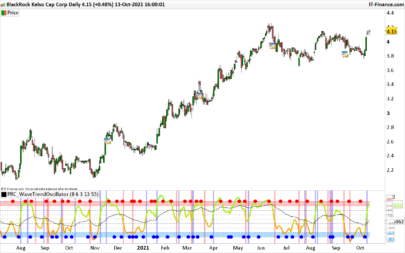

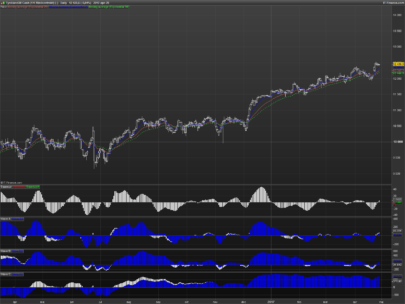

This is a indicator that find an count Elliott Waves. The original idea is coming from https://www.prorealcode.com/prorealtime-indicators/jeffrey-kennedy-trend-analyzer, I transform it to simpler to be used in my strategy. Basically the green is for uptrend and red is for downtrend. Although I find it more reliable on higher time frame, but can be used for any time frame.

I think any new discussion can be directly into here, https://www.prorealcode.com/topic/jeffrey-kennedy-trend-analyzer/

Kudos to the original author @ and @Zigo

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 |

//JKFast //fastLength=5 //slowLength=20 valuefast=ExponentialAverage[fastlength](close)-ExponentialAverage[slowlength](close) hv5 = Highest[a1](valuefast) lv5 = Lowest[a1](valuefast) if hv5 = lv5 then JKFast5=0 else JKFast5=((hv5 - valuefast) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[a2](valuefast) lv10 = Lowest[a2](valuefast) if hv10 = lv10 then JKFast10=0 else JKFast10=((hv10 - valuefast) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[a3](valuefast) lv15 = Lowest[a3](valuefast) if hv15 = lv15 then JKFast15=0 else JKFast15=((hv15 - valuefast) / (hv15 - lv15) * (-100) + 100) endif //JK TA valuebase=ExponentialAverage[fastlength](close) hv5 = Highest[a1](valuebase) lv5 = Lowest[a1](valuebase) if hv5 = lv5 then JKTA5=0 else JKTA5=((hv5 - valuebase) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[a2](valuebase) lv10 = Lowest[a2](valuebase) if hv10 = lv10 then JKTA10=0 else JKTA10=((hv10 - valuebase) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[a3](valuebase) lv15 = Lowest[a3](valuebase) if hv15 = lv15 then JKTA15=0 else JKTA15=((hv15 - valuebase) / (hv15 - lv15) * (-100) + 100) endif //JK Slow valueslow=ExponentialAverage[slowLength](close) hv5 = Highest[a1](valueslow) lv5 = Lowest[a1](valueslow) if hv5 = lv5 then JKSlow5=0 else JKSlow5=((hv5 - valueslow) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[a2](valueslow) lv10 = Lowest[a2](valueslow) if hv10 = lv10 then JKSlow10=0 else JKSlow10=((hv10 - valueslow) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[a3](valueslow) lv15 = Lowest[a3](valueslow) if hv15 = lv15 then JKSlow15=0 else JKSlow15=((hv15 - valueslow) / (hv15 - lv15) * (-100) + 100) endif //Return JKFast5 coloured (255,150,255) as "JKFast5", JKFast10 coloured (255,100,255) as "JKFast10", JKFast15 coloured (255,50,255) as "JKFast15", JKSlow5 coloured (150,200,0) as "JKSlow5", JKSlow10 coloured (100,200,0) as "JKSlow10", JKSlow15 coloured (50,200,0) as "JKSlow15", JKTA5 coloured (150,150,255) as "JKTA5", JKTA10 coloured (100,100,255) as "JKTA10", JKTA15 coloured (50,50,255) as "JKTA15" JKF1=summation[a1](JKFast5)/a1 JKF2=summation[a2](JKFast10)/a2 JKF3=summation[a3](JKFast15)/a3 JKTA1=summation[a1](JKTA5)/a1 JKTA2=summation[a2](JKTA10)/a2 JKTA3=summation[a3](JKTA15)/a3 JKSl1=summation[a1](JKSlow5)/a1 JKSl2=summation[a2](JKSlow10)/a2 JKSL3=summation[a3](JKSlow15)/a3 JKSum1=(jkf1+jkf2+jkf3)/3 jksum2=(jkta1+jkta2+jkta3)/3 jksum3=(jksl1+jksl2+jksl3)/3 if jksum1 > 50 then F=1 else F=-1 endif if jksum2 > 50 then TA= 1 else TA=-1 endif if jksum3 > 50 then Sl=1 else sl=-1 endif sign= sin(atan(F+TA+ Sl)) positivesign = 0 negativesign = 0 nosign = 0 if sign > 0 then positivesign = sign elsif sign < 0 then negativesign = sign else nosign = sign endif Return positivesign coloured (50,205,50) STYLE(histogram), negativesign coloured (255,0,0) STYLE(histogram), nosign coloured (128,128,128) STYLE(histogram) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials