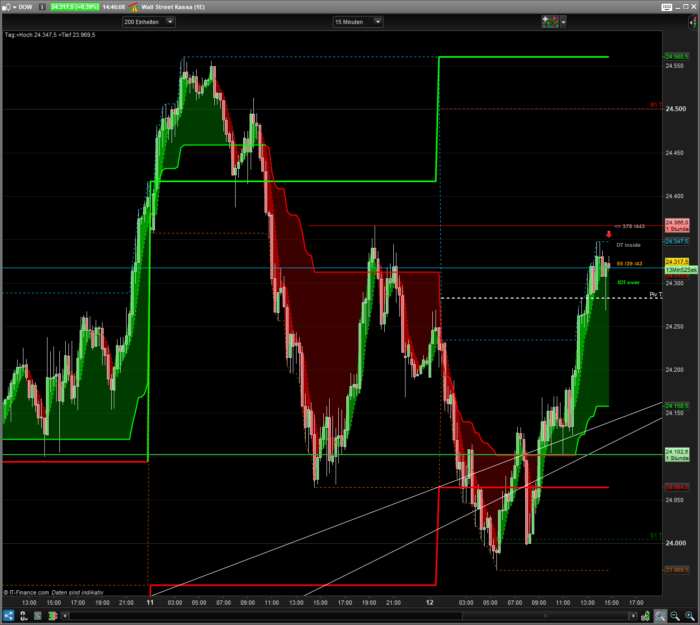

Info: Shows the range of previous candle, ATR 10 and EMA 20 of ATR10.

If ATR is greater than its average or Range greater then ATR the text will be displayed in orange =Better moves.

And the ranges between intraday daily hgh – low and the range of last five days as (<> 123/123).

IntradayTrend: Close over Centerline (Intraday Range) displayed green Text “IDT over” and revers red Text “IDT under”. The idea is when the price is over the middle intraday range then we have at the moment intraday a Bulltrend and revers.

Daytrend: Close over yesterday high displayed green Text “DT over” and revers under yesterday low red Text “DT under”. The idea is when the price is over yesterday high then we have at the moment ia daily Bulltrend and revers under low.

Centerline: Show the middle of the range between Intraday high and low as a dotted line.

High/LowIntraday: Show the intraday highest high and lowest low as line. High as line like a resist and low like a support. Or revers.

HighLow: Show the daily highest high and lowest low beginning on yesterday.

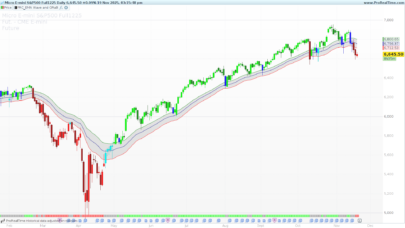

Arrows: Shows Arrows in green and red color. When the Price Trend (calculation in code) over EMA20 and OBV (On Balance Volume) over EMA10 and EMA20 displayed green Arrow and revers. Depends on “Trendforce” and / or “OBVforce” activation checkbox.

Trendforce: Trend strength is used to calculate the arrows. For this, “Arrows” must be also activated. Or also with “OBVforce”.

OBVforce: Volumen strength, based on OBV, is used to calculate the arrows. For this, “Arrows” must be also activated. Or also with “Trendforce”.

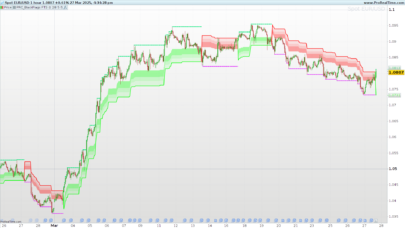

Example. You can deactivate for instrument whitout OBV/Volume Data. Forex, etc.

Periods10not20: Activated the calculation for Trendforce and OBVforce based on 10 period. Not actived 20 periods.

You can / should define the color zone yourself. One for course over / under Heikin Ashi Line and one for course over / under Centerline.

Of course you can show and hide everything as you like.

Update from https://www.prorealcode.com/prorealtime-indicators/mycandle-infos-v1-2/

I trade this in combination with Kombination mit myOutsidebar+Stop, myOpening Range…, MyThermometer

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 |

// myCandel-Infos-V1.3 // 18.06.2019 (Release 1.2) // 18.04.2020 (Release 1.3) // 01.05.2020(Release 1.4) // Thomas Geisler // Sharing ProRealTime knowledge // https://www.prorealcode.com/library/ defparam drawonlastbaronly=true // Zeichung nur am letzten Bar //--init-- alpha = 255 TP = myEATR/2 //Position for Infos lookback = 1 // Info = 1 // IntradayTrend // DayTrend = 1 // Centerline = 1 // HighLowIntraday = 1 // HighLow = 1 // Arrows = 1 // Trendforce = 1 // OBVforce = 1 //-- end-- //--Info-- // previous Candle Range[1] and ATR[10] and EMA-ATR[20]of ATR[1] myRange = round(Range[1]) myATR = round(AverageTrueRange[10](close[0])) myEATR = round(ExponentialAverage[20](AverageTrueRange[10](close[0]))) // Forex without round //myRange = Range[1] //myATR = AverageTrueRange[10](close[0]) //myEATR = ExponentialAverage[20](AverageTrueRange[10](close[0])) //--centerline (DM0) and intraday range (DMR) mytdayhigh=DHigh(0) mytdaylow=DLow(0) DM0 = (mytdayhigh-mytdaylow)/2+mytdaylow DMR = round((mytdayhigh-mytdaylow)) //--rounded range of last five days D1 = DHigh(1)-DLow(1) D2 = DHigh(2)-DLow(2) D3= DHigh(3)-DLow(3) D4 = DHigh(4)-DLow(4) D5 = DHigh(5)-DLow(5) DMA = round((D1+D2+D3+D4+D5)/5) //--end-- //--Dailys highest high and lowest Low-- if day <> day[1] then dayindex = dayindex + 1 dayhigh = 0 daylow = close //dayopen = open //dayclose = close if dayindex > lookback then for j = 1 to barindex if dayindex[j] = dayindex - lookback then mydayhigh = dayhigh[j] mydaylow = daylow[j] break endif next endif endif dayhigh = max(dayhigh,high) daylow = min(daylow,low) //--end-- //--show or not, Daily High / Low Line if HighLow = 1then mydayhigh2 = mydayhigh mydaylow2 = mydaylow endif // change color od Day Hig/Low Lines If mydayhigh[0] > mydayhigh[1] and mydaylow[0] > mydaylow[1] then dha = 0 dhb = 255 dla = 255 dlb = 0 elsif mydayhigh[0] < mydayhigh[1] and mydaylow[0] < mydaylow[1] then dha = 255 dhb = 0 dla = 0 dlb = 255 elsif mydayhigh[0] > mydayhigh[1] and mydaylow[0] < mydaylow[1] or mydayhigh[0] < mydayhigh[1] and mydaylow[0] > mydaylow[1]then dha = 255 dhb = 153 dla = 255 dlb = 153 endif //--end-- //--show or not, centerline, center of range between intraday high/low-- If CenterLine = 1 then mytdaycenter = DM0 else mytdaycenter = undefined endif if mytdaycenter[0] > mytdaycenter[1] then cla = 0 clb = 255 elsif mytdaycenter[0] < mytdaycenter[1] then cla = 255 clb = 0 endif //--end-- // Ranges Candels in different colour and print today daily range (High/Low) If Info = 1 then DrawText(" <> #DMR#/#DMA#",barindex,open+TP+TP,Dialog,Bold,10) coloured(153,153,153,alpha) if myATR > ExponentialAverage[20](myATR) or myRange > myATR then DrawText(" #myRange#/#myATR#/#myEATR#",barindex,open,Dialog,Bold,10) coloured(255,153,0,alpha) else DrawText(" #myRange#/#myATR#/#myEATR#",barindex,open,Dialog,Bold,10) coloured(153,153,153,alpha) endif endif //--end-- //-- proof close over/under Centerline and/or close over/under yesterday high/low-- If