Introduction

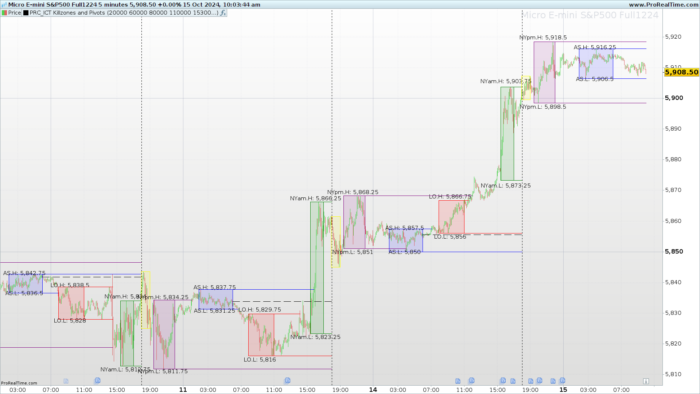

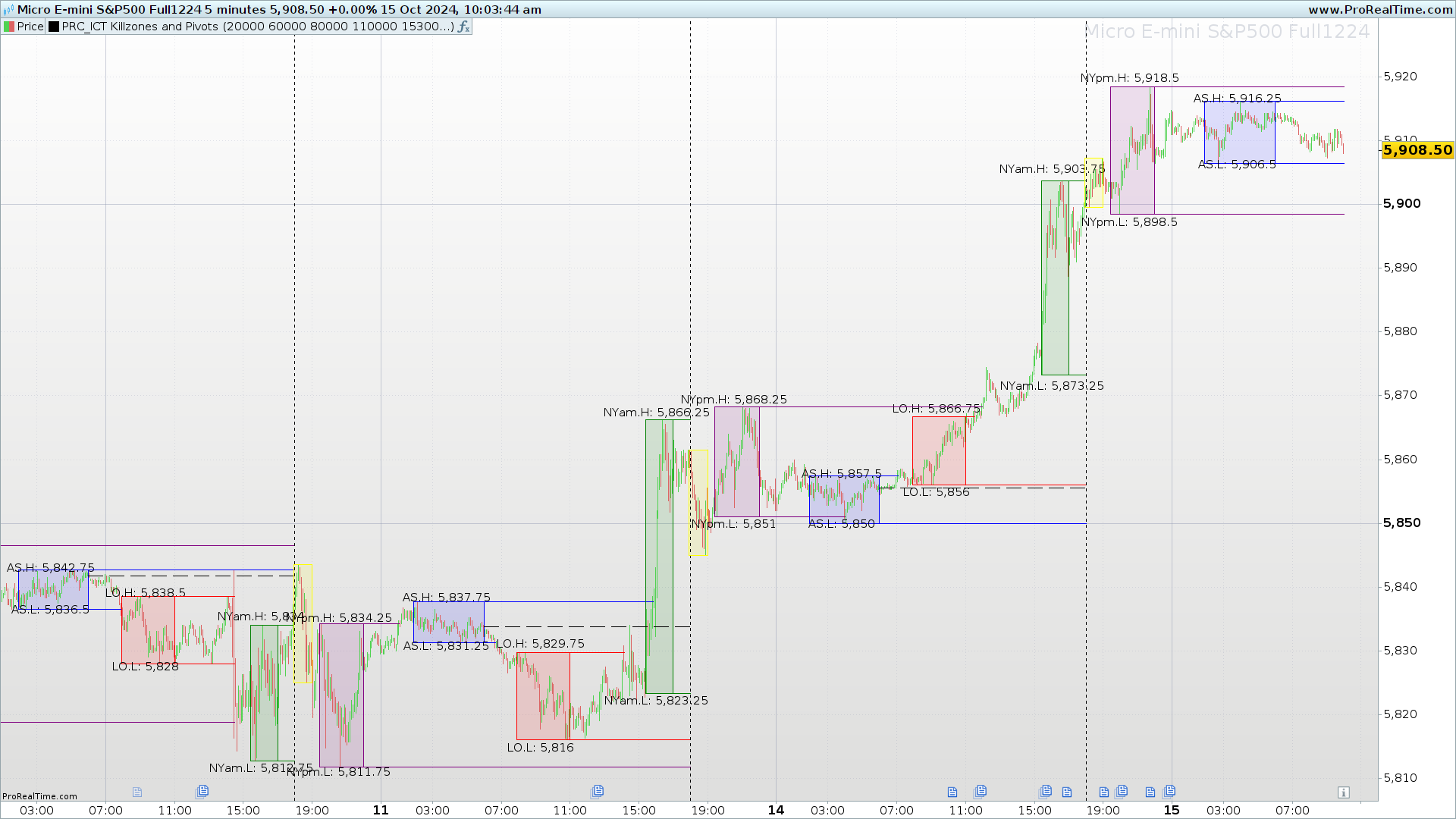

The ICT Killzones and Pivots indicator is a tool designed to help traders identify key time zones in financial markets, known as Killzones. These zones correspond to the most active sessions in global markets, such as the Asian, London, and New York sessions. During these periods, markets tend to show higher volume and volatility, which can provide unique trading opportunities.

In addition to marking the time zones, the indicator plots important pivots within each of these sessions. The pivots are generated based on the highs and lows reached during each Killzone, providing critical reference points for making informed trading decisions.

This indicator is ideal for traders operating in timeframes of 1 hour or less. If a higher timeframe is selected, the indicator will display a warning message asking the user to adjust to an appropriate timeframe to ensure proper functioning.

Indicator Objective

The main objective of the ICT Killzones and Pivots is to highlight the time zones where markets tend to have higher activity and volatility. These zones, known as Killzones, are key to identifying possible trend changes, price breakouts, or important consolidations in the market.

Each Killzone is associated with one of the main global financial market sessions: Asia, London, and New York. Within each session, the indicator identifies and marks the highs and lows reached, providing reference levels that can act as dynamic support and resistance.

In addition to the Killzones, the indicator also plots pivots based on price crossings with the high or low levels of previous sessions. These pivots can be used to validate breakouts, consolidations, or trend reversals, offering traders valuable information for making more precise decisions.

The ICT Killzones and Pivots is specifically designed for traders who operate in intraday or short-term timeframes, as its accuracy depends on the correct identification of key levels in timeframes of 1 hour or less.

Explanation of Time Zones (Killzones)

The ICT Killzones and Pivots indicator divides the market into three main time zones, or Killzones, each corresponding to a key session of the global markets: Asia, London, and New York. These Killzones help identify periods of greater volatility in each session by highlighting the highs and lows reached within these timeframes.

Below is a description of each zone and how it functions:

- Asia (ASIA Zone):

- Operating Hours: from 02:00 to 06:00.

- Description: The Asian session is the first Killzone highlighted by the indicator. During this time window, the highs and lows of the price reached between 02:00 and 06:00 are plotted. These levels serve as reference points that can act as support or resistance zones for future price movements. The levels are displayed on the chart with a blue rectangle.

- London (London Open Zone):

- Operating Hours: from 08:00 to 11:00.

- Description: This Killzone marks the opening of the London session, one of the most important due to its high trading volume. The indicator plots the highs and lows of the price during this session, highlighting them with a red rectangle. These levels can indicate important confluence areas for traders who operate breakouts or consolidations.

- New York (New York Zones):

- New York AM: from 15:30 to 17:00.

- New York Lunch: from 18:00 to 19:00.

- New York PM: from 19:30 to 22:00.

- Description: The New York session is divided into three parts: the morning session (AM), the lunch hour (Lunch), and the afternoon session (PM). Each of these subzones allows for more precise identification of critical points in each segment of the American session. The levels of these zones are highlighted on the chart with rectangles of different colors: green for the AM session, yellow for the Lunch session, and purple for the PM session.

These Killzones provide a clear visual framework for traders who seek to trade based on the opening and closing phases of the most important sessions in the global market. Identifying the highs and lows within each Killzone can provide valuable opportunities for strategies based on breakouts, consolidations, or trend reversals.

Recommended Timeframe

The ICT Killzones and Pivots is designed to be used in timeframes of 1 hour or less. If a higher timeframe is selected, the indicator will display a warning message to inform the user that they need to adjust the timeframe for the indicator to properly show the Killzones.

Indicator Functionality

The ICT Killzones and Pivots uses a series of key features to mark the time zones and critical levels within these sessions:

- High and low zones: Each Killzone plots the highs and lows of the price during the corresponding session. These levels are drawn as rectangles of different colors according to the session (blue for Asia, red for London, green for New York AM, yellow for New York Lunch, and purple for New York PM).

- Segments and pivots: When the price crosses the previous high or low levels of a session, lines are drawn to highlight these pivots. These lines act as dynamic support and resistance during the current session, providing entry or exit points depending on market conditions.

- Day limits and reset: The indicator automatically resets at the start of each new trading day or at the close of the American session, ensuring that the plotted price levels are accurate and up-to-date for the new trading day.

Indicator Customization

The ICT Killzones and Pivots is highly customizable, allowing traders to adjust several parameters according to their needs. The customization options include:

- Opening and closing hours of sessions: The indicator allows modification of the opening and closing hours of the Asian, London, and New York sessions. These times can be adjusted to match local trading hours or according to the trader’s preferences.

- Display of the New York lunch session: Through the

ShowNylchparameter, it is possible to enable or disable the display of the New York lunch session, allowing for greater control over the zones to be highlighted on the chart.

Indicator Usage

The ICT Killzones and Pivots is especially useful for traders who want to operate during the most volatile sessions of the market. Identifying the highs and lows within each Killzone can serve as a reference for making decisions based on:

- Price breakouts: Trading based on price breakouts when it crosses the pivot levels generated by the indicator.

- Trend reversals: Taking advantage of possible market turns at key levels, where the price may reverse after reaching significant support or resistance.

Suggested Strategies

- Pivot Breakouts: Traders can trade breakouts when the price crosses the pivot levels marked in each Killzone. This strategy is especially useful during session openings, where volume tends to increase.

- Reversals at extremes: The highs and lows of the Killzones often act as important support and resistance areas, making it easier to identify potential reversals or consolidations at these levels.

Configuration in ProRealTime

Below is the source code for the indicator in ProRealTime, ready for use and customization. The schedules and colors of the zones can be modified directly from the configurable variables at the top of the code.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 305 306 307 308 309 310 |

//----------------------------------------------// //PRC_ICT Killzones and Pivots //version = 0 //10.10.2024 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //----------------------------------------------// //-----INPUTS-----------------------------------// //----------------------------------------------// openAS=020000 closeAS=060000 openLO=080000 closeLO=110000 openNYam=153000 closeNYam=170000 openNYlch=180000 closeNYlch=190000 openNYpm=193000 closeNYpm=220000 openNY=openNYam closeNY=closeNYpm limitday=180000 openTrueDay=060000 ShowNylch=1 if gettimeframe<=3600 then //----------------------------------------------// //-----ASIA Zone--------------------------------// //----------------------------------------------// once maxHighAS=high once minLowAS=low if opentime>=openAS and opentime<=closeAS then barAS=barAS+1 if high>=maxHighAS then maxHighAS=high else maxHighAS=maxHighAS endif if low<=minLowAS then minLowAS=low else minLowAS=minLowAS endif endif if opentime=closeAS then drawrectangle(barindex[barAS],minLowAS,barindex,maxHighAS)coloured("blue")fillcolor("blue",30) drawtext("AS.H: #maxHighAS#",barindex[round(barAS/2)],maxHighAS+0.3*tr) drawtext("AS.L: #minLowAS#",barindex[round(barAS/2)],minLowAS-0.3*tr) prevLowAS=minLowAS prevHighAS=maxHighAS previdxAS=barindex barAS=0 minLowAS=high*100 maxHighAS=0 endif if low crosses under prevLowAS then drawsegment(previdxAS,prevLowAS,barindex,prevLowAS)coloured("blue") prevLowAS=0 elsif opentime=limitday and prevLowAS<>0 then drawsegment(previdxAS,prevLowAS,barindex,prevLowAS)coloured("blue") prevLowAS=0 elsif islastbarupdate and prevLowAS<>0 then drawsegment(previdxAS,prevLowAS,barindex,prevLowAS)coloured("blue") endif if high crosses over prevHighAS then drawsegment(previdxAS,prevHighAS,barindex,prevHighAS)coloured("blue") prevHighAS=0 elsif opentime=limitday and prevHighAS<>0 then drawsegment(previdxAS,prevHighAS,barindex,prevHighAS)coloured("blue") prevHighAS=0 elsif islastbarupdate and prevHighAS<>0 then drawsegment(previdxAS,prevHighAS,barindex,prevHighAS)coloured("blue") endif //----------------------------------------------// //-----London Zone------------------------------// //----------------------------------------------// once maxHighLO=high once minLowLO=low if opentime>=openLO and opentime<=closeLO then barLO=barLO+1 if high>=maxHighLO then maxHighLO=high else maxHighLO=maxHighLO endif if low<=minLowLO then minLowLO=low else minLowLO=minLowLO endif endif if opentime=closeLO then drawrectangle(barindex[barLO],minLowLO,barindex,maxHighLO)coloured("red")fillcolor("red",30) drawtext("LO.H: #maxHighLO#",barindex[round(barLO/2)],maxHighLO+0.3*tr) drawtext("LO.L: #minLowLO#",barindex[round(barLO/2)],minLowLO-0.3*tr) prevLowLO=minLowLO prevHighLO=maxHighLO previdxLO=barindex barLO=0 minLowLO=high*100 maxHighLO=0 endif if low crosses under prevLowLO then drawsegment(previdxLO,prevLowLO,barindex,prevLowLO)coloured("red") prevLowLO=0 elsif opentime=limitday and prevLowLO<>0 then drawsegment(previdxLO,prevLowLO,barindex,prevLowLO)coloured("red") prevLowLO=0 elsif islastbarupdate and prevLowLO<>0 then drawsegment(previdxLO,prevLowLO,barindex,prevLowLO)coloured("red") endif if high crosses over prevHighLO then drawsegment(previdxLO,prevHighLO,barindex,prevHighLO)coloured("red") prevHighLO=0 elsif opentime=limitday and prevHighLO<>0 then drawsegment(previdxLO,prevHighLO,barindex,prevHighLO)coloured("red") prevHighLO=0 elsif islastbarupdate and prevHighLO<>0 then drawsegment(previdxLO,prevHighLO,barindex,prevHighLO)coloured("red") endif if ShowNylch then //----------------------------------------------// //-----New York AM------------------------------// //----------------------------------------------// once maxHighNYam=high once minLowNYam=low if opentime>=openNYam and opentime<=closeNYam then barNYam=barNYam+1 if high>=maxHighNYam then maxHighNYam=high else maxHighNYam=maxHighNYam endif if low<=minLowNYam then minLowNYam=low else minLowNYam=minLowNYam endif endif if opentime=closeNYam then drawrectangle(barindex[barNYam],minLowNYam,barindex,maxHighNYam)coloured("green")fillcolor("green",30) drawtext("NYam.H: #maxHighNYam#",barindex[round(barNYam/2)],maxHighNYam+0.3*tr) drawtext("NYam.L: #minLowNYam#",barindex[round(barNYam/2)],minLowNYam-0.3*tr) prevLowNYam=minLowNYam prevHighNYam=maxHighNYam previdxNYam=barindex barNYam=0 minLowNYam=high*100 maxHighNYam=0 endif if low crosses under prevLowNYam then drawsegment(previdxNYam,prevLowNYam,barindex,prevLowNYam)coloured("green") prevLowNYam=0 elsif opentime=limitday and prevLowNYam<>0 then drawsegment(previdxNYam,prevLowNYam,barindex,prevLowNYam)coloured("green") prevLowNYam=0 elsif islastbarupdate and prevLowNYam<>0 then drawsegment(previdxNYam,prevLowNYam,barindex,prevLowNYam)coloured("green") endif if high crosses over prevHighNYam then drawsegment(previdxNYam,prevHighNYam,barindex,prevHighNYam)coloured("green") prevHighNYam=0 elsif opentime=limitday and prevHighNYam<>0 then drawsegment(previdxNYam,prevHighNYam,barindex,prevHighNYam)coloured("green") prevHighNYam=0 elsif islastbarupdate and prevHighNYam<>0 then drawsegment(previdxNYam,prevHighNYam,barindex,prevHighNYam)coloured("green") endif //----------------------------------------------// //-----New York lunch Zone----------------------// //----------------------------------------------// once maxHighNYlch=high once minLowNYlch=low if opentime>=openNYlch and opentime<=closeNYlch then barNYlch=barNYlch+1 if high>=maxHighNYlch then maxHighNYlch=high else maxHighNYlch=maxHighNYlch endif if low<=minLowNYlch then minLowNYlch=low else minLowNYlch=minLowNYlch endif endif if opentime=closeNYlch then drawrectangle(barindex[barNYlch],minLowNYlch,barindex,maxHighNYlch)coloured("yellow")fillcolor("yellow",30) prevLowNYlch=minLowNYlch prevHighNYlch=maxHighNYlch previdxNYlch=barindex barNYlch=0 minLowNYlch=high*100 maxHighNYlch=0 endif //----------------------------------------------// //-----New York PM -----------------------------// //----------------------------------------------// once maxHighNYpm=high once minLowNYpm=low if opentime>=openNYpm and opentime<=closeNYpm then barNYpm=barNYpm+1 if high>=maxHighNYpm then maxHighNYpm=high else maxHighNYpm=maxHighNYpm endif if low<=minLowNYpm then minLowNYpm=low else minLowNYpm=minLowNYpm endif endif if opentime=closeNYpm then drawrectangle(barindex[barNYpm],minLowNYpm,barindex,maxHighNYpm)coloured("purple")fillcolor("purple",30) drawtext("NYpm.H: #maxHighNYpm#",barindex[round(barNYpm/2)],maxHighNYpm+0.3*tr) drawtext("NYpm.L: #minLowNYpm#",barindex[round(barNYpm/2)],minLowNYpm-0.3*tr) prevLowNYpm=minLowNYpm prevHighNYpm=maxHighNYpm previdxNYpm=barindex barNYpm=0 minLowNYpm=high*100 maxHighNYpm=0 endif if low crosses under prevLowNYpm then drawsegment(previdxNYpm,prevLowNYpm,barindex,prevLowNYpm)coloured("purple") prevLowNYpm=0 elsif opentime=limitday and prevLowNYpm<>0 then drawsegment(previdxNYpm,prevLowNYpm,barindex,prevLowNYpm)coloured("purple") prevLowNYpm=0 elsif islastbarupdate and prevLowNYpm<>0 then drawsegment(previdxNYpm,prevLowNYpm,barindex,prevLowNYpm)coloured("purple") endif if high crosses over prevHighNYpm then drawsegment(previdxNYpm,prevHighNYpm,barindex,prevHighNYpm)coloured("purple") prevHighNYpm=0 elsif opentime=limitday and prevHighNYpm<>0 then drawsegment(previdxNYpm,prevHighNYpm,barindex,prevHighNYpm)coloured("purple") prevHighNYpm=0 elsif islastbarupdate and prevHighNYpm<>0 then drawsegment(previdxNYpm,prevHighNYpm,barindex,prevHighNYpm)coloured("purple") endif else once maxHighNY=high once minLowNY=low if opentime>=openNY and opentime<=closeNY then barNY=barNY+1 if high>=maxHighNY then maxHighNY=high else maxHighNY=maxHighNY endif if low<=minLowNY then minLowNY=low else minLowNY=minLowNY endif endif if opentime=closeNY then drawrectangle(barindex[barNY],minLowNY,barindex,maxHighNY)coloured("purple")fillcolor("purple",30) drawtext("NY.H: #maxHighNY#",barindex[round(barNY/2)],maxHighNY+0.3*tr) drawtext("NY.L: #minLowNY#",barindex[round(barNY/2)],minLowNY-0.3*tr) prevLowNY=minLowNY prevHighNY=maxHighNY previdxNY=barindex barNY=0 minLowNY=high*100 maxHighNY=0 endif if low crosses under prevLowNY then drawsegment(previdxNY,prevLowNY,barindex,prevLowNY)coloured("purple") prevLowNY=0 elsif opentime=limitday and prevLowNY<>0 then drawsegment(previdxNY,prevLowNY,barindex,prevLowNY)coloured("purple") prevLowNY=0 elsif islastbarupdate and prevLowNY<>0 then drawsegment(previdxNY,prevLowNY,barindex,prevLowNY)coloured("purple") endif if high crosses over prevHighNY then drawsegment(previdxNY,prevHighNY,barindex,prevHighNY)coloured("purple") prevHighNY=0 elsif opentime=limitday and prevHighNY<>0 then drawsegment(previdxNY,prevHighNY,barindex,prevHighNY)coloured("purple") prevHighNY=0 elsif islastbarupdate and prevHighNY<>0 then drawsegment(previdxNY,prevHighNY,barindex,prevHighNY)coloured("purple") endif endif //----------------------------------------------// //-----Limit Day--------------------------------// //----------------------------------------------// if opentime=openTrueDay then openTD=open barTD=barindex else if opentime=limitday then drawvline(barindex)style(dottedline) drawsegment(barTD,openTD,barindex,openTD)style(dottedline1) endif endif else drawtext("Change timeframe to 1hr or less",0,0,SansSerif,bold,34)anchor(middle,xshift,yshift) endif return |

