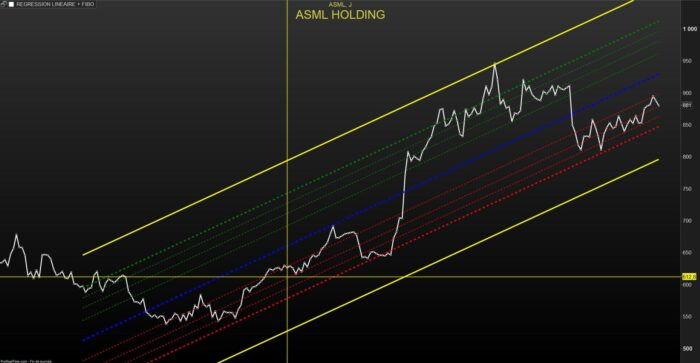

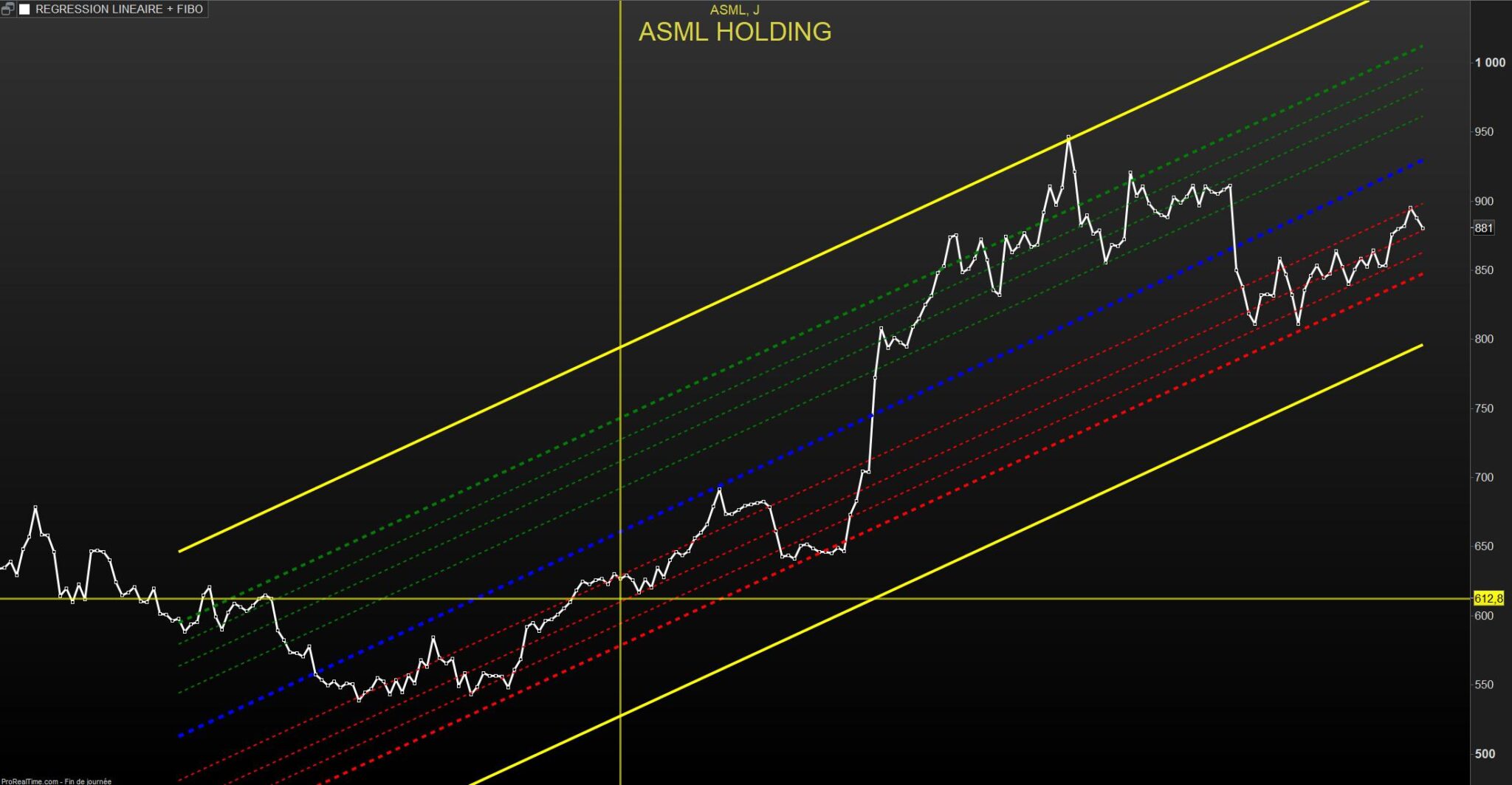

What is the Linear Regression Channel with Fibonacci?

The Linear Regression Channel is a statistical tool used to identify trends and potential reversal points in the market. By incorporating Fibonacci levels, this tool becomes even more powerful, providing additional support and resistance levels. Understanding and utilizing this combination can significantly enhance your trading strategy.

Coding the Indicator

To begin, we’ll set up the basic parameters and calculate the necessary sums for the Linear Regression Line. Here’s the initial setup:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 |

// Linear Regression Channel with FIBONACCI by Ivan on 30.05.2024 defparam drawonlastbaronly=true defparam calculateonlastbars=1000 // --- settings lookback= 200 //channel period ChannelType = 1 //1= Standard Deviation ; 2= Standard Error NbDeviation = 1 //Deviation multiplier colorRed = 255 colorGreen = 255 colorBlue = 0 // --- end of settings sumx = 0 sumy = 0 sumxy = 0 sumx2 = 0 for cmpt = lookback downto 0 do tmpx = cmpt tmpy = close[cmpt] sumy = sumy + tmpy sumx = sumx + tmpx sumx2 = sumx2 + (tmpx * tmpx) sumxy = sumxy + (tmpy * tmpx) next n = lookback + 1 if (sumx2 = sumx * sumx) then // protection to avoid infinite values b = sumxy - sumx * sumy else b = (n * sumxy - sumx * sumy) / (n * sumx2 - sumx * sumx) endif a = (sumy - b * sumx) / n |

This code sets up the parameters for the lookback period, channel type, and deviation multiplier, and calculates the sums needed for the Linear Regression Line.

Drawing the Regression Channel with Fibonacci Levels

Next, we will draw the regression channel and overlay Fibonacci levels. The following code does just that:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

// Channel if ChannelType = 1 then //Standard Deviation dat = std[lookback] * NbDeviation else dat = ste[lookback] * NbDeviation endif drawsegment(barindex[lookback], (a + b * lookback) + dat, barindex, a + b * 0 + dat) coloured(colorRed, colorGreen, colorBlue) style(line, 4) coloured("yellow") drawsegment(barindex[lookback], (a + b * lookback) + 0.618 * dat, barindex, a + b * 0 + 0.618 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 4) coloured("green") drawsegment(barindex[lookback], (a + b * lookback) + 0.5 * dat, barindex, a + b * 0 + 0.5 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("green") drawsegment(barindex[lookback], (a + b * lookback) + 0.382 * dat, barindex, a + b * 0 + 0.382 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("green") drawsegment(barindex[lookback], (a + b * lookback) + 0.236 * dat, barindex, a + b * 0 + 0.236 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("green") drawsegment(barindex[lookback], a + b * lookback, barindex, a + b * 0) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 5) coloured("blue") drawsegment(barindex[lookback], (a + b * lookback) - 0.236 * dat, barindex, a + b * 0 - 0.236 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("red") drawsegment(barindex[lookback], (a + b * lookback) - 0.382 * dat, barindex, a + b * 0 - 0.382 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("red") drawsegment(barindex[lookback], (a + b * lookback) - 0.5 * dat, barindex, a + b * 0 - 0.5 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 2) coloured("red") drawsegment(barindex[lookback], (a + b * lookback) - 0.618 * dat, barindex, a + b * 0 - 0.618 * dat) coloured(colorRed, colorGreen, colorBlue) style(dottedline, 4) coloured("red") drawsegment(barindex[lookback], (a + b * lookback) - dat, barindex, a + b * 0 - dat) coloured(colorRed, colorGreen, colorBlue) style(line, 4) coloured("yellow") Return customclose as "REGRESSION LINEAIRE + FIBO" |

This code draws the main regression line and the channels above and below it, using Fibonacci retracement levels (0.618, 0.5, 0.382, 0.236). Each level is colored and styled to help distinguish between them visually.

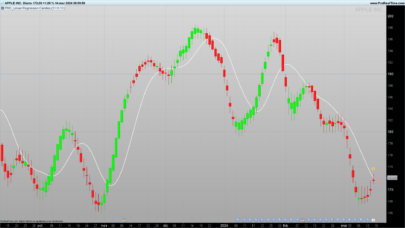

Practical Application

Using the Linear Regression Channel with Fibonacci in your trading can provide you with critical insights into market trends and potential reversal points. The standard deviation channels give you a sense of volatility, while the Fibonacci levels provide precise areas of support and resistance. By integrating these tools into your analysis, you can make more informed trading decisions and enhance your overall strategy.

Conclusion

Mastering the Linear Regression Channel with Fibonacci in ProRealTime can significantly boost your trading analysis. This combination helps you visualize market trends and potential reversal points, making your trading strategy more robust. Get started with this powerful indicator and take your trading to the next level!

If you have any questions or need further assistance, don’t hesitate to reach out. Happy trading!

Complete code:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 |

// REGRESSION LINEAIRE DROITE + FIBONACCI by Ivan le 30.05.2024 //PRC_Std and Ste LinRegChannel indicator //Standard Deviation and Standard Error //Linear Regression Channel //12.03.2019 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // Modifié par IVAN le 30.05.2024 (Fibo) defparam drawonlastbaronly=true defparam calculateonlastbars=1000 // --- settings lookback= 200 //channel period ChannelType = 1 //1= Standard Deviation ; 2= Standard Erro NbDeviation = 1 //Deviation multiplier colorRed = 255 colorGreen = 255 colorBlue = 0 // --- end of settings sumx = 0 sumy = 0 sumxy = 0 sumx2 = 0 for cmpt = lookback downto 0 do tmpx = cmpt tmpy = close[cmpt] sumy = sumy+tmpy sumx = sumx+tmpx sumx2 = sumx2 + (tmpx*tmpx) sumxy = sumxy + (tmpy*tmpx) next n = lookback+1 if (sumx2 = sumx * sumx) then // protection to avoid infinite values b = sumxy - sumx * sumy else b = (n * sumxy - sumx * sumy) / (n * sumx2 - sumx * sumx) endif a = (sumy - b * sumx) / n ///////////////////////////////////////// //channel if ChannelType = 1 then //Standard Deviation dat = std[lookback]*NbDeviation else dat = ste[lookback]*NbDeviation endif drawsegment(barindex[lookback],(a+b*lookback)+dat,barindex,a+b*0+dat) coloured(colorRed,colorGreen,colorBlue)style(line,4)coloured("yellow") drawsegment(barindex[lookback],(a+b*lookback)+0.618*dat,barindex,a+b*0+0.618*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,4)coloured("green") drawsegment(barindex[lookback],(a+b*lookback)+0.5*dat,barindex,a+b*0+0.5*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("green") drawsegment(barindex[lookback],(a+b*lookback)+0.382*dat,barindex,a+b*0+0.382*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("green") drawsegment(barindex[lookback],(a+b*lookback)+0.236*dat,barindex,a+b*0+0.236*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("green") drawsegment(barindex[lookback],a+b*lookback,barindex,a+b*0) coloured(colorRed,colorGreen,colorBlue)style(dottedline,5)coloured("blue") drawsegment(barindex[lookback],(a+b*lookback)-0.236*dat,barindex,a+b*0-0.236*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("red") drawsegment(barindex[lookback],(a+b*lookback)-0.382*dat,barindex,a+b*0-0.382*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("red") drawsegment(barindex[lookback],(a+b*lookback)-0.5*dat,barindex,a+b*0-0.5*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,2)coloured("red") drawsegment(barindex[lookback],(a+b*lookback)-0.618*dat,barindex,a+b*0-0.618*dat) coloured(colorRed,colorGreen,colorBlue)style(dottedline,4)coloured("red") drawsegment(barindex[lookback],(a+b*lookback)-dat,barindex,a+b*0-dat) coloured(colorRed,colorGreen,colorBlue)style(line,4)coloured("yellow") Return customclose as " REGRESSION LINEAIRE + FIBO " |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials