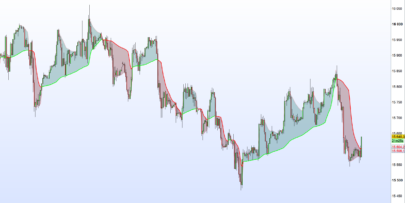

The MESA Adaptive Moving Average (MAMA) adapts to price movement in an entirely new and unique way. The adapation is based on the rate change of phase as measured by the Hilbert Transform Discriminator I have previously described. The advantage of this method of adaptation is that it features a fast attack average and a slow decay average so that composite average rapidly ratchets behind price changes and holds the average value until the next ratchet occurs.

An interesting set of indicators result if the MAMA is applied to the first MAMA line to produce a Following Adaptive Moving Average (FAMA). By using an alpha in FAMA that is half the value of the alpha in MAMA, the FAMA has steps in time synchronization with MAMA, but the vertical movement is not as great. As a result, MAMA and FAMA do not cross unless there has been a major change in market direction. This suggests an adaptive moving average crossover system that is virtually free of whipsaw trades.

(text and code adapted from jamesgoulding.com website).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 |

//parameters : // FastLimit = 0.5 // SlowLimit = 0.05 Price = (High+Low)/2 if(barindex>5) then Smooth = (4*Price + 3*Price[1] + 2*Price[2] + Price[3]) / 10 Detrender = (.0962*Smooth + .5769*Smooth[2] - .5769*Smooth[4] - .0962*Smooth[6])*(.075*Period[1] + .54) Q1 = (.0962*Detrender + .5769*Detrender[2] - .5769*Detrender[4] - .0962*Detrender[6])*(.075*Period[1] + .54) I1 = Detrender[3] jI = (.0962*I1 + .5769*I1[2] - .5769*I1[4] - .0962*I1[6])*(.075*Period[1] + .54) jQ = (.0962*Q1 + .5769*Q1[2] - .5769*Q1[4] - .0962*Q1[6])*(.075*Period[1] + .54) I2 = I1 - jQ Q2 = Q1 + jI I2 = .2*I2 + .8*I2[1] Q2 = .2*Q2 + .8*Q2[1] Re = I2*I2[1] + Q2*Q2[1] Im = I2*Q2[1] - Q2*I2[1] Re = .2*Re + .8*Re[1] Im = .2*Im + .8*Im[1] If Im <> 0 and Re <> 0 then Period = 360/ATAN(Im/Re) endif If Period > 1.5*Period[1] then Period = 1.5*Period[1] endif If Period < .67*Period[1] then Period = .67*Period[1] endif If Period < 6 then Period = 6 endif If Period > 50 then Period = 50 endif Period = .2*Period + .8*Period[1] SmoothPeriod = .33*Period + .67*SmoothPeriod[1] if(I1<>0) then Phase = ATAN(Q1 / I1) endif DeltaPhase = Phase[1] - Phase If DeltaPhase < 1 then DeltaPhase = 1 endif alpha = FastLimit / DeltaPhase If alpha < SlowLimit then alpha = SlowLimit endif MAMA = alpha*Price + (1 - alpha)*MAMA[1] FAMA = .5*alpha*MAMA + (1 - .5*alpha)*FAMA[1] endif RETURN MAMA as "MAMA", FAMA as "FAMA" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

nice work , nicolas , very good.

Hi.

When I import MAMA the blue and red lines appear twice on my chart. Any way of getting only one line of each to appear?

thanks

You have certainly apply the indicator twice on the price chart. If you want to hide one of the curve, you can set its Style to “invisible”.

Buongiorno Nicolas,

come faccio a trasformare questo interessantissimo indicatore in uno screener long/short?

Grazie,

Fabrizio

Si desidera testare una croce sopra di 2 media mobile? Si prega di fare un argomento nel forum per la vostra richiesta. Grazie.

A great job Nicolas, thanks. A question about averages, what period is the fast average and what period is the slow average? thank you

This Indicator is very useful if the Risk number is altered to suit the time frame, volume or tick count. If combined with the PRC ASC Trend, also adjusted to suit, then some good results can be had. Thank you

how are you applying it to asc trend

error displaying, code must end with RETURN. Any idea hot to fix it?