Conclusion

The ICT Killzones and Pivots is a powerful visual tool designed for traders who want to take advantage of market movements within the main time zones of the Asian, London, and New York sessions. Thanks to its customization capabilities and the clarity of the levels generated, this indicator is ideal for both intraday strategies and traders who prefer to operate during specific sessions of the day.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello Ivan and thank you for your tools. Would you be able to create an indicator that in those time periods (for example, USA market from 15.30 to 17.00) shows how much (in % from the previous day close) the price has gone up or down in that period and represent it on the graph for each of those time periods?

For example, day 10 the price went to a minimum of 210.52 and this is a -3.2% from previous day close, then went to the maximum (for those 15.30-17.00 periods) of 215.20 and this was a +2.4% since the minimum (not the previous day close but in comparison with the minimum of that session). And that session there was a -4% and just went up (the maximum of that session from 15.30-17.00) of +0.5% (since the minimum of that session) just write -4% +0.5% (instead of the minimum and maximum as you represent it in the indicator).

For each session (USA market 15.30-17.00)? Or even better, with an option in the indicator to show (if you want it or not) only when the % for the minimum of that day was for example higher than -2% since last day close)? Even showing just the % and not the real price maximum or minimum in that day.

What lines should we add in the code of this indicator to show this?

Another alternative would be to just plot on the graph those days that went up or down + – 2% (and not showing the rest of the days were it was less than a 2% (up or down), so we can easily see and find just these sessions that went +-2% for the last weeks or months (and not those that were 1.2% or -0.8%).

I want to find sessions with a -2% or +2% (15.30–>17.00) and just analyze what the chart did in just these days. Maybe a parameter to show sessions with +2 -2% or allow to configure it to show it or show every day (all % up or down). Thanks!

Hi. You could add these lines of code:

if intradaybarindex=0 then

varhigh=round((dhigh(1)/dopen(1)-1)*100,2)

varlow=round((dlow(1)/dopen(1)-1)*100,2)

drawtext(“VarHigh=#varhigh#%”,barindex[round(variationbars*0.5)],dhigh(1))coloured(“Green”)

drawtext(“VarLow=#varlow#%”,barindex[round(variationbars*0.5)],dlow(1))coloured(“red”)

variationbars=0

else

variationbars=variationbars+1

endif

merci

I

Edit

Hello, How can we make the vertical bars of the “Drawrectancle” disappear?

Hi. When you draw a rectangle you can configure line’s transparency.

coloured(“red”,transparency)

transparency goes from 0 to 255. 0 means no color.

Thank you Ivan.

I have a problem! The “Kill Zones” do not start and stop at the appointed time but at the closing of the candle (Timeframe) on which the indicator is applied. Which will change the information considerably, depending on whether the indicator is applied on a 5-minute or 30-minute chart, the upper and lower limits will not be the same at all…

I’ll specify here, when the KillZone closing time has arrived and we are on the high or low of it. The KillZone does not take into account the real time, but will be drawn at the close of the candle according to the timeframe on which we apply the indicator! That is for a closing at 11:00, on a 1 minute chart at 11:01, on a 5 minute chart at 11:05, on a 15 minute chart at 11:15 etc… This is not trivial!

Hi! Yes that’s it. The indicator draws the rectangle after close

Congratulations and many thanks for sharing your code Ivan. Clear and customizable.. added to my chart!

Hi Iván, Thanks for this nice indicator!

I am trying to figure out how to use the variable in the settings but it is hard coded in the code but i want to be able to change the values in the settings, how can i do that?

Hola. El indicador esta perfecto. Me pregunto como se puede hacer para usar los niveles maximos y minimos de cada sesion en un sistema de trading…

Hello.

All my PRT is configured Paris time and I am getting a strange behaviour:

* Using Dax Future NY PM is not showing.

* Using NS Future NY AM is not showing.

Is this something known ?

Kind Regards,

Hi. You have to adjust open and close time to the tickets you are trading. For example, in DAX closeNYpm=215500 if you are trading with 5mn candle, or 215900 if you are trading with 1mn.