DayTrend = 1 then if close < mydayhigh[1] and close > mydaylow[1] then DrawText(" DT inside",barindex,open+TP,Dialog,Bold,10) coloured(153,153,153,alpha) elsif close > mydayhigh[1] then DrawText(" DT over",barindex,open+TP,Dialog,Bold,10) coloured(0,255,0,alpha) elsif close < mydaylow[1] then DrawText(" DT under",barindex,open+TP,Dialog,Bold,10) coloured(255,0,0,alpha) endif endif If IntradayTrend = 1 then if close > DM0 then DrawText(" IDT over",barindex,open-TP,Dialog,Bold,10) coloured(0,255,0,alpha) else DrawText(" IDT under",barindex,open-TP,Dialog,Bold,10) coloured(255,0,0,alpha) endif endif //--end-- //--Show Intraday HighLow as dotted line-- If HighLowIntraday = 1 then mytdayhigh = DHigh(0) mytdaylow = DLow(0) else mytdayhigh = undefined mytdaylow = undefined endif //--end-- //--Arrows-- //Trend bzw Trend force if Arrows = 1 then if Periods10not20 = 1 then //Periods 10 BullTrend = (Close - LOWEST[10](LOW)) / AVERAGETRUERANGE[10] BearTrend = (HIGHEST[10](HIGH) - Close) / AVERAGETRUERANGE[10] Trend = (BullTrend - BearTrend) TrendEMA = ExponentialAverage[10](Trend) // On Balance Volumen zur Bestimmung der Kaufkraft der Bewegung/Trend myOBV = OBV myOBVA1 = ExponentialAverage[10](myOBV) else //Periods 20 BullTrend = (Close - LOWEST[20](LOW)) / AVERAGETRUERANGE[20] BearTrend = (HIGHEST[20](HIGH) - Close) / AVERAGETRUERANGE[20] Trend = (BullTrend - BearTrend) TrendEMA = ExponentialAverage[20](Trend) // On Balance Volumen zur Bestimmung der Kaufkraft der Bewegung/Trend myOBV = OBV myOBVA1 = ExponentialAverage[20](myOBV) endif if Trendforce = 1 and OBVforce = 1 then If Trend > TrendEMA and myOBV > myOBVA1 then //and myOBV > myOBVA2 then DRAWARROWup(barindex,low-TP) coloured(0,255,0,alpha) elsif Trend < TrendEMA and myOBV < myOBVA1 then //and myOBV < myOBVA2 then DRAWARROWdown(barindex,high+TP)coloured(255,0,0,alpha) endif elsIf OBVforce = 1 and not Trendforce then if myOBV > myOBVA1 then //and myOBV > myOBVA2 then DRAWARROWup(barindex,low-TP) coloured(0,255,0,alpha) elsif myOBV < myOBVA1 then //and myOBV < myOBVA2 then DRAWARROWdown(barindex,high+TP)coloured(255,0,0,alpha) endif elsIf Trendforce = 1 and not OBVforce then if Trend > TrendEMA then DRAWARROWup(barindex,low-TP) coloured(0,255,0,alpha) elsif Trend < TrendEMA then DRAWARROWdown(barindex,high+TP)coloured(255,0,0,alpha) endif endif endif //--end-- // Show or not Heikin Ashi Line if HAline = 1 then once haOpen = open once haClose = Close N = 0 if barindex = 0 then haOpen = open haClose = close elsif N = 0 then haClose =(Open+High+Low+Close)/4 haOpen =(haOpen[1]+haClose[1])/2 endif if haOpen[0] > haOpen[1] then haa = 0 hab = 255 else haa = 255 hab = 0 endif endif //--end-- // To show Outsidebar use external Indicator OutsideBarColorSolo.itf Return mydayhigh2 COLOURED (dha,dhb,0)style(line,3) AS "High", mydaylow2 COLOURED (dla,dlb,0)style(line,3) AS "Low", mytdayhigh COLOURED (0,204,255)style(dottedline,1) AS "Today High", mytdaylow COLOURED (204,102,0)style(dottedline, 1) AS "Today Low", mytdaycenter COLOURED (cla,clb,0 )style(line,2) as "Today Centerline", haOpen COLOURED (haa,hab,0 )style(dottedline,1)as "Heikin Ashi Line" // End and make money |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials