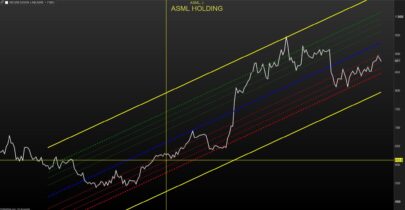

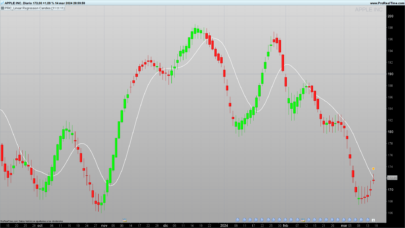

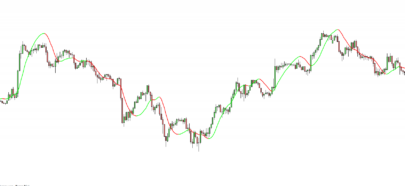

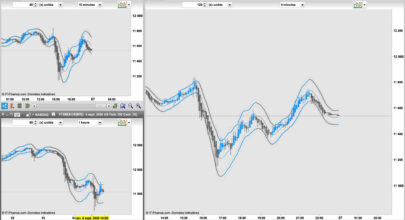

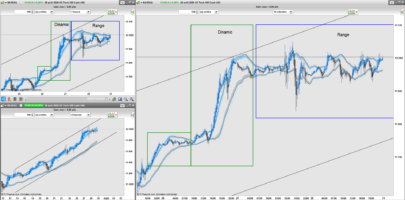

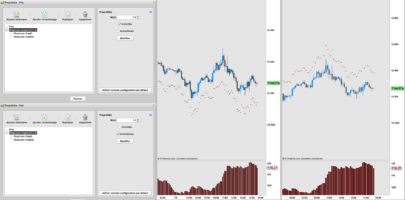

Hello everyone, after a long time from the creation and creation, I decided to share with the whole world and not just with a few friends, a very useful indicator. Not from trading directions, but helps eliminate the problem of emotions, the worst enemy of the trader. The Fill Channel, I called it that, is used to place the order the SL and TP, and the size. Try it is very intuitive, you could even share opportunities, maybe here in the forum. A dream would be that prorealtime put the Fill Channel between the default presets.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 |

