This indicator counts the number of standard deviations price is above or below an average of price.

Discussion regarding this indicator can be found here:

https://www.prorealcode.com/topic/higher-timeframes-bollinger-filter/#post-93803

Thanks to Jebus89 for the original concept which I then recoded so as to allow different levels of standard deviation to be used in the indicator.

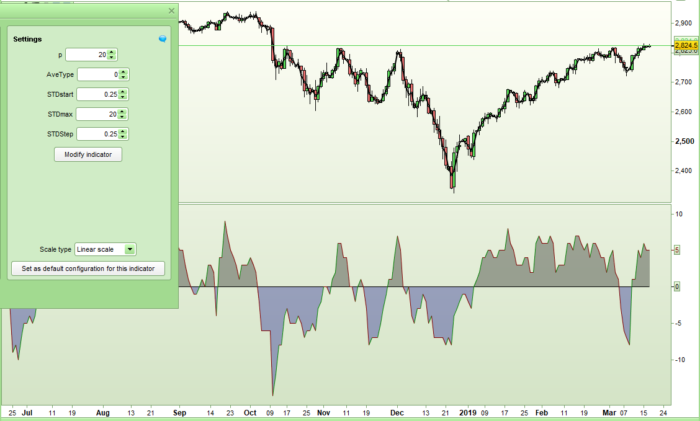

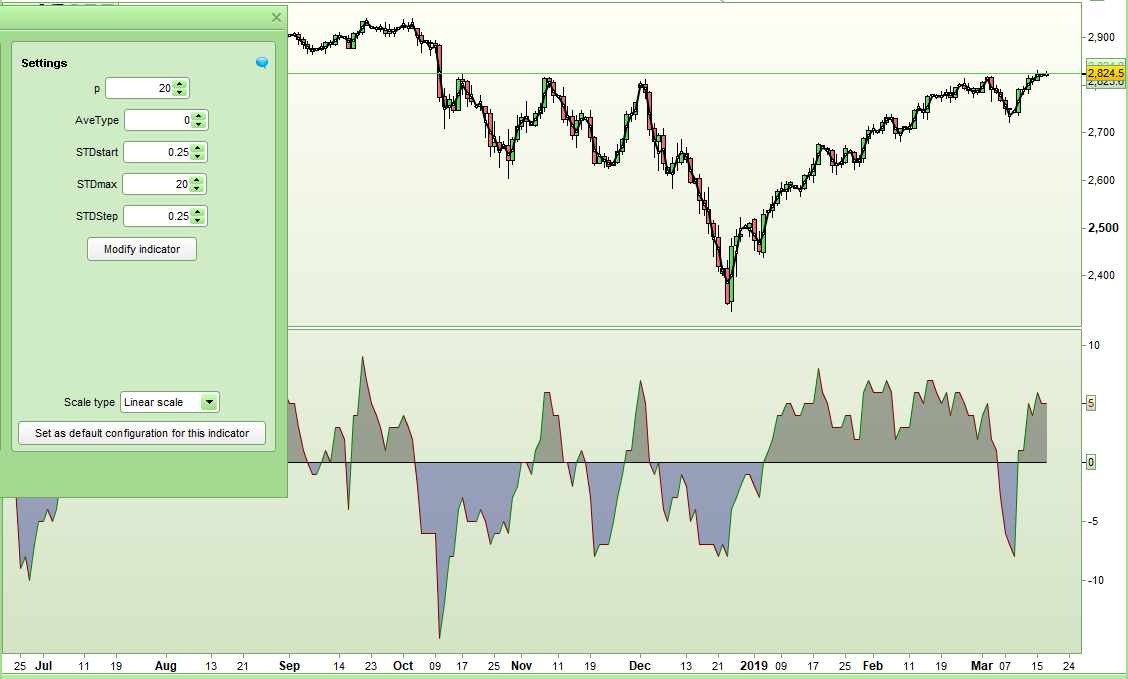

The following variables can be adjusted to alter the output.

- p = The period used for the average.

- AveType = The type of average used. Values from 0 to 6 as follows:0 = SMA1 = EMA

2 = WMA

3 = Wilder

4 = Triangular

5 = End point

6 = Time series

- STDstart = The first STD of average to be used.

- STDmax = The maximum STD of average to be used.

- STDstep = Step levels of STD used.

So for example if STDstart = 1 and STDmax = 3 and STDstep = 0.5 then 1.0, 1.5, 2.0, 2.5 and 3.0 STD multiples will be used as well as -1.0, -1.5, -2.0, -2.5 and -3.0 for the indicator output.

The line is red if Force is falling and green if Force is rising. A Force reading above zero indicates how far price has moved above the average and a Force reading below zero how far price has moved below the average.

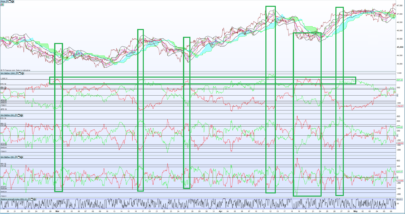

Jebus89’s original idea was to use this indicator on higher time frames as a filter to check how far from the mean a price has moved to help evaluate whether it is a good time to enter the market on lower time frames but it can also be used in many other ways.

I recommend downloading and importing the ITF file to get full functionality.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 |

// Force indicator // Concept by jebus89 / Coding by Vonasi // 18 March 2019 p = 20 AveType = 0 //0 to 6 STDstart = 0.1 STDmax = 10 STDstep = 0.1 if close > Average[p, AveType](close) then a = STDstart force = 0 while a <= STDmax if close > Average[p, AveType](close) + a*std[p](close) then force = force + 1 a = a + STDstep else break endif wend endif if close < Average[p, AveType](close) then a = -STDstart force = 0 while a >= -STDmax if close < Average[p, AveType](close) + a*std[p](close) then force = force - 1 a = a - STDstep else break endif wend endif r = 128 g = 0 if force > force[1] then r = 0 g = 128 endif return 0 coloured(0,0,0), force coloured(r,g,0) as "Force!" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

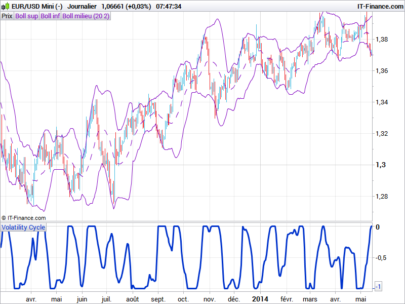

Thanks for this code. i will try to adapt it in the EUR/USD Pac Man Strategy who is based on the STD function : https://www.prorealcode.com/topic/short-eur-usd-m15-pac-man-strategy/page/4/

I still have two versions of the PacMan strategy on forward test although there have been various stoppages and periods of no trading beyond my control so the results are a bit inaccurate. Neither version has proven very profitable but on the bright side neither has lost a fortune yet either!

I use your version on a real account and the strategy is profitable and i did not have any problem of cutting. Yes the profit is small but if i add overnight positive coast it starts to become interesting ! Another good point is that the strategy does not seem to be overfitted and continues to perform 🙂