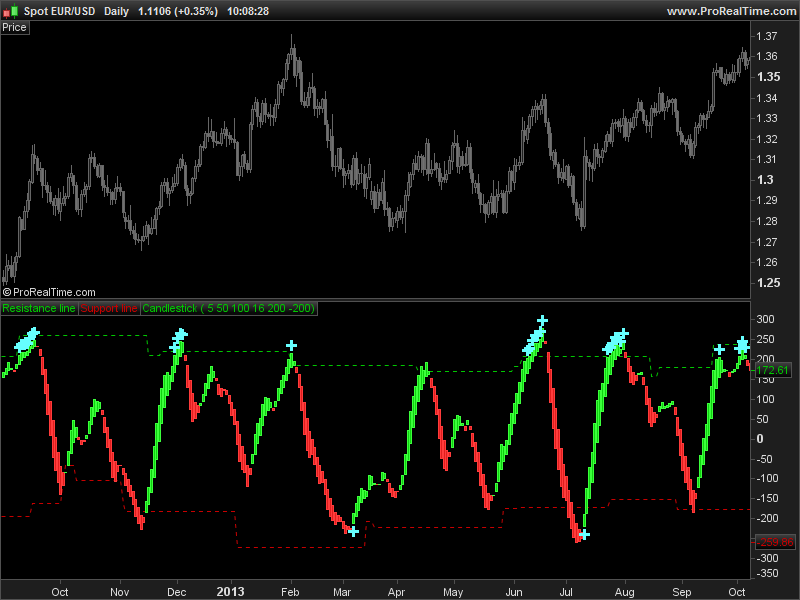

This indicator spot potential reversal of the market while identifying Accumulation/Distribution zones. It is compatible with any instrument and timeframe, parameters should be adapted at will. Each levels can act like support and resistance.

The blue dots appear when the oscillator is piercing the +200 overbought level of the -200 oversold level.

This indicator is only compatible for Prorealtime version 10.3

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 |

//--External parameters //Smoother=5 //SupResPeriod = 50 //SupResPercentage = 100 //PricePeriod = 16 //ob = 200 //os = -200 nn = Smoother ys1 = ( high + low + close * 2 ) / 4 rk3 = exponentialaverage[nn](ys1) rk4 = std[nn](ys1) rk5 = (ys1 - rk3 ) * 200 / rk4 rk6 = exponentialaverage[nn](rk5) up = exponentialaverage[nn](rk6) down = exponentialaverage[nn](up) if up<down then Oo = up else oO = down endif if up<down then Ll = down else Ll = up endif Cc = Ll if up<down then DRAWCANDLE(Oo,Cc,Oo,Cc)COLOURED(200,0,0) else DRAWCANDLE(Oo,Oo,Cc,Cc)COLOURED(0,200,0) endif //-------S/R Zones------ Lookback = SupResPeriod PerCent = SupResPercentage Pds = PricePeriod C3 = cci[Pds](close) Osc = C3 Value1 = Osc Value2 = highest[Lookback](Value1) Value3 = lowest[Lookback](Value1) Value4 = Value2 - Value3 Value5 = Value4 * ( PerCent / 100 ) ResistanceLine = Value3 + Value5 SupportLine = Value2 - Value5 //--Overbought/Oversold/Warning Detail UPshape = up > 200 and up>down DOWNshape = down < -200 and up>down if UPshape then DRAWTEXT("+",barindex,highest[1](up)+20,Dialog,Bold,20) coloured(102,255,255) endif if DOWNshape then DRAWTEXT("+",barindex,lowest[1](down)-20,Dialog,Bold,20) coloured(102,255,255) endif RETURN ResistanceLine COLOURED(0,200,0) STYLE(dottedline,1) as "Resistance line", SupportLine COLOURED(200,0,0) STYLE(dottedline,1) as "Support line" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

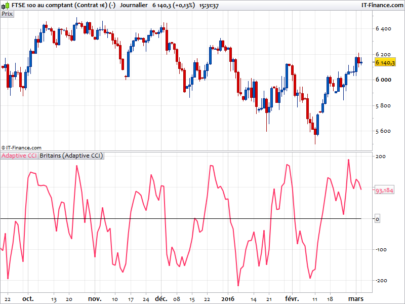

On peut faire varier le seuil des surachats /surventes; en bougeant les seuils par action on peut affiner les points de retournements.//--Overbought/Oversold/Warning Detail

// UPshape = up > 200 and up>down

UPshape = up > ob and up>down

// DOWNshape = down < -200 and up>down

DOWNshape = down < os and up>down

Dear Nicolas,

Regarding this indicator. If i select the wizard to create the conditions for a buy and a sell signal i can only select the candle and the resistance and support line.

My idea is for example to go long when the candle changes from red to green and go short from green to red in any timeframe.

Can you please tell me how i can adjust and implement this in the code?

Thanks.

regards,

Patrick

You need to add 2 new variables to the RETURN instruction of the indicator: up and down.

In your strategy, you’ll get these 2 new variables with a CALL instruction. Then you can test if up>down or vice-versa to trigger your trades.

I have no idea how to do that, but thanks for the reply.

Hi Nicolas. It looks great :-).

Have you tested it on lower timeframes?

I have too ask since I cant test it myself since I dont have V.10.3

Like any other oscillator it has its pros and cons. An adaptive overbought and oversold areas would maybe improve it. You can get a free account at prorealtime.com to get access to the 10.3 version.

@wp01, you can graph the difference between up and down: it will be positive if the bars are green, and negative if the bars are red. So you can easily switch between longs and shorts.

I changed the bar colors to understand better the curve, if you want you can test it. Sorry, I have not access to the “Insert PRT code” button.

//Matrix Series-Flower Indicator//–External parameters//Smoother=5//SupResPeriod = 50//SupResPercentage = 100//PricePeriod = 16ob = 200os = -200

nn = Smoother

ys1 = ( high + low + close * 2 ) / 4// Weighted pricerk3 = exponentialaverage[nn](ys1)rk4 = std[nn](ys1)rk5 = (ys1 – rk3 ) * 200 / rk4rk6 = exponentialaverage[nn](rk5)up = exponentialaverage[nn](rk6)down = exponentialaverage[nn](up)

if up<down thenOo = upelseoO = downendif

if up<down thenLl = downelseLl = upendifCc = Lldif=up-down

if up<down and up<up[1] and dif<0 and dif>dif[1] thenDRAWCANDLE(Oo,Oo,Cc,Cc)COLOURED(255,160,122)//light salmonelsif up<down and up<up[1] thenDRAWCANDLE(Oo,Cc,Oo,Cc)COLOURED(200,0,0)//redelsif up<down and up>up[1] thenDRAWCANDLE(Oo,Cc,Oo,Cc)COLOURED(255,215,0)//yellowelsif up>down and up>up[1] and dif>0 and dif<dif[1] thenDRAWCANDLE(Oo,Oo,Cc,Cc)COLOURED(127,255,212)//aquamarineelsif up>down and up>up[1] thenDRAWCANDLE(Oo,Oo,Cc,Cc)COLOURED(0,200,0)//greenelsif up>down and up<up[1] thenDRAWCANDLE(Oo,Oo,Cc,Cc)COLOURED(255,215,0)//yellowendif

//——-S/R Zones——Lookback = SupResPeriodPerCent = SupResPercentagePds = PricePeriod

C3 = cci[Pds](close)

Osc = C3Value1 = OscValue2 = highest[Lookback](Value1)Value3 = lowest[Lookback](Value1)Value4 = Value2 – Value3Value5 = Value4 * ( PerCent / 100 )ResistanceLine = Value3 + Value5SupportLine = Value2 – Value5

//–Overbought/Oversold/Warning DetailUPshape = up > ob and up>downDOWNshape = down < os and up<down

if UPshape thenDRAWTEXT(“+”,barindex,highest[1](up)+30,Dialog,Bold,20) coloured(0,0,255)endifif DOWNshape thenDRAWTEXT(“+”,barindex,lowest[1](down)-30,Dialog,Bold,20) coloured(0,0,255)endif

RETURN ResistanceLine COLOURED(0,200,0) STYLE(dottedline,2) as “Resistance line”, SupportLine COLOURED(200,0,0) STYLE(dottedline,2) as “Support line”, ob AS “ob”, os AS “os”, 0 AS “Zero”, dif AS “Dif”

@Petrus,

Sorry for the late response, but thank you for your help.

Hi there,

I am testing this indicator on gold.

On a lower timefram ( 1,2,3 min) it is not working in Prorealtime 10.3. so I switch over to the 5 min graph.

since today it is not working on the 5 min either.

Is there something what I can do to fix this?

Thanks for any help.

Do you have still have values displayed on the vertical axis of the indicator? The indicator window is empty?

Hi Nicolas,

I try to explain my problem: for example if I zoom out the 3 min chart, the matrix indicator will collaps.

Sometimes the indicator work on the 1 min, and sometime not. for example if you take the 1 min graph with 100 units and you scroll back to midnight you see the indicator. And if you scroll back to real time it will collaps.

hopefully you understand what I am meaning 😉

image:

http://nl.tinypic.com/r/novojm/9

http://nl.tinypic.com/r/105thdv/9

Please add more ‘units’ on your chart for the exponential average to compute completely.

That doesn’t work on the 1 min chart.

it works on 200 units with the 1 min graph and only if you zoom in massive.

Is there noting to do with the code, so it will work on every timeframe?

Bonjour Nicolas,

Je viens d’essayer ton indicateur, il fonctionne parfaitement sur EURUSD, EURJPY et USDJPY, par contre sur AUDUSD il n’apparait pas, tout comme GBPUSD.

Qu’est ce qu’il faudrait faire pour le voir apparaitre selon toi?

Je joins une capture pour avoir une idée

Je te remercie pour tout.

En effet, j’ai déjà eu ce genre de retour sur cet indicateur, je t’avoue avoir eu du mal à corriger ce phénomène. Je suis actuellement indisponible, j’essaierai de m’en occuper dés mon retour. Merci.

Bonjour Nicolas.

Je trouve cet indicateur intéressant et j’essaie de l’intégrer dans une stratégie .

Je me demandais si la ligne 126 ne devrait-elle pas être

DOWNshape = down < -200 and up < down

Salutations

Non tout est correct, mais je comprends que tu aies un doute. C’est la façon dont a été écrit l’indicateur ..