This is an implementation of John Ehlers’ Adaptive RSI, as described in his book Rocket Science for Traders: Digital Signal Processing Applications (2001-07-20).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 |

// Adaptive Relative Strength Index (RSI) // Rocket Science for Traders: Digital Signal Processing Applications // 2001-07-20 John F. Ehlers Price = (high+low)/2 CycPart = .5 If BarIndex > 5 then Smooth = (4*Price + 3*Price[1] + 2*Price[2] + Price[3]) / 10 Detrender = (.0962*Smooth + .5769*Smooth[2] - .5769*Smooth[4] - .0962*Smooth[6])*(.075*Period[1] + .54) // Compute InPhase and Quadrature components Q1 = (.0962*Detrender + .5769*Detrender[2] - .5769*Detrender[4] - .0962*Detrender[6])*(.075*Period[1] + .54) I1 = Detrender[3] // Advance the phase of I1 and Q1 by 90 degrees j1 = (.0962*I1 + .5769*I1[2] - .5769*I1[4] - .0962*I1[6])*(.075*Period[1] + .54) jQ = (.0962*Q1 + .5769*Q1[2] - .5769*Q1[4] - .0962*Q1[6])*(.075*Period[1] + .54) // Phasor addition for 3 bar averaging I2 = I1 - jQ Q2 = Q1 + j1 // Smooth the I and Q components before applying the discriminator I2 = .2*I2 + .8*I2[1] Q2 = .2*Q2 + .8*Q2[1] // Homodyne Discriminator Re = I2*I2[1] + Q2*Q2[1] Im = I2*Q2[1] - Q2*I2[1] Re = .2*Re + .8*Re[1] Im = .2*Im + .8*Im[1] If Im <> 0 and Re <> 0 then Period = 360/ATAN(Im/Re) Endif If Period > 1.5*Period[1] then Period = 1.5*Period[1] Endif If Period < .67*Period[1] then Period = .67*Period[1] Endif If Period < 6 then Period = 6 Endif If Period > 50 then Period = 50 Endif Period = .2*Period + .8*Period[1] SmoothPeriod = .33*Period + .67*SmoothPeriod[1] CU = 0 CD = 0 For count = 0 to ROUND(CycPart*SmoothPeriod) - 1 do If Close[count] - Close[count + 1] > 0 then CU = CU + (Close[count] - Close[count + 1]) Endif If Close[count] - Close[count + 1] < 0 then CD = CD + (Close[count + 1] - Close[count]) Endif Next If CU + CD <> 0 then ARSI = 100*CU / (CU + CD) Endif Endif Return ARSI as "RSI" |

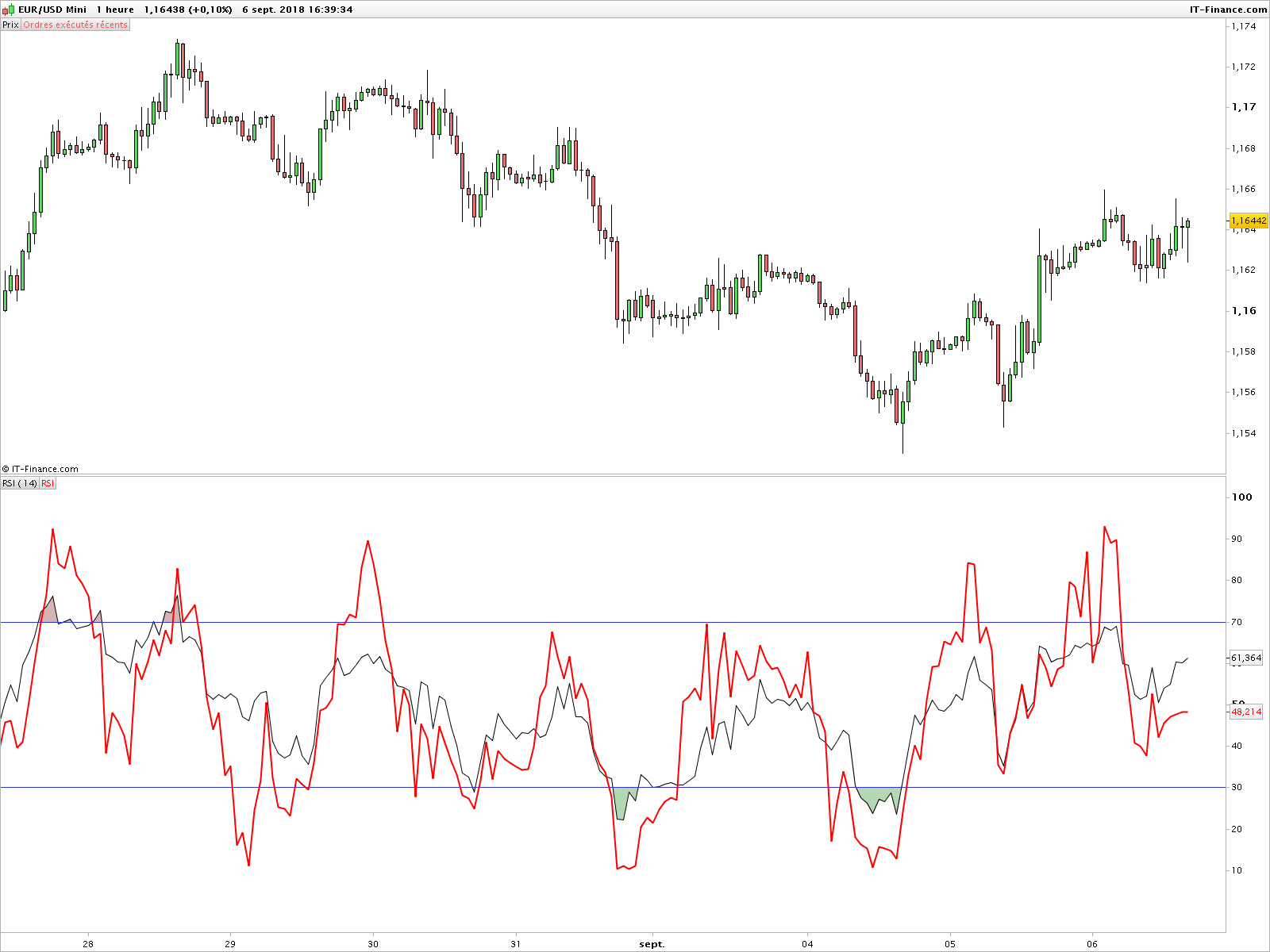

The attached screenshot shows J. Welles Wilder’s RSI (black) and John Ehlers’ Adaptive RSI (red).

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials