Introduction

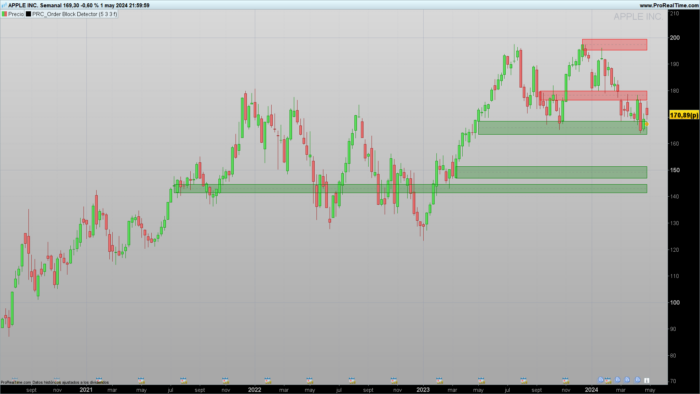

