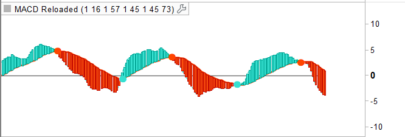

In the annual publication of the IFTA, year 2023, there is an interesting study by Alexandros Spiroglou (page 70-91) that solves some problems of the classic MACD through the modification of the formula with the use of the volatility of the asset under analysis. The main problems of the classic MACD are measurements over time, measurements in different markets, non-scalable momentum readings, signal line accuracy and timing. The proposed change is to divide the difference of the two ema, short minus long, by the ATR and multiply everything by one hundred.

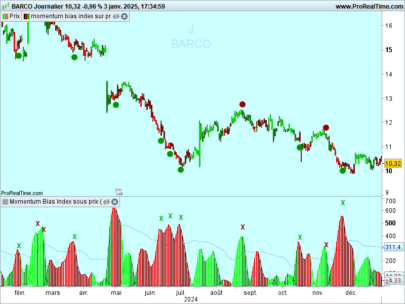

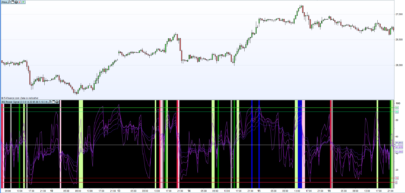

The result, as is evident from the graphs, returns metrics that are not confined and free to move through the zero line, with areas of excess placed at 150/-150 and areas of attention at 50/-50.

I also added lines 40/-40 related to histogram attention areas.

The full reading of the article provides examples and metrics in large numbers on indices, bonds and commodities and further information on the use of MACD-V.

As exponential average periods change, so do the limits of excess and attention.

ifta.org/publications/journal/2023

|

1 2 3 4 5 6 7 8 9 10 11 |

// Indicatore MACD volatility creato 12/11/2022 studio IFTA 2023 EMAL=ExponentialAverage[emalunga](close) //default = 26 EMAB=ExponentialAverage[emabreve](close) //default = 12 Lineamacd=((EMAB-EMAL)/AverageTrueRange[periodoatr](close))*100 //ATR defalut = 26 EMAD=ExponentialAverage[emasegnale](Lineamacd) //default 9 Is=Lineamacd-EMAD Return Lineamacd as "Macd line", EMAD as "Signal line", Is as "Istogramma", 0 as "linea0",40 as "isto40", 50 as "linea50",150 as "linea150",-40 as "isto-40",-50 as "linea-50",-150 as "linea-150" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Amazing, thank You for your contribution!

Thank you for featuring my work,

and I hope you found it useful.

Mind the paper was published in 2022,

but the original work was done in 2015.

Since then I have done a lot more advanced stuff with it,

than the material featured in the Paper.

If you need more info, please feel free to contact me

all the best

Alex Spiroglou

P.S. The paper was awarded the

the NAAIM “Founders Award”, for advances in Active Investment Management (2022)

and the CMT Association “Charles H. Dow Award”, for outstanding research in Technical Analysis (2022),