Description: AlgoAlpha’s Momentum Bias Index is designed to provide traders with a powerful tool for assessing market momentum bias. The indicator calculates positive and negative momentum bias to assess which is higher in order to determine the trend.

Main features:Full momentum analysis: the script aims to detect momentum trend bias, typically in an uptrend, the momentum oscillator will oscillate around the zero line but will have stronger positive values than negative ones, similarly for a downtrend, momentum will have stronger negative values. . This script aims to quantify this phenomenon.

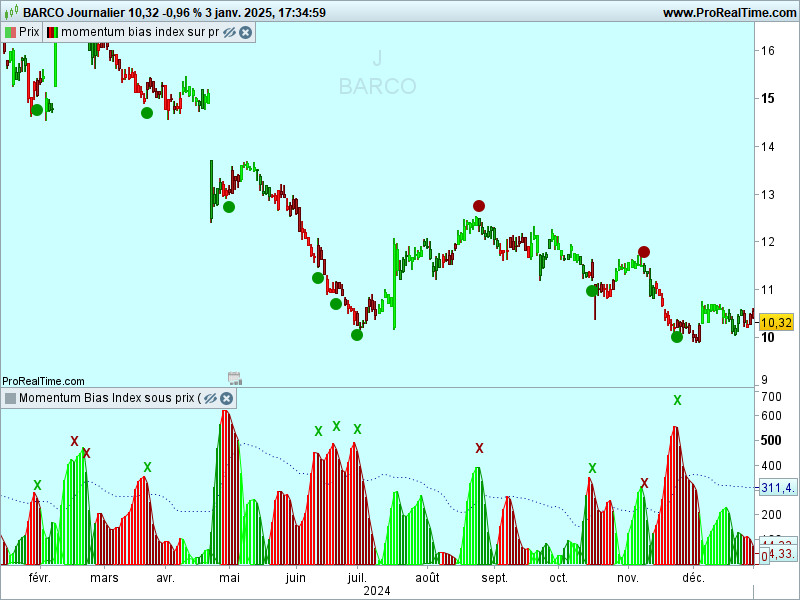

Overlay mode: traders can choose to overlay the indicator on the price chart for a clear visual representation of market dynamics.

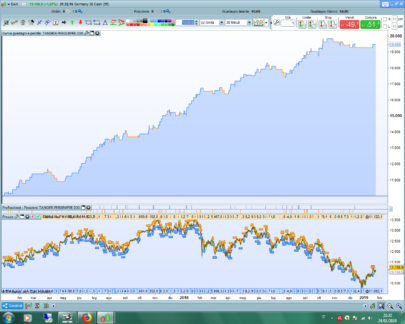

Take-profit signals: the indicator includes signals to lock in profits, appearing as dots with the over-price indicator and as crosses with the under-price indicator.

Impulse limit: the script includes an impulse limit. The impulse limit is a threshold for visualizing significant impulse peaks.

Standard deviation multiplier: users can adjust the standard deviation multiplier to increase the noise tolerance of the impulse limit.

Bias length control: traders can customize the bias evaluation length, enabling them to fine-tune the indicator to their trading preferences. A longer bias length will result in a longer-term trend bias.

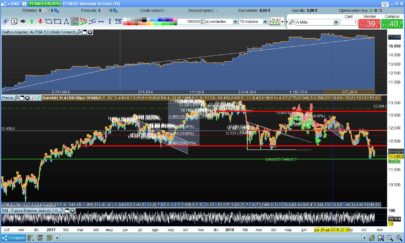

momentum bias index on price :

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 |

momentumLength = 10 biasLength = 5 smoothLength = 10 impulseBoundaryLength = 30 stdDevMultiplier = 3 smoothIndicator =1 // Calcul de Momentum et Déviation Standard moment = close - close[momentumLength] stdDev = moment / ExponentialAverage[momentumLength](high - low) * 100 momentumUp = max(stdDev, 0) momentumDown = min(stdDev, 0) // Calcul des sommes avec une boucle sumMomentumUp = 0 sumMomentumDown = 0 FOR i = 0 TO biasLength - 1 DO sumMomentumUp = sumMomentumUp + momentumUp[i] sumMomentumDown = sumMomentumDown + momentumDown[i] NEXT // Lissage et calcul des biais avec HMA intégrée IF smoothIndicator=1 THEN // Calcul de la Hull Moving Average (HMA) pour momentumUp wmaHalfUp = WeightedAverage[ROUND(smoothLength / 2)](momentumUp) wmaFullUp = WeightedAverage[smoothLength](momentumUp) hullIntermediateUp = 2 * wmaHalfUp - wmaFullUp smoothedMomentumUp = WeightedAverage[ROUND(SQRT(smoothLength))](hullIntermediateUp) // Calcul de la Hull Moving Average (HMA) pour momentumDown wmaHalfDown = WeightedAverage[ROUND(smoothLength / 2)](momentumDown) wmaFullDown = WeightedAverage[smoothLength](momentumDown) hullIntermediateDown = 2 * wmaHalfDown - wmaFullDown smoothedMomentumDown = WeightedAverage[ROUND(SQRT(smoothLength))](hullIntermediateDown) momentumUpBias = max(smoothedMomentumUp, 0) momentumDownBias = max(-smoothedMomentumDown, 0) ELSE IF smoothIndicator=0 THEN momentumUpBias = max(sumMomentumUp, 0) momentumDownBias = max(-sumMomentumDown, 0) ENDIF ENDIF // Moyenne des biais averageBias = (momentumDownBias + momentumUpBias) / 2 // Calcul de la limite (boundary) boundary = ExponentialAverage[impulseBoundaryLength](averageBias) + STD[impulseBoundaryLength](averageBias) * stdDevMultiplier // Affichage des signaux bullishSignal = momentumDownBias < momentumDownBias[1] AND momentumDownBias > boundary AND momentumDownBias > momentumUpBias bearishSignal = momentumUpBias < momentumUpBias[1] AND momentumUpBias > boundary AND momentumUpBias > momentumDownBias IF bullishSignal AND NOT bullishSignal[1] THEN DRAWPOINT(barindex, low-0.02*low, 3)coloured(0,150,0) //DRAWTEXT("TP", barindex,low-0.02*low, dialog, bold, 14) COLOURED(0, 150, 0) ENDIF IF bearishSignal AND NOT bearishSignal[1] THEN DRAWPOINT(barindex, high+0.02*high,3)coloured(150,0,0) //DRAWTEXT("TP", barindex,high+0.02*high, dialog, bold, 14) COLOURED(150,0, 0) ENDIF IF momentumUpBias > momentumUpBias[1] AND NOT (momentumDownBias > momentumDownBias[1]) THEN r = 0 g = 255 b = 0 ELSIF momentumUpBias < momentumUpBias[1] AND NOT (momentumDownBias < momentumDownBias[1]) THEN r = 0 g = 150 b = 0 ELSIF momentumDownBias > momentumDownBias[1] AND NOT (momentumUpBias > momentumUpBias[1]) THEN r = 255 g = 0 b = 0 ELSIF momentumDownBias < momentumDownBias[1] AND NOT (momentumUpBias < momentumUpBias[1]) THEN // Couleur rouge atténuée r = 150 g = 0 b = 0 ENDIF // Application des couleurs aux chandeliers DRAWCANDLE(open, high, low, close) COLOURED(r,g,b) RETURN |

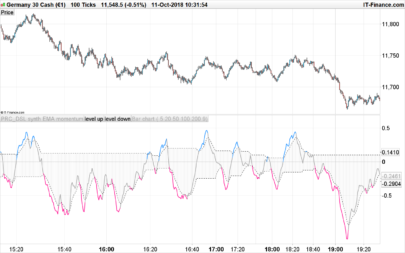

momentum bias index below price :

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 |

momentumLength = 10 biasLength = 5 smoothLength = 10 impulseBoundaryLength = 30 stdDevMultiplier = 3 smoothIndicator =1 // Calcul de Momentum et Déviation Standard moment = close - close[momentumLength] stdDev = moment / ExponentialAverage[momentumLength](high - low) * 100 momentumUp = max(stdDev, 0) momentumDown = min(stdDev, 0) // Calcul des sommes avec une boucle sumMomentumUp = 0 sumMomentumDown = 0 FOR i = 0 TO biasLength - 1 DO sumMomentumUp = sumMomentumUp + momentumUp[i] sumMomentumDown = sumMomentumDown + momentumDown[i] NEXT // Lissage et calcul des biais avec HMA intégrée IF smoothIndicator=1 THEN // Calcul de la Hull Moving Average (HMA) pour momentumUp wmaHalfUp = WeightedAverage[ROUND(smoothLength / 2)](momentumUp) wmaFullUp = WeightedAverage[smoothLength](momentumUp) hullIntermediateUp = 2 * wmaHalfUp - wmaFullUp smoothedMomentumUp = WeightedAverage[ROUND(SQRT(smoothLength))](hullIntermediateUp) // Calcul de la Hull Moving Average (HMA) pour momentumDown wmaHalfDown = WeightedAverage[ROUND(smoothLength / 2)](momentumDown) wmaFullDown = WeightedAverage[smoothLength](momentumDown) hullIntermediateDown = 2 * wmaHalfDown - wmaFullDown smoothedMomentumDown = WeightedAverage[ROUND(SQRT(smoothLength))](hullIntermediateDown) momentumUpBias = max(smoothedMomentumUp, 0) momentumDownBias = max(-smoothedMomentumDown, 0) ELSE IF smoothIndicator=0 THEN momentumUpBias = max(sumMomentumUp, 0) momentumDownBias = max(-sumMomentumDown, 0) ENDIF ENDIF // Moyenne des biais averageBias = (momentumDownBias + momentumUpBias) / 2 // Calcul de la limite (boundary) boundary = ExponentialAverage[impulseBoundaryLength](averageBias) + STD[impulseBoundaryLength](averageBias) * stdDevMultiplier // Affichage des signaux bullishSignal = momentumDownBias < momentumDownBias[1] AND momentumDownBias > boundary AND momentumDownBias > momentumUpBias bearishSignal = momentumUpBias < momentumUpBias[1] AND momentumUpBias > boundary AND momentumUpBias > momentumDownBias IF bullishSignal AND NOT bullishSignal[1] THEN DRAWTEXT("X", barindex, momentumDownBias + 0.2 * momentumDownBias, dialog, bold, 14) COLOURED(0, 175, 0) ENDIF IF bearishSignal AND NOT bearishSignal[1] THEN DRAWTEXT("X", barindex, momentumUpBias + 0.2 * momentumUpBias, dialog, bold, 14) COLOURED(150, 0, 0) ENDIF IF momentumUpBias > momentumUpBias[1] AND NOT (momentumDownBias > momentumDownBias[1]) THEN // Couleur verte vive r = 0 g = 255 b = 0 ELSIF momentumUpBias < momentumUpBias[1] AND NOT (momentumDownBias < momentumDownBias[1]) THEN // Couleur verte atténuée r = 0 g = 150 b = 0 ELSIF momentumDownBias > momentumDownBias[1] AND NOT (momentumUpBias > momentumUpBias[1]) THEN // Couleur rouge vive r = 255 g = 0 b = 0 ELSIF momentumDownBias < momentumDownBias[1] AND NOT (momentumUpBias < momentumUpBias[1]) THEN // Couleur rouge atténuée r = 150 g = 0 b = 0 ENDIF // Application des couleurs aux histogrammes RETURN boundary COLOURED(0, 0, 150) STYLE(DOTTEDLINE4) AS "boundary",momentumUpBias COLOURED(r, g, b) STYLE(histogram, 1) AS "momentumUp",momentumDownBias COLOURED(r, g, b) STYLE(histogram, 3) AS "momentumDown",momentumUpBias COLOURED(r, g, b) STYLE(line, 1) AS "lmomentumUp",momentumDownBias COLOURED(r, g, b) STYLE(line, 1) AS "lmomentumDown" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hola, me gusta mucho tu indicador, sobre todo el que está en el precio, ¿podrías hacer un proyectador al igual que has hecho con anteriores indicadores tuyos?, a poder ser cuando aparece un punto ya sea rojo o verde. Muchas gracias por tus trabajos

Hola, no me sale, me da varios errores, no tengo ni idea de programación, he copiado el texto y pegado y en varias líneas me da error de código

me sigue dando error en algunas líneas: 8, 44, 45, 46, 47 y 49, no sé si será por la traducción, de todas formas te estoy muy agradecido por las molestias, no quiero molestar, mañana miraré a ver si puedo intentarlo, gracias de nuevo por todo

voir le forum proscreener topic “screener momentum bias” je vous ai déposé le fichier momentum bias.itf