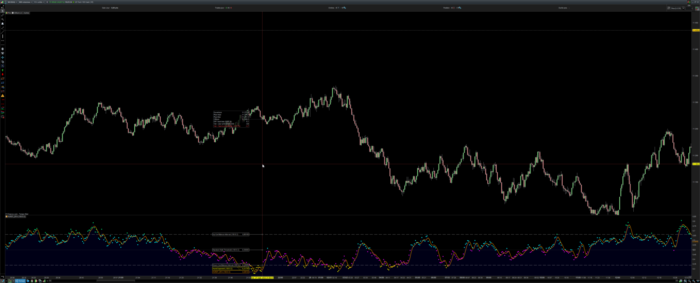

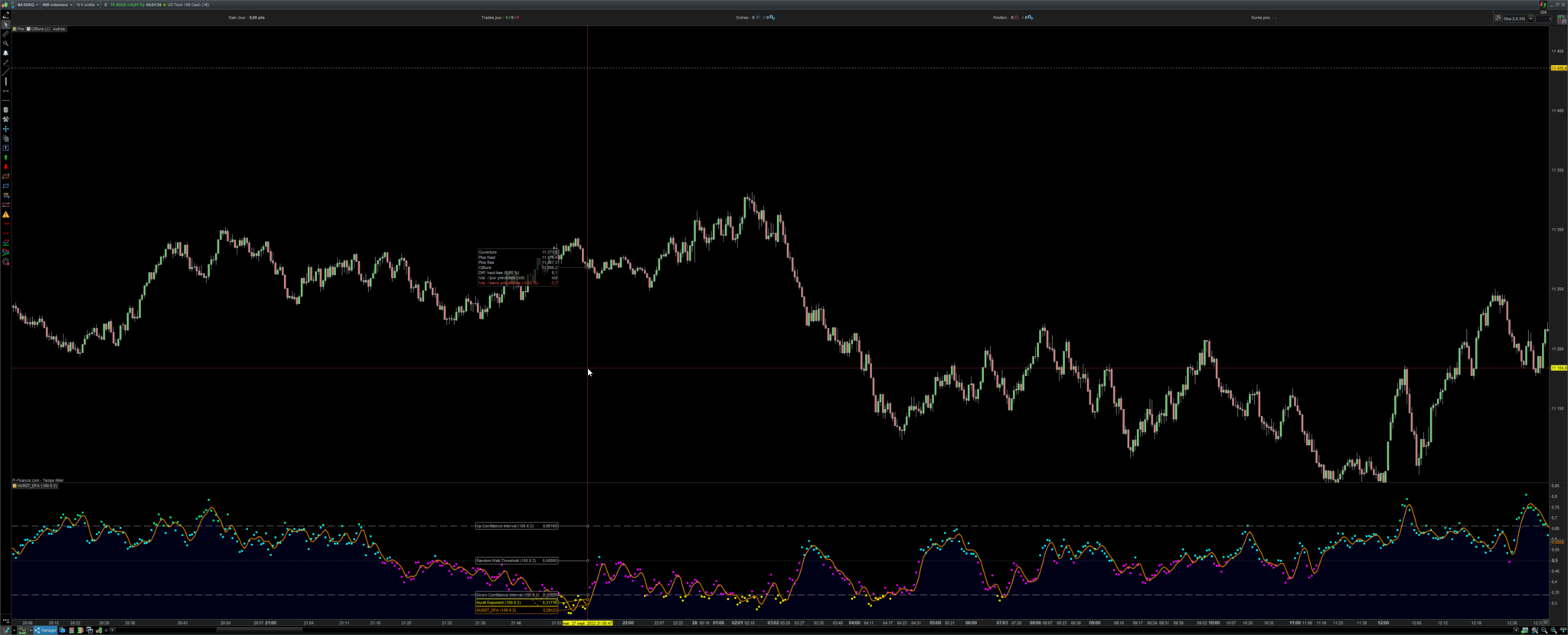

This is the port to PRT of the nice balipour indicator from tradingview.

In stochastic processes, chaos theory and time series analysis, detrended fluctuation analysis (DFA) is a method for determining the statistical self-affinity of a signal. It is useful for analyzing time series that appear to be long-memory processes and noise.

WARNING : this indicator will hit your CPU very hard. It was a test drive for me to test the limit of ProBuilder. I don’t recommend using it in real time.

For practical and intuitive indicators, you can have a look at my ProRealCode Market store.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 |

//defparam calculateonlastbars = 2000 // Params len: 100 bsc: 8 msc: 2 //Log Return r = log(close / close[1]) //Mean of Log Return mean = average[len](r) //Cumulative Sum sum = 0 for i = 0 to len - 1 do sum = (r[i] - mean) + sum $csum[i] = sum next // Approximating log scale function (save sample size) for i = 0 to 9 do $fs[i] = round(bsc*pow(pow(len/(msc*bsc),0.1111111111),i)) next for i = 0 to 9 do //Average of Root Mean Sum Measured each block (Log Scale) ARMS bar = $fs[i] num = floor(len / bar) sumr = 0 for j = 0 to num - 1 do //Root Mean Sum (FLuctuation) function linear trend to calculate error between linear trend and cumulative sum rms = 0 count = 0 N1 = j * bar N = bar //Slicing the array into different segments for k = 0 to N - 1 do count = count + 1 $seq[k] = count next for k = N1 to N1 + N - 1 do $y[k - N1] = $csum[k] next //Linear regression measuing trend (N/(N-1) for sample unbiased adjustedment) ec = 0 for k = 0 to N - 1 do ec = ec + $seq[k] next mc = ec / N varx = 0 for k = 0 to N - 1 do varx = varx + square($seq[k] - mc) next sdx = sqrt(varx/N) * sqrt(N/(N-1)) ey = 0 for k = 0 to N - 1 do ey = ey + $y[k] next my = ey / N vary = 0 for k = 0 to N - 1 do vary = vary + square($y[k] - my) next sdy = sqrt(vary/N) * sqrt(N/(N-1)) esy = 0 for k = 0 to N - 1 do esy = esy + $seq[k] * $y[k] next msy = esy / N cov = (msy - mc * my) * (N/(N-1)) rr2 = pow(cov/(sdx*sdy), 2) rms = sqrt(1 - rr2) * sdy sumr = sumr + rms next $fluc[i] = log(sumr / num) / log(10) next //Set Ten Points of data scale along the X log axis for i = 0 to 9 do $scl[i] = log($fs[i]) / log(10) next // Slope Measured from RMS and scale on log log plot using linear regression ssc = 0 for i = 0 to 9 do ssc = ssc + $scl[i] next esc = ssc / 10 sfl = 0 for i = 0 to 9 do sfl = sfl + $fluc[i] next efl = sfl / 10 sf = 0 for i = 0 to 9 do sf = sf + ($scl[i] - esc) * ($fluc[i] - efl) next cov = sf / 10 ssq = 0 for i = 0 to 9 do ssq = ssq + square($scl[i] - esc) next var = ssq / 10 hurst = cov / var //Critical Value based on Confidence Interval (95% Confidence) ci = 1.645 * (0.3912 / pow(len,0.3)) //Expected Value plus Crtical Value cu = 0.5 + ci cd = 0.5 - ci if hurst > cu then hr = 0 hg = 255 hb = 128 elsif hurst >= 0.5 then hr = 0 hg = 255 hb = 255 elsif hurst < cd then hr = 255 hg = 255 hb = 0 elsif hurst < 0.5 then hr = 255 hg = 0 hb = 255 endif smooth = (hurst + 2 * hurst[1] + 2 * hurst[2] + hurst[3]) / 6 return hurst coloured(hr, hg, hb) style(point, 3) as "Hurst Exponent", cu as "Up Confidence Interval", cd as "Down Confidence Interval", 0.5 as "Random Walk Threshold", smooth |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

This is great! Such a job you did!. I do not really understand though how it works.

Thank you, I’ve just realized that all links are missing in the description. You can find the original indicator and explanations here : https://www.tradingview.com/script/vTloluai-Hurst-Exponent-Detrended-Fluctuation-Analysis-pig/ and my store here : https://market.prorealcode.com/store/digital-filters-workshop/