// By filviole@tin.it // Once j=0 defparam CalculateOnLastBars = 10000000 defparam drawonlastbaronly=true //---settings //k=10 //s=0.001 //j=0 //AttivaEntry=1 //true //AttivaStepLong=0 //false //AttivaStepShort=0 //false //Step=6 //PrimoBuy=0 //PipStopLoss=0 //QuanteEntry=3 //Money=0 //false //Size=0.1 //--- end of settings de48=DPO[k*2](close) //de48=Average[k*2](close) if de48=de48[1] and de48[1]=de48[2] and de48[2]<>de48[3] then flag=1 endif n=(k*2)-4 p=(n/2)-1 d100=DPO[n](close) moy100=close-d100 co=(moy100-moy100[1]+(close[p])/n)*n if flag=1 and flag[1]=0 then test=linearregression[k](co) test1=linearregressionslope[k](co) a=test1 b=test-test1*k endif if flag=0 then reg=undefined else j=j+1 reg=a*j+b endif bluH=reg+s bluL=reg-s ArancioH=(s*3)+reg neroh=(s*2)+reg nerol=reg-(s*2) ArancioL=reg-(s*3) pip1=(PrimoBuy)*pipsize pip2=pipStopLoss*pipsize step2=abs(Step)*pipsize if AttivaStepLong then //====================== LONG ArancioL=ArancioL-pip2 //+PipStop StepL2=reg StepL3=reg StepL1=bluL-s-pip1 Buy11=StepL1*100000*size StopLoss=ArancioL*100000*size Target11=reg*100000*size Target21=BluH*100000*size Perdita=Stoploss-Buy11 Guadagno1=Target11-buy11 Guadagno2=Target21-buy11 if QuanteEntry>=2 then StepL2=StepL1-Step2 Buy21=StepL2*100000*size Perdita=(stoploss*2)-(Buy11+Buy21) Guadagno1=(2*Target11)-(Buy11+Buy21) Guadagno2=(2*Target21)-(Buy11+Buy21) endif if QuanteEntry=3 then StepL3=StepL1-Step2-Step2 Buy21=StepL2*100000*size Buy31=StepL3*100000*size Perdita=(stoploss*3)-(Buy11+Buy21+Buy31) Guadagno1=(3*Target11)-(Buy11+Buy21+Buy31) Guadagno2=(3*Target21)-(Buy11+Buy21+Buy31) endif NeroL=NeroH else stepL1=neroL stepL2=neroL stepL3=neroL endif if AttivaStepShort then //======================= SHORT ArancioH=ArancioH+pip2 StepS2=reg StepS3=reg StepS1=bluH+s+pip1 Buy1=StepS1*100000*size StopLoss=ArancioH*100000*size Target1=reg*100000*size Target2=BluL*100000*size Perdita=Buy1-stoploss Guadagno1=Buy1-Target1 Guadagno2=Buy1-Target2 if QuanteEntry>=2 then StepS2=StepS1+Step2 Buy2=StepS2*100000*size Perdita=(Buy1+Buy2)-stoploss*2 Guadagno1=(Buy1+Buy2)-(2*Target1) Guadagno2=(Buy1+Buy2)-(2*Target2) endif if QuanteEntry=3 then StepS3=StepS1+Step2+Step2 Buy2=StepS2*100000*size Buy3=StepS3*100000*size Perdita=(Buy1+Buy2+Buy3)-stoploss*3 Guadagno1=(Buy1+Buy2+Buy3)-(3*Target1) Guadagno2=(Buy1+Buy2+Buy3)-(3*Target2) endif NeroH=NeroL else stepS1=neroH stepS2=neroH stepS3=neroH endif if AttivaStepLong and AttivaStepShort then NeroH=reg NeroL=reg endif H1 = HIGHEST[12](HIGH) L1 = LOWEST[12](LOW) PM = (H1+L1)/2 S1 = (PM*2)-H1 R1 = (PM*2)-L1 alfaSuggerimenti=255*AttivaEntry once numeroMassimoCandelePerInversione = 10 once ritardo = 0 if (barindex>2) then HAclose= totalprice HAOpen = (HAOpen[1]+HAclose[1])/2 HAHigh = Max (Max (High,HAOpen) , Max(HAOpen,HAclose)) HALow = MIN (Min(low,HAOpen),Min(HAOpen,HAclose)) endif refClose=HAclose refOpen=HAOpen refHigh=HAHigh refLow=HALow if refClose crosses over neroH then sbloccaInversioneShort=1 sbloccaInversioneShortIndex=barindex endif if refClose crosses under neroL then sbloccaInversioneLong=1 sbloccaInversioneLongIndex=barindex endif if ((barindex - sbloccaInversioneShortIndex > numeroMassimoCandelePerInversione) or (refClose crosses over arancioH)) then sbloccaInversioneShort=0 // slsupe endif if ((barindex - sbloccaInversioneLongIndex > numeroMassimoCandelePerInversione) or (refClose crosses under arancioL)) then sbloccaInversioneLong=0 endif if (sbloccaInversioneShort) then shortCondition= refClose[1+ritardo] - refOpen[1+ritardo]>0 and refClose[0+ritardo] - refOpen[0+ritardo]<0 endif if (sbloccaInversioneLong) then longCondition= refClose[1+ritardo] - refOpen[1+ritardo]<0 and refClose[0+ritardo] - refOpen[0+ritardo]>0 endif if (shortCondition) then DRAWARROWDOWN(barindex, refHigh) coloured (159,0,0,alfaSuggerimenti) sbloccaInversioneShort=0 shortCondition=0 endif if (longCondition) then DRAWARROWUP(barindex, refLow) coloured (0,51,255,alfaSuggerimenti) sbloccaInversioneLong=0 longCondition=0 endif //s3=close[1] //cand=barindex-barindex+1 //DRAWTEXT("c=#lolo#", cand, low[1]) if Money and AttivaStepLong then DRAWTEXT("#perdita#",barindex,ArancioL,SansSerif,Bold,20)coloured(255,0,0) DRAWTEXT("#guadagno1#",barindex,reg,SansSerif,Bold,20)coloured(0,83,81) DRAWTEXT("#guadagno2#",barindex,BluH,SansSerif,Bold,20)coloured(0,0,255) endif if Money and AttivaStepShort then DRAWTEXT("#perdita#",barindex,ArancioH,SansSerif,Bold,20)coloured(255,0,0) DRAWTEXT("#guadagno1#",barindex,reg,SansSerif,Bold,20)coloured(0,83,81) DRAWTEXT("#guadagno2#",barindex,BluL,SansSerif,Bold,20)coloured(0,0,255) endif return S1 COLOURED(255, 0, 0) AS "Sup" , R1 COLOURED(51,204, 0) AS "Res",reg COLOURED(255, 0,0),bluh COLOURED(0,0,255),blul COLOURED(0, 0, 255),nerol COLOURED(0, 0, 0),neroh COLOURED(0, 0, 0),arancioH COLOURED(255, 100, 0) as "Stop Loss" ,ArancioL COLOURED(255, 100, 0)as "Stop Loss", stepL1 COLOURED(0,0,0) AS "STEP1", stepL2 COLOURED(0,0,0) AS "STEP2", stepL3 COLOURED(0,0,0) AS "STEP3" , stepS1 COLOURED(0,0,0) AS "STEP1", stepS2 COLOURED(0,0,0) AS "STEP2", stepS3 COLOURED(0,0,0) AS "STEP3" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

We can add :

/////////////////////////////////

M = ( S1 + R1 ) / 2

//////////////////////////////////

Supertiti, en que parte del codigo lo deberiamos de poner?

Grazie per il tuo suggerimento. In pratica sarebbe la media tra massimi e minimi di 12 periodi. A cosa servirebbe? Io per le media preferisco guardare la regressione lineare (trend line rossa) secondo me da un’dea più precisa rispetto al trend e periodo. A breve farò un video per come utilizzare il canale di fill, che ripeto è forse più una strategia di money management che un’indicatore.

Per chi volesse usare il Canale di Fill con come indicatore può commentare la linea

4 // defparam drawonlastbaronly=true

in questa modalità togliere la spunta “money” e spuntare “attiva entry”. Regolare periodi e ampiezza a piacere e buon trading

Scusami Filippo, non ho capito come utilizzi questo “indicatore”, potresti spiegarlo? Grazie

pues no sé que hago mal pero no me sale igual que aquí!

si si… farò un video a breve

ok. Gracias.

Hi Filippo, any news about your video to explain how to use this indicator? thanks