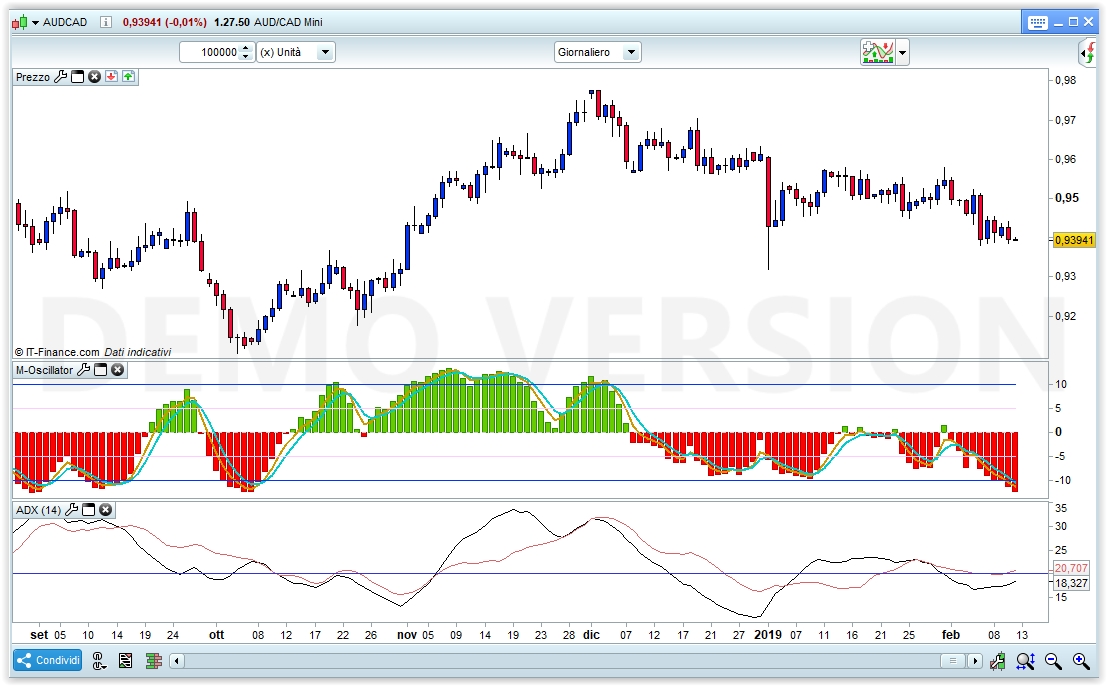

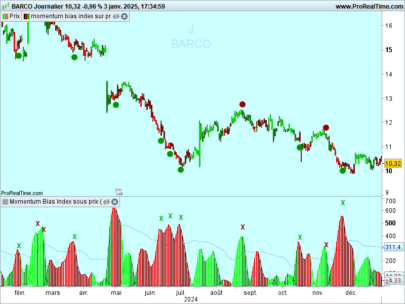

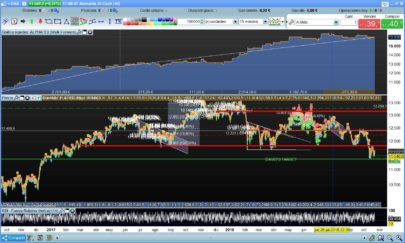

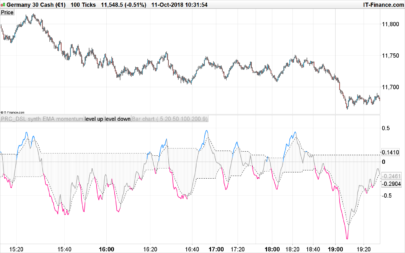

M – Oscillator

An improvement of the Momentum Oscillator – Published on IFTA Journal 2018 by Mohamed Fawzy (pages 28-53)

a value > 10 is considered OverBought

a value < -10 is considered OverSold

In sharp upward moves the M-Oscillator ranges from 5 to 14

In sharp downward moves the M-Oscillator ranges from -5 to -14

In an UpTrend value ranges from 0 through 14

In a DownTrend value ranges from 0 through -14

Usually a SHORT signal is generated when, after entering the OB area, the M-Oscillator re-crosses it downwards

Usually a LONG signal is generated when, after entering the OS area, the M-Oscillator re-crosses it upwards

(such indications are valid in sideways markets, because in trending markets, values may remain in the OS/OS area

for quite a long time)

ADX can be used in conjunction to detect a range when its value is < 25

Divergences, like for other oscillators, can be taken advantage of.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 |

DEFPARAM CalculateOnLastBars = 1000 Period = 14 //Number of Periods ct = close //Today's close S = 0 FOR i = 1 TO Period cp = close[i] r = (ct - cp) > 0 //R = Today's CLOSE - Previous Day's CLOSE, 1 = today > yesterday IF r = 0 THEN r = ((ct - cp) < 0) * -1 //R = Today's CLOSE - Previous Day's CLOSE, -1 = today < yesterday ENDIF s = s + r //Sum up all r's NEXT Ema5 = ExponentialAverage[5](s) //Histogram Ema3 = ExponentialAverage[3](Ema5)//M-Oscillator Ema3b= ExponentialAverage[3](Ema3)//Signal Line RETURN Ema5 AS "Histo",Ema3 AS "M-Oscillator",Ema3B AS "Signal Line", 0 AS "Zero", 10 AS "Ob", -10 AS "Os",5 AS "MidUP",-5 AS "MidDN" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Per coloro che volessero approfondire questo oscillatore e leggersi tutto lo studio dell’autore sull’IFTA Journal 2018, ecco il link: http://www.ftaa.org.hk/Files/2018130101754DGQ1JB2OUG.pdf

Grazie Roberto!

Grazie luxrun

The above link is to the IFTA Journal as reported on the indicator

Fantastic indicator, how would you create a screener to filter stocks when the signal line crosses above zero, thanks Andy

Sorry for my late reply. I’ll make it and open a new topic quite soon.

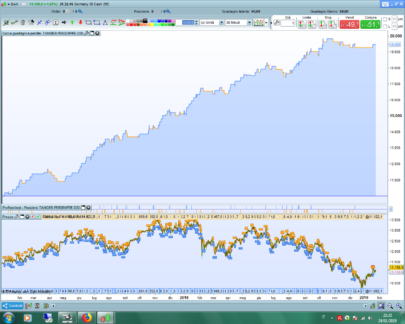

This is a rally interesting indicator. I read the whole article and I tried to run some quick backtest. The results are very variable. What I noticed though is that if the Ichimoku Kumo is used to define the trend (and not the EMA60) the percentage of winning trades increases significantly and also the gain per trade….food for thoughts 🙂

Great!

Thanks.

ah ah ! je n’avais pas vue celui-ci, excellent robert 😉

Thank you swapping.