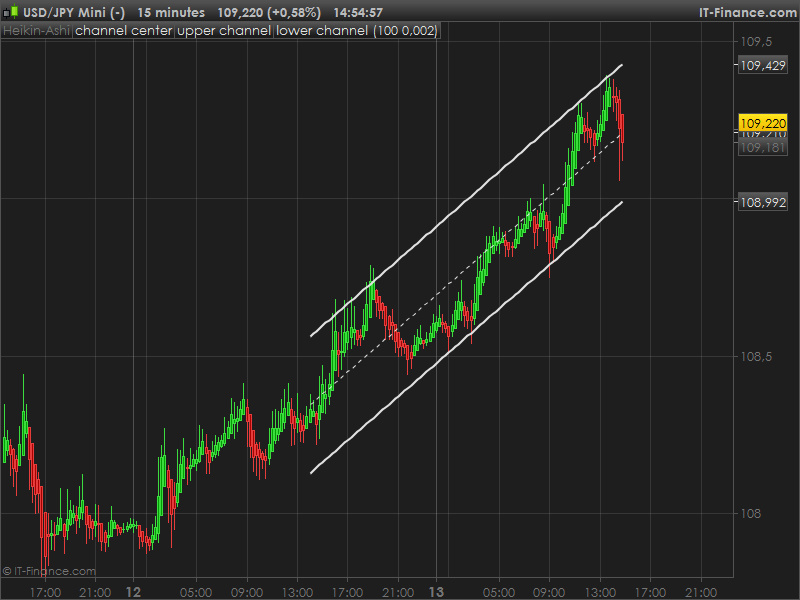

This channel is made of initial code by HK-LISSE to draw a linear regression. Coded by request, this modification is an attempt to draw the correct channel made with an upper and a lower lines deviated from the center by price percentage.

This code maybe of interest for anyone to make screeners and automated strategies around it, because there are no possibilities actually to call the values of the platform embedded same indicator.

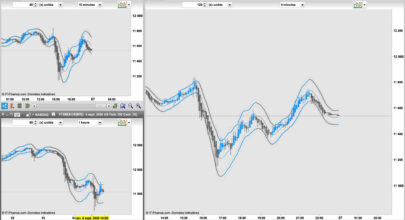

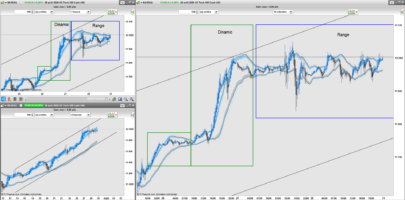

Beware that the channel is moving at candle close and informations of the N+0 past channel would have not be the same in the past at N+10 periods for example.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 |

//Parameters : // Len = 100 // percent = 0.002 once j=0 de48=DPO[Len*2](close) if de48=de48[1] and de48[1]=de48[2] and de48[2]<>de48[3] then flag=1 endif n=(Len*2)-4 p=(n/2)-1 d100=DPO[n](close) moy100=close-d100 co=(moy100-moy100[1]+(close[p])/n)*n if flag=1 and flag[1]=0 then test=linearregression[Len](co) test1=linearregressionslope[Len](co) a=test1 b=test-test1*Len endif if flag=0 then reg=undefined upperchan=undefined lowerchan=undefined else j=j+1 reg=a*j+b upperchan = reg + reg*percent lowerchan = reg - reg*percent endif RETURN reg as "channel center", upperchan as "upper channel", lowerchan as "lower channel" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Tanks,

I tried to build a TS with this indicator but don’t run. The idea is to enter long when the candle crosses the lower channel and enter short when the candle crosser th upper channel. For exit rules I think it’s better when the price is > of channel center for long position and < of channel center for short position. I think to insert a stop loss equal to a % of ATR. I want to test it for a TF of 15 min. Can you aid me ? Tanks

This indicator will not move with price since it’s build with future datas on its first load, sorry. This indicator is a kind of a trick to build lines on price chart while its not possible until version 10.3

Hello Nicolas!Thank you so much for sharing this code. However I can’t manage to get the indicator applied ONTO the price action. Instead, the indicator appears in a separate window below the price. Do you have any idea on how to fix this?Sincerely,Gustaf

Hi Gustaf, look at this video tutorial to add and configure an indicator in Prorealtime :

http://www.prorealcode.com/blog/video-tutorials/add-and-configure-indicators-prorealtime/

hi nicolas compliments are very good and really helpful , version 10.3 when it’s available ?

version 10.3 beta is already available at http://www.prorealtime.com

Thank you Nicolas.Now it works!

Hello,

with

I am currently use this linear regression channel. I would like to add a additional linear regression channel with the same lenght but X periods before (like 3) in order to see the evolution of the channel?

Thanks for your help!

BR,

Renaud

Hi Nicolas,

A very nice indicator. But I want to know how to calculate the correlation coefficient? It seems there is function called Correlation by ProRealTime?

Pretty much the same as : https://www.prorealcode.com/prorealtime-indicators/linear-regression-slope-oscillator/

Bonjour Nicolas,

Is there a way to dynamically vary the length of this indicator in realtime and still get it to display? I am only interested in the most recent “len” setting and understand that the indicator will change but I am unable to do this dynamically.

If I set the length to 20 and leave it there over the entire period of measurement it works perfectly but if I change the length variable dynamically it does not display anything… Can this be done somehow?

The issue can be replicated by replacing “len=100” with the following code (which just simply alternates between a period of 50 and 100):

Once Len = 100

If Len = 100 then

Len = 50

Else

Len = 100

EndIf

I wish to get a clearer unstanding of the theory behind this code. What does j=j+1 imply? Im going to start prorealcode but right now im switching between this and another programme where i need to translate the script but im having problems understanding the logic behind it. By the way, i love this indicator!

Hi Nicolas. In order to do tests, is there the possibility to set the start and the end of this channel, to see how it changes with the time? Now it’s only possible to define the start of the channel, because the end is always the last bar.

I would not recommend using this version of the linear regression channel, but this one instead: https://www.prorealcode.com/prorealtime-indicators/standard-deviation-standard-error-linear-regression-channel/

This new one is the same as the default tool of the platform.

Hello, Is it possible to updated the indicator to the more updated versione of ProrealTime? it does not plot the upper and lower channel ine, but only the centre. thank’s in advance

Use that code instead: https://www.prorealcode.com/prorealtime-indicators/standard-deviation-standard-error-linear-regression-channel/