gives an advanced indication of a cyclic turning point. It is computed by subtracting the simple moving average of the detrended synthetic price from the detrended synthetic price.

According to period lenght, this indicator can be useful to predict turning point in price.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

//Detrended Ehlers Leading Indicator //by AlexF //period=14 if high>high[1] then prevhigh=high endif if low<low[1] then prevlow=low endif price=(prevhigh+prevlow)/2 if barindex>2 then alpha=2/(period+1) else alpha=.67 endif alpha2=alpha/2 ema1=(alpha*price)+((1-alpha)*Ema1) ema2=((alpha2)*price)+((1-alpha2)*Ema2) dsp=ema1-ema2 temp=(alpha*dsp)+((1-alpha)*temp) deli=dsp-temp return deli as "DELI", 0 as "ZERO" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials