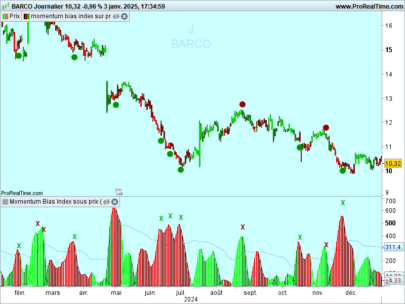

Rate of Change (ROC) indicator is the foundation of Know Sure Thing (KST) indicator. Know sure thing (KST) indicator is useful to identify major stock market cycle junctures because it formula is weighed to have larger influence by the longer and more dominant time span to better reflecting the primary swings of stock market cycle.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 |

X1 = 10 X2 = 15 X3 = 20 X4 = 30 W1 = 1 W2 = 2 W3 = 3 W4 = 4 AVG1 = 10 AVG2 = 10 AVG3 = 10 AVG4 = 15 ROC1 = (1-Close/Close[X1])*100 ROC2 = (1-Close/Close[X2])*100 ROC3 = (1-Close/Close[X3])*100 ROC4 = (1-Close/Close[X4])*100 KST = ( Average[AVG1](ROC1) * W1 ) + ( Average[AVG2](ROC2) * W2 ) + ( Average[AVG3](ROC3) * W3 ) + ( Average[AVG4](ROC4) * W4 ) RETURN KST |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials