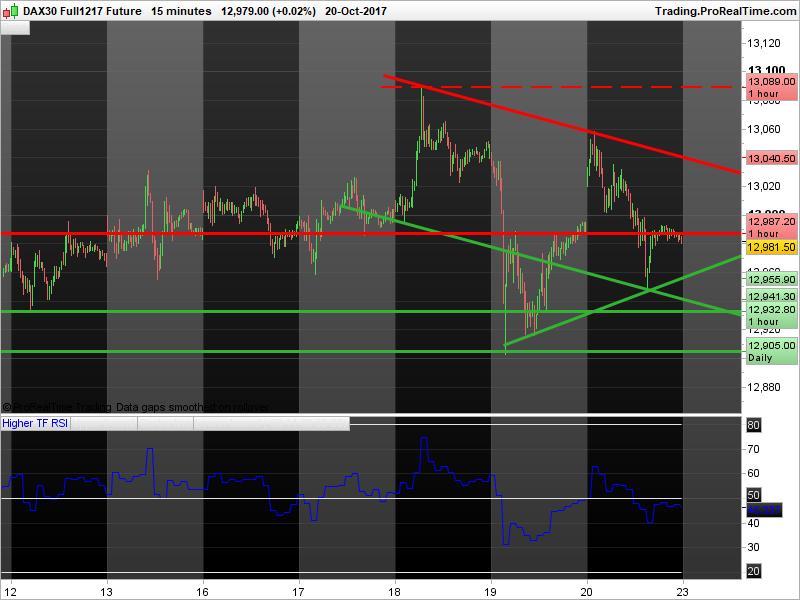

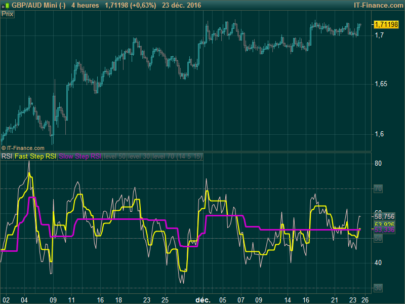

Does exactly what it says on the tin – gives the RSI value for a desired lookback period on a higher timeframe.

Only works up to timeframes of 2 hours (3 and 4 hour timeframes do not work as first bar of the day is sometimes a different duration, e.g. 1 or 2 hours, which messes up the calculations). Make sure obviously that the current timeframe is less than the specified higher timeframe.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 |

// Chart timeframe: IF Minute > 0 THEN IF Day = Day[1] THEN ChartTimeframe = Minute-Minute[1] ELSIF Day <> Day[1] THEN ChartTimeframe = Minute ENDIF ELSIF Minute = 0 THEN IF Hour - Hour[1] = 1 THEN ChartTimeframe = (60-Minute[1]) ELSIF Hour - Hour[1] > 1 THEN ChartTimeframe = (Hour-Hour[1]) * 60 ENDIF ENDIF IF BarIndex > 0 AND BarIndex[1] > 0 AND ChartTimeFrame <> ChartTimeFrame[1] THEN ChartTimeFrame = ChartTimeFrame[1] ENDIF // StartHour = 7 // No. of Closes to go back for each higher timeframe: ResHTF = (Hour-StartHour) MOD MAX((HigherTimeFrame/60),1) IF ChartTimeFrame > 0 THEN Calc1 = Minute MOD HigherTimeFrame Calc2 = Minute MOD ChartTimeFrame Pf1 = (ResHTF[1]*60) + (((Calc1-Calc2)/ChartTimeFrame)+1)[1] ENDIF // Higher TF RSI calculation: IF Pf1 = HigherTimeFrame/ChartTimeFrame THEN Change = Close-Close[Pf1] ELSE Change = 0 ENDIF IF Pf1 = HigherTimeFrame/ChartTimeFrame AND Change >= 0 THEN Gain = Change GainMarker = 1 ELSE Gain = 0 GainMarker = 0 ENDIF IF Pf1 = HigherTimeFrame/ChartTimeFrame AND Change < 0 THEN Losss = ABS(Change) LossMarker = 1 ELSE Losss = 0 LossMarker = 0 ENDIF IF Pf1 = (HigherTimeFrame/ChartTimeFrame) THEN GainSMA = Summation[(ROUND(HigherTimeFrame/ChartTimeFrame)*(per-1))+Pf1](Gain)/Summation[(ROUND(HigherTimeFrame/ChartTimeFrame)*(per-1))+Pf1](GainMarker) LossSMA = Summation[(ROUND(HigherTimeFrame/ChartTimeFrame)*(per-1))+Pf1](Losss)/Summation[(ROUND(HigherTimeFrame/ChartTimeFrame)*(per-1))+Pf1](LossMarker) ELSE GainSMA = 0 LossSMA = 0 ENDIF IF Pf1 = (HigherTimeFrame/ChartTimeFrame) AND BarIndex = (per*(HigherTimeFrame/ChartTimeFrame)) THEN AverageGain = (Gain+((per-1)*GainSMA[Pf1]))/per AverageLoss = (Losss+((per-1)*LossSMA[Pf1]))/per ELSIF Pf1 = (HigherTimeFrame/ChartTimeFrame) AND BarIndex > (per*(HigherTimeFrame/ChartTimeFrame)) THEN AverageGain = (Gain+((per-1)*AverageGain[Pf1]))/per AverageLoss = (Losss+((per-1)*AverageLoss[Pf1]))/per ELSE AverageGain = 0 AverageLoss = 0 ENDIF IF Pf1 = (HigherTimeFrame/ChartTimeFrame) THEN RS = AverageGain/AverageLoss ELSE RS = 0 ENDIF IF Pf1 = (HigherTimeFrame/ChartTimeFrame) THEN IF AverageLoss = 0 THEN MyRSI = 100 ELSIF AverageLoss > 0 THEN MyRSI = 100-(100/(1+RS)) ENDIF ENDIF UpperBound = ub Centreline = cl LowerBound = lb RETURN MyRSI COLOURED(0, 0, 255) AS "Higher TF RSI", UpperBound COLOURED(0, 0, 0) AS "Upper bound", Centreline COLOURED(0, 0, 0) AS "Centre line", LowerBound COLOURED(0, 0, 0) AS "Lower bound" // Gain COLOURED(0, 255, 0) AS "Gain", Losss COLOURED(255, 0, 0) AS "Loss", GainMarker COLOURED(0, 0, 0) AS "Gain marker", LossMarker COLOURED(0, 0, 0) AS "Loss marker", GainSMA COLOURED(0, 255, 0) AS "Gain SMA", LossSMA COLOURED(255, 0, 0) AS "Loss SMA", AverageGain COLOURED(0, 255, 0) AS "Average Gain", AverageLoss COLOURED(255, 0, 0) AS "Average Loss", |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Might be dump question, but can you set it on 20 minutes? or only 1 or 2 h?

Yes you can – as long as both timeframes are 2 hours or less (and shorter timeframe less than higher timeframe obviously).

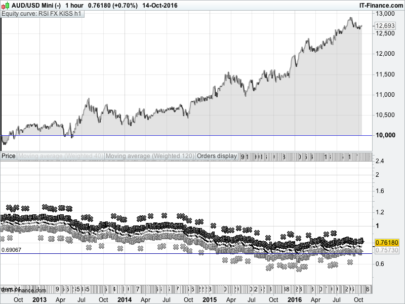

Interesting idea to bypass the limit of PRT about multiple timeframe, and I am just trying to plot 15 minutes Rsi on 1 minute Chart for the EURUSD.

In the first moment, trying to convalidate the code on ProBuilder I received this message: «Define variables: highertimeframe, per, ub, cl, lb» and because I cannot understand enough the logic of the code and also some functions used in it I was uncertain how to define the variables. Looking a little bit more I could make the code partially working.

Very obviously “ub” “cl” and “lb” stay for the bounds of the RSI, so I put them ub=70 (upper bound), cl=0 (center line) and lb=30 (lower bound).

Also obviously “highertimeframe” stays for the higher frame: so, meaning to plot 15m RSI on the 1m chart I put highertimeframe=15:

I was uncertain about the meaning of “per”… then, after trying some random values to plot something, I concluded it was meaning “period” and I wrote per=15 (also if, in this case, it was a not necessary variable yet existing “highertimeframe=15”)

Anyway plotting the indicator I could obtain values changing every 15 minutes with a line looking like Rsi. Controlling the values with the normal 15 minutes chart I saw sligtly bigger values..

So I tried per=14 (I don’t know why..because I dont understand the calculation method) and the results are about identical to the normal Rsi15 with the problem that going back they are not correct sometime on the changing of the day.

For what I controlled manually ,here is a table for these last days setting per=14 (remember the Rsi you see below the 15 minutes candle, for example, of 10:00 is the Rsi for the opening of the next candle (signed 10:15) and you see it on the 1minute chart below the 10:16 candle)

EURUSD 15 minutes Chart___EURUSD 1 minute Chart

Date____Time____Rsi 15m ____RsiHigher 1m

7 nov____10:00___14,85 ______14,85___(exact)

8 nov____00:30___73,94_______98,28___(out of scale)

__________07:30___33.63_______31,05___(not exact)

__________09:45___65:36_______65,72___(slightly exact)

9 nov____02:30___36.72_______36.72___(exact)

__________08:15___75,75_______75,75___(exact)

__________13:00___81,31_______81,31___(exact)

__________15:15___40,28_______40,28___(exact)

10 nov___01:15___65,73_______65,73___(exact)

__________09:15___31,13_______31,13____(exact)

__________11:00___66,32_______66,32____(exact)

__________16:30___70,19_______70,19____(exact)

For what I see, also if there are problems going back, anyway, working on the current day, the indicator is ok and surely it will work also with 30m or 1h Rsi on 1 minute chart setting may be “HigerTimeFrame” 30/60 and, may be, “per” 29/59… Thanks for the code.

Looking a little bit more, now I understand what had to be absolutely obvious from the first moment: the variable “per” (that I founded randomly) means period of calculation of RSI that is normaly set to 14 and has nothing to do with the timeframe. So for Rsi of 30/60m on 1m chart you have to put “HigherTimeFrame” at 30/60 but “per” is always 14, if you dont want for some reason to use non-standard Rsi on both timeframes. Re-thanks for the code.

nice code! I’m trying to use your method to do a higher timeframe EMA, without success yet. Is this even possible?