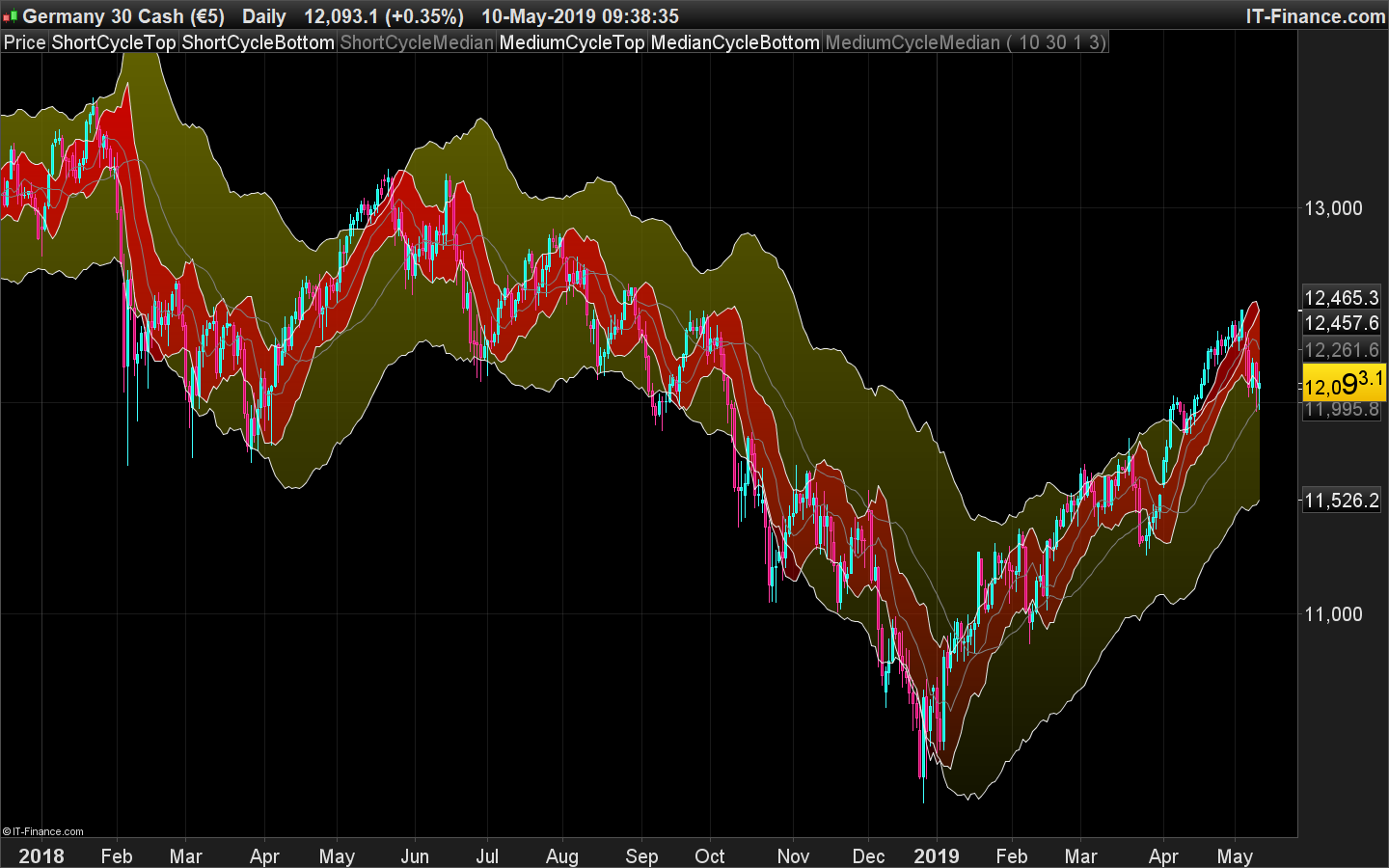

Cycle Channel is loosely based on Hurst’s nested channels. Basic idea is to identify and highlight the shorter cycles, in the context of higher degree cycles.

This indicator plots the shorter term (red) & medium term (green) cycles as channels. Some things to note:

As you can see the red channel keeps moving with in the bounds of green channel. When green breaches red channel, it usually signifies extreme market condition.

Both red & green channels provide support/resistance levels. Also, the green channel provides S/R levels to the inner red channel.

Movement of red channel with reference to green highlights reversal points, reducing momentum et al. For ex., point “(x)” in the chart shows how red channel failed to reach the upper green channel line and highlighted the local top.

(description from the original author LazyBear). Converted from pinescript by a request in the forum.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

//PRC_Hurst Cycle Channel Clone | indicator //10.05.2019 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted from pinescript // --- settings sclt = 10 //Short Cycle Length mclt = 30 //Medium Cycle Length scm = 1.0 //Short Cycle Multiplier mcm = 3.0 //Medium Cycle Multiplier // --- end of settings src=customclose //Source once scl = round(sclt/2) once mcl = round(mclt/2) mascl=wilderaverage[scl](src) mamcl=wilderaverage[mcl](src) scmoff = scm*averagetruerange[scl] mcmoff = mcm*averagetruerange[mcl] once scl2=round(scl/2) once mcl2=round(mcl/2) sct = mascl[scl2]+ scmoff scb = mascl[scl2]- scmoff mct = mamcl[mcl2]+ mcmoff mcb = mamcl[mcl2]- mcmoff return sct coloured(232,232,232) as "ShortCycleTop", scb coloured(232,232,232) as "ShortCycleBottom", (sct+scb)/2 coloured(128,128,128) as "ShortCycleMedian", mct coloured(232,232,232) as "MediumCycleTop", mcb coloured(232,232,232) as "MedianCycleBottom", (mct+mcb)/2 coloured(128,128,128) as "MediumCycleMedian" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour Nicolas, génial! J’ai intégré cet indicateur immédiatement. Pouvez-vous ajouter une troisième unité de temps ici? merci!

Bonjour Nicolas, j’ai réussi. J’ai intégré une troisième unité de temps, tout va bien! Je vais le mettre demain …

Good evening Nicolas,

thanks for the indicator.

How are the short and medium trend periods determined; are they, generally speaking, applicable for more timeframes and markets, both indices and commoditie ?

(sclt = 10 //Short Cycle Length mclt = 30 //Medium Cycle Length?

KR jan

I don’t know, that code is a 1:1 translation from another platform.

Hello Nicolas,

Is this a conversion from Tradestation Easy Language?

If so, do you have a link to the TS code?

Thanks,

Jim

Sorry I do not provide assistance for Tradestation code.

Bonjour,

Je suis pas expert en PRT donc si qq’un peut m’expliquer un peu le code ?

Par exemple :

mascl=wilderaverage[scl](src) <<<<< calcul d'une wilder mov average de 10 période sur la src (ici customclose) ?? vrai ??

scmoff = scm*averagetruerange[scl] <<<< ici calcul d'un 1*ATR(5) par rapport a quoi ? toujours la (src) ? ou le wilderma qu'on vient de calculer ?

sct = mascl[scl2]+ scmoff <<<< ici j'ai du mal a comprendre ! la wilderma[5] + atr ? mascl[scl2] c'est un tableau ?

Merci de m’éclairer.

A bientot.

src c’est bien le customclose en effet. ATR, si aucune série de données n’est spécifié, il utilise Close par défaut.

[scl2] = c’est la quantité de période en arrière (offset) de la série de données (variable) calculée “mascl”