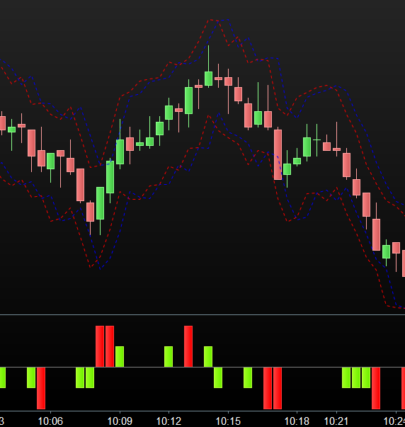

Shows the previous Candelrange, ATR[10] and EMA[20] of ATR[10] near candle in two different colours.

Colour change when ATR is over EMA to orange. When range over atr and atr over ema possible stronger moves/volatility.

Shows Arrows for Long and Short recommendation depend on Priceaction and OBV.

You can select which info you want.

18.06.2019 (Release 1.0)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 |

// myCandel // Shows the Candelrange, ATR and EMA-ATR near candel in two different colours. // Schows Arrows for Long and Short recommendation depend on Priceaction and OBV. // 18.06.2019 (Release 1.0) // Thomas Geisler // Sharing ProRealTime knowledge defparam drawonlastbaronly=true // Zeichung nur am letzten Bar //--settings info = 1 arrows = 1 //--end //--init-- alpha = 255 PIP=pipsize*2 //--end-- // --Info // Vorherige Range[1] und ATR[10] / EMA-ATR[20]Berechnung myRange = round(Range[1]) myATR = round(AverageTrueRange[10](close[0])) myEATR = round(ExponentialAverage[20](AverageTrueRange[10](close[0]))) // Anzeige der aktuellen Range / ATR / EMA ATR. Orange wenn über dem Durchschnitt If Info = 1 then if myATR < ExponentialAverage[20](myATR) then DrawText(" #myRange#/#myATR#/#myEATR#",barindex,close-5,SansSerif,Bold,10) coloured(153,153,153,alpha) else DrawText(" #myRange#/#myATR#/#myEATR#",barindex,close-5,SansSerif,Standard,10) coloured(255,153,0,alpha) endif endif // -- Arrows //Trend bzw Trendstärke ermitteln // Bestimmung der Stärke eines bullischen Trends BullTrend = (Close - LOWEST[20](LOW)) / AVERAGETRUERANGE[10] // Bestimmung der Stärke eines bearischen Trends BearTrend = (HIGHEST[20](HIGH) - Close) / AVERAGETRUERANGE[10] // Angleichen Trend = (BullTrend - BearTrend) TrendEMA = ExponentialAverage[20](Trend) // On Balance Volumen zur Bestimmung der Kaufkraft der Bewegung/Trend myOBV = OBV myOBVA1 = Average[20](myOBV) myOBVA2 = Average[10](myOBV) if Arrows = 1 then If Trend > TrendEMA and myOBV > myOBVA1 and myOBV > myOBVA2 then DRAWARROWup(barindex,low-PIP) coloured(0,255,0,alpha) elsif Trend < TrendEMA and myOBV < myOBVA1 and myOBV < myOBVA2 then DRAWARROWdown(barindex,high+PIP)coloured(255,0,0,alpha) endif endif Return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Errore in riga 13 e 16, non funziona

@maurizio I dont no how i can change my post. The error in line 13 ist / but need //

Better to use the ITF

Please advise what is the repair to the code. Not working.

The code is fixed. Noiw // in line 13.

Better to use the ITF, ther is no error.

What is the indicator just bellow the price chart please ?

?? near the candel are the range of previous bar, ATR[10] and EMA[20]ATR[10].

Under/over the candels sometime arrows for Long and Short recommendation depend on Priceaction and OBV.

Both option can be activate or deactivate.

@Sofitech Sorry, now 🙂 Thats the OBV and on top BB 20,2 . When OBV over 20average is green and reverse red. It the OBV out of BB is a white colour. This a areas ther most oversold/overbought

Thanks. This is interesting

Hola,

Podrias explicar un poco la idea de trading que está detras del indicador ?.. Gracias

Traducción de Google del alemán:

Estoy buscando movimientos fuertes. Si el ATR es más grande que su promedio y el tamaño de la vela es más grande que el ATR, tengo movimientos rápidos. Por ejemplo, 12/10/9: La vela tiene 12 puntos, el ATR 10 y el promedio de 9.

Las flechas verde y roja me muestran que el movimiento también es compatible con el volumen.

Como dirección de tendencia se puede utilizar, por ejemplo, el VWAP.

Google translation from German:

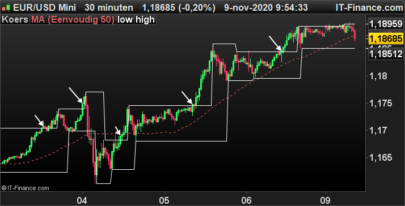

I am looking for strong movements. If the ATR is larger than its average and the size of the candle is larger than the ATR, I have fast movements. For example, 12/10/9: The candle has 12 points, the ATR 10 and the average 9.

The green and red arrows show me that the movement is also supported by the volume.

As trend direction one can use for example the VWAP.

Beispiel, Ejemplo

sigue sin funcionar puedes corregir el codigo gracias es que no se ve nada se queda en negro, al aplicarlo.

Como? no intiendo. Can you write in english . It works! Download the itf file.

New Version comin soon…

OLA NAO SERVE PARA MT4?