it uses an approximation of Up and Down Volume (because they are not kept by Tradingview/not accessible by Pinescript).

The approximation is:

The “up path” on the “up” candle can be approximated by ( High-Low ).

The “down path” on the “up” candle can be approximated by (High-Close)+(Open-Low).

(and similar for the down candle, like in the 1st post.)

Total path=up path + down path.

Up volume = Tick volume * up path/total path

Down volume = Tick volume * down path/total path

(description from original author: kprsa)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 |

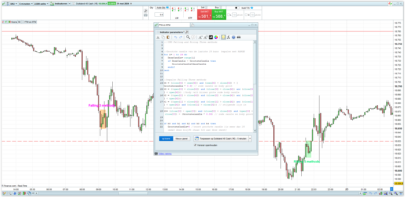

//PRC_Monster Cumulative Delta | indicator //30.06.2022 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted from pinescript //U1 if(close>=open and (close-open+2*(high-close)+2*(open-low)))>0 then U1= volume*(high-low)/(close-open+2*(high-close)+2*(open-low)) else U1=0.0 endif //D1 if(close<open and (open-close+2*(high-open)+2*(close-low)))>0 then D1 = volume*(high-low)/(open-close+2*(high-open)+2*(close-low)) else D1=0.0 endif //Delta if(close>=open) then Delta= U1 else Delta= -D1 endif if barindex>1 then cumDelta=(cumDelta[1])+Delta if close>=open then hi= cumDelta else hi =cumDelta[1] endif if close<=open then lo= cumDelta else lo=cumDelta[1] endif drawcandle(cumDelta[1], hi, lo, cumDelta) endif return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

bonjour Nicolas, je ne vois pas bien l’utilité de cet indicateur; d’autant qu’ il n’est pas possible de lui adjoindre une moyenne mobile par exemple.

bien à vous

A contrario du commentaire précédent, cet indicateur est génial à condition de comprendre le “Delta Cumulé” ! Cependant là ou je rejoins le commentaire de “Regisnouveau”, c’est que la plateforme ne lui détecte aucune valeur ! Donc impossible d’y appliquer un indicateur ou même une “Alerte sur seuil” via la plateforme!!! @Nicolas, penses-tu pouvoir lui donner une data qui permettra de régler cet inconvénient ??? Merci

Modifier la dernière ligne par:

RETURN cumDelta[1], hi, lo, cumDelta

pour obtenir les valeurs OHLC des chandeliers

Cela fonctionne très bien !!! Super Merci

Ciao Nicolas, molto bello questo indicatore, l’ho apprezzato molto.

Lo sto testando insieme al VWAP e al Volume profile. Entrambi si aggiornano ogni mattina (ripartono da 0), sarebbe possibile farlo ripartire da zero ogni giorno?

Grazie e buona giornata.

Andrea

Je poste ici un lien afin de mieux appréhender le CVD-Cumulative Volume Delta : https://www.beatmarket.fr/p/bientot-le-meilleur-moment-dinvestir#:~:text=Le%20Cumulative%20Volume%20Delta%20(CVD)%20est%20un%20indicateur%20qui%20trace,ordres%20de%20vente%20au%20march%C3%A9).