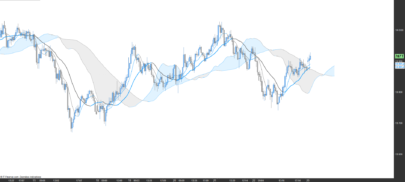

Trying to understand the relevance of the values linked to ichimoku, I tried several experiments that I transmit as a cloud or a colored line

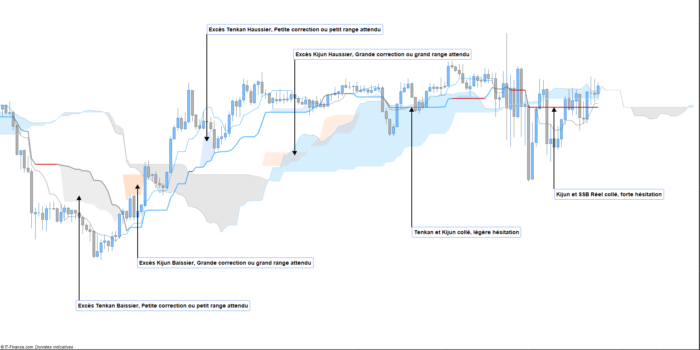

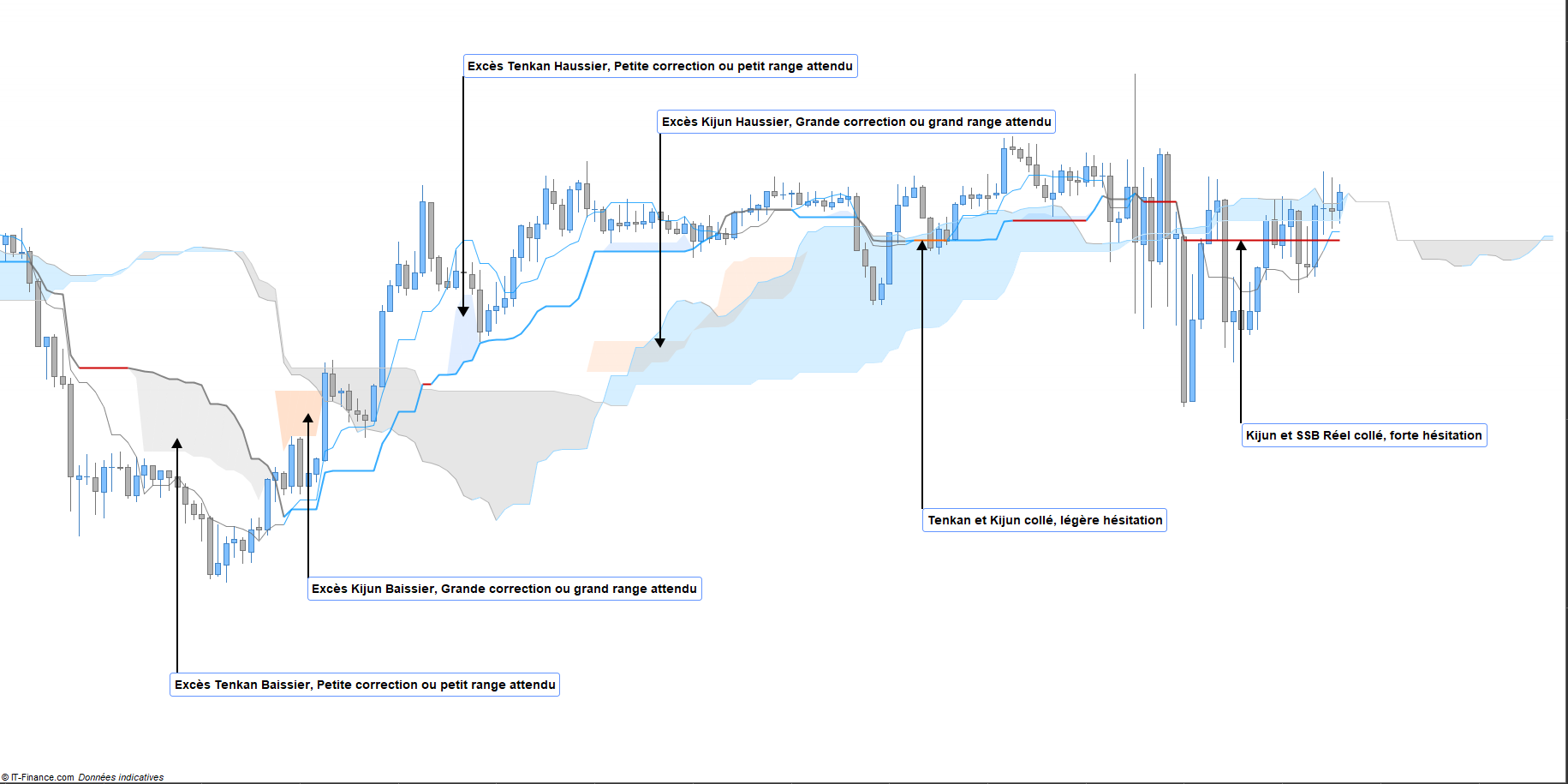

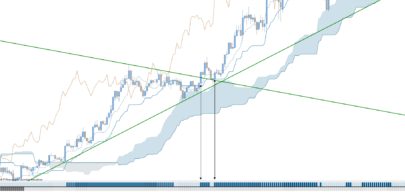

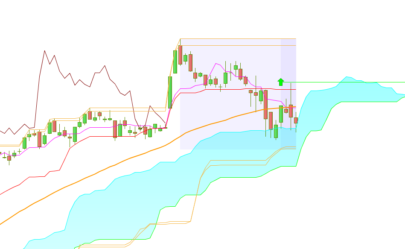

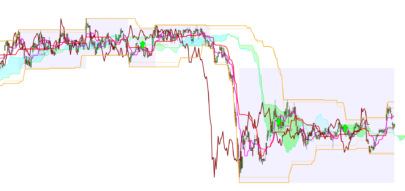

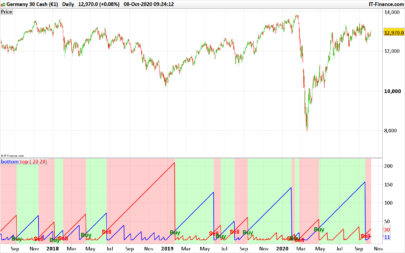

By applying the highest and lowest 9, I observed that it could indicate small corrections or small range before their appearance, this is explained by the effect of over-purchase or overselling, you can then see a small cloud stuck to the kijun when this “elastic” effect appears,

By applying the highest and lowest 26, I observed that it could indicate strong corrections or large range before their appearance, this is explained by the effect of overbought or oversold :), you can then see an orange cloud appearing.

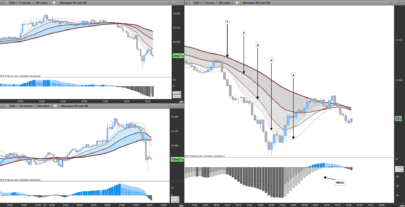

Also on the image, you can see the Kijun becoming Orange, this coloration appears when the Kijun and the Tenkan are glued and horizontal, the movements that follow are often uncertain…

When the Kijun turns Red, the Kijun and the Real SSB are glued and horizontal, the movements that follow are very erratic!

The main picture shows this information quite clearly.

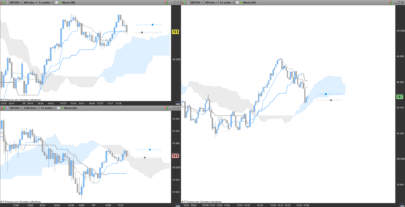

I know we have our favorite colors!

That’s why at the beginning of the code, you have a panel that allows you to modify the color codes with information to know which code corresponds to which color .

Update link and discussions: https://www.prorealcode.com/topic/discution-et-maj-indicateur-kinko-yo/

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 |

// //=/===============/=//=/===============/=//=/ Paramettre de Base // defparam calculateonlastbars = 2000 // //=/===============/=//=/===============/=//=/ Paramettre des couleurs // // //=/ = = Tenkan // //=/ Tenkan Hausse UPxT1 = 0 UPxT2 = 150 UPxT3 = 255 UPxT4 = 200 //=/ Tenkan Baisse DWxT1 = 102 DWxT2 = 102 DWxT3 = 102 DWxT4 = 200 //=/ Tenkan Anormalité ANxT1 = 255 ANxT2 = 102 ANxT3 = 0 ANxT4 = 250 // //=/ = = Kijun // //=/ Kijun Hausse UPxK1 = 0 UPxK2 = 150 UPxK3 = 255 UPxK4 = 200 //=/ Kijun Baisse DWxK1 = 102 DWxK2 = 102 DWxK3 = 102 DWxK4 = 200 //=/ Kijun Anormalité Type 1 A1xK1 = 255 A1xK2 = 102 A1xK3 = 0 A1xK4 = 250 //=/ Kijun Anormalité Type 2 A2xK1 = 204 A2xK2 = 0 A2xK3 = 0 A2xK4 = 250 // //=/ = = Excès Tenkan // //=/ Excès Haussier EHxT1 = 0 EHxT2 = 150 EHxT3 = 255 EHxT4 = 30 //=/ Excès Baissier EBxT1 = 102 EBxT2 = 102 EBxT3 = 102 EBxT4 = 30 // //=/ = = Excès Kijun // EKxT1 = 255 EKxT2 = 102 EKxT3 = 0 EKxT4 = 30 // //=/===============/=//=/===============/=//=/ Indicateur // //=/ Ichimoku Hx1 = highest[9](high) Lx1 = lowest[9](low) //=// Hx2 = highest[26](high) Lx2 = lowest[26](low) //=// Hx3 = highest[52](high) Lx3 = lowest[52](low) //=// XB = (Hx3+Lx3)/2 XA = (Hx1+Lx1+Hx2+Lx2)/4 //=// SA = (XA[26]) SB = (XB[26]) TK = (highest[9](high)+lowest[9](low))/2 KJ = (highest[26](high)+lowest[26](low))/2 // //=/===============/=//=/===============/=//=/ Tenkan // //=/ UP if TK > KJ then Rx1 = UPxT1 Gx1 = UPxT2 Bx1 = UPxT3 Tx1 = UPxT4 elsif TK = KJ and TK > TK[1] then Rx1 = UPxT1 Gx1 = UPxT2 Bx1 = UPxT3 Tx1 = UPxT4 //=/ Down elsif TK < KJ then Rx1 = DWxT1 Gx1 = DWxT2 Bx1 = DWxT3 Tx1 = DWxT4 elsif TK = KJ and TK < TK[1] then Rx1 = DWxT1 Gx1 = DWxT2 Bx1 = DWxT3 Tx1 = DWxT4 //=/ Alerte else Rx1 = ANxT1 Gx1 = ANxT2 Bx1 = ANxT3 Tx1 = ANxT4 endif // //=/===============/=//=/===============/=//=/ Kijun // //=/ UP if KJ < TK and (KJ > XB or KJ < XB) then Rx2 = UPxK1 Gx2 = UPxK2 Bx2 = UPxK3 Tx2 = UPxK4 elsif KJ < TK and KJ = XB and KJ > KJ[1] then Rx2 = UPxK1 Gx2 = UPxK2 Bx2 = UPxK3 Tx2 = UPxK4 elsif KJ = TK and TK > TK[1] and (KJ > XB or KJ < XB) then Rx2 = UPxK1 Gx2 = UPxK2 Bx2 = UPxK3 Tx2 = UPxK4 elsif KJ = TK and KJ = XB and KJ > KJ[1] then Rx2 = UPxK1 Gx2 = UPxK2 Bx2 = UPxK3 Tx2 = UPxK4 //=/ Down elsif KJ > TK and (KJ > XB or KJ < XB) then Rx2 = DWxK1 Gx2 = DWxK2 Bx2 = DWxK3 Tx2 = DWxK4 elsif KJ > TK and KJ = XB and KJ < KJ[1] then Rx2 = DWxK1 Gx2 = DWxK2 Bx2 = DWxK3 Tx2 = DWxK4 elsif KJ = TK and TK < TK[1] and (KJ > XB or KJ < XB) then Rx2 = DWxK1 Gx2 = DWxK2 Bx2 = DWxK3 Tx2 = DWxK4 elsif KJ = TK and KJ = XB and KJ < KJ[1] then Rx2 = DWxK1 Gx2 = DWxK2 Bx2 = DWxK3 Tx2 = DWxK4 //=/ Alerte 1 elsif KJ = TK and TK = TK[1] and (KJ > XB or KJ < XB) then Rx2 = A1xK1 Gx2 = A1xK2 Bx2 = A1xK3 Tx2 = A1xK4 //=/ Alerte 2 else Rx2 = A2xK1 Gx2 = A2xK2 Bx2 = A2xK3 Tx2 = A2xK4 endif // //=/===============/=//=/===============/=//=/ Excès Tenkan // //=/ UP T1 if Lx1 > KJ and Lx1[1] => KJ[1] and TK > KJ then drawtriangle(barindex[1],Lx1[1],barindex[1],KJ[1],barindex,KJ) coloured(EHxT1,EHxT2,EHxT3,EHxT4) bordercolor(0,0,0,0) drawtriangle(barindex,Lx1,barindex,KJ,barindex[1],Lx1[1]) coloured(EHxT1,EHxT2,EHxT3,EHxT4) bordercolor(0,0,0,0) endif //=// if Lx1 > KJ and Lx1[1] =< KJ[1] and TK > KJ then drawtriangle(barindex,Lx1,barindex,KJ,barindex[1],KJ[1]) coloured(EHxT1,EHxT2,EHxT3,EHxT4) bordercolor(0,0,0,0) endif //=// if Lx1 =< KJ and Lx1[1] > KJ[1] and TK > KJ then drawtriangle(barindex[1],Lx1[1],barindex[1],KJ[1],barindex,KJ) coloured(EHxT1,EHxT2,EHxT3,EHxT4) bordercolor(0,0,0,0) endif //=/ DW T1 if Hx1 < KJ and Hx1[1] =< KJ[1] and TK < KJ then drawtriangle(barindex[1],Hx1[1],barindex[1],KJ[1],barindex,KJ) coloured(EBxT1,EBxT2,EBxT3,EBxT4) bordercolor(0,0,0,0) drawtriangle(barindex,Hx1,barindex,KJ,barindex[1],Hx1[1]) coloured(EBxT1,EBxT2,EBxT3,EBxT4) bordercolor(0,0,0,0) endif //=// if Hx1 < KJ and Hx1[1] => KJ[1] and TK < KJ then drawtriangle(barindex,Hx1,barindex,KJ,barindex[1],KJ[1]) coloured(EBxT1,EBxT2,EBxT3,EBxT4) bordercolor(0,0,0,0) endif //=// if Hx1 => KJ and Hx1[1] < KJ[1] and TK < KJ then drawtriangle(barindex[1],Hx1[1],barindex[1],KJ[1],barindex,KJ) coloured(EBxT1,EBxT2,EBxT3,EBxT4) bordercolor(0,0,0,0) endif // //=/===============/=//=/===============/=//=/ Excès Kijun // //=/ UP T1 if Lx2 > XB and Lx2[1] => XB[1] and KJ > XB then drawtriangle(barindex[1],Lx2[1],barindex[1],XB[1],barindex,XB) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) drawtriangle(barindex,Lx2,barindex,XB,barindex[1],Lx2[1]) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif //=// if Lx2 > XB and Lx2[1] =< XB[1] and KJ > XB then drawtriangle(barindex,Lx2,barindex,XB,barindex[1],XB[1]) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif //=// if Lx2 =< XB and Lx2[1] > XB[1] and KJ > XB then drawtriangle(barindex[1],Lx2[1],barindex[1],XB[1],barindex,XB) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif //=/ DW T1 if Hx2 < XB and Hx2[1] =< XB[1] and KJ < XB then drawtriangle(barindex[1],Hx2[1],barindex[1],XB[1],barindex,XB) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) drawtriangle(barindex,Hx2,barindex,XB,barindex[1],Hx2[1]) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif //=// if Hx2 < XB and Hx2[1] => XB[1] and KJ < XB then drawtriangle(barindex,Hx2,barindex,XB,barindex[1],XB[1]) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif //=// if Hx2 => XB and Hx2[1] < XB[1] and KJ < XB then drawtriangle(barindex[1],Hx2[1],barindex[1],XB[1],barindex,XB) coloured(EKxT1,EKxT2,EKxT3,EKxT4) bordercolor(0,0,0,0) endif // //=/===============/=//=/===============/=//=/ Fin // return TK coloured(Rx1,Gx1,Bx1,Tx1) style(line,1) as "Tenkan", KJ coloured(Rx2,Gx2,Bx2,Tx2) style(line,2) as "Kijun" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Merci l’ami, passe une bonne semaine

Merci de même 😉