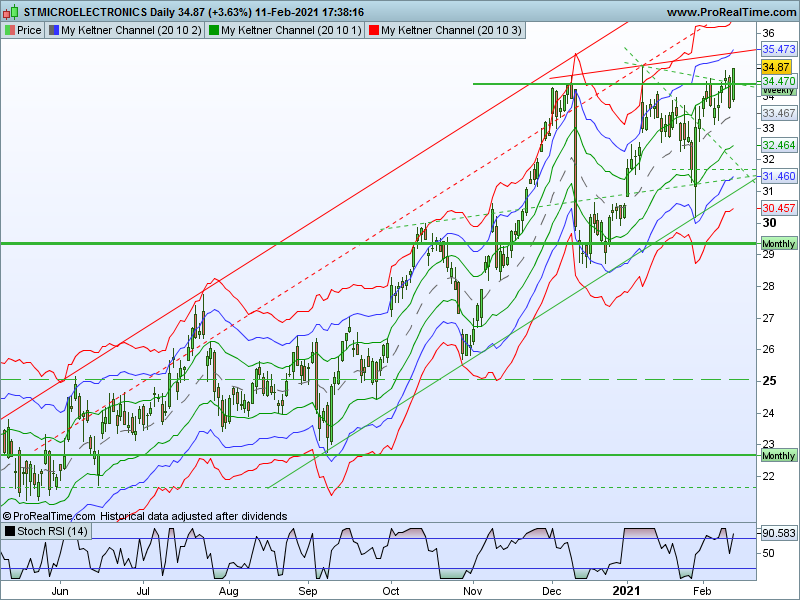

In his 1960 book, How to Make Money in Commodities, Chester Keltner introduced the “Ten-Day Moving Average Trading Rule,” which is credited as the original version of Keltner Channels.

This original version started with a 10-day SMA of the typical price {(H+L+C)/3)} as the centerline. The 10-day SMA of the High-Low range was added and subtracted to set the upper and lower channel lines. Linda Bradford Raschke introduced the newer version of Keltner Channels in the 1980s. Like Bollinger Bands, this new version used a volatility based indicator, Average True Range (ATR), to set channel width.

|

1 2 3 4 5 6 7 8 9 10 11 12 |

// Keltner Channel //periodMA=20 //periodATR=10 //k=2 MA = ExponentialAverage[periodMA](close) // Upper Keltner Band UpperBand = MA + k*AverageTrueRange[periodATR](close) // Lower Keltner Band LowerBand = MA - k*AverageTrueRange[periodATR](close) RETURN MA AS "Keltner MA" , UpperBand AS "Keltner Upper Band" , LowerBand as "Keltner Lower Band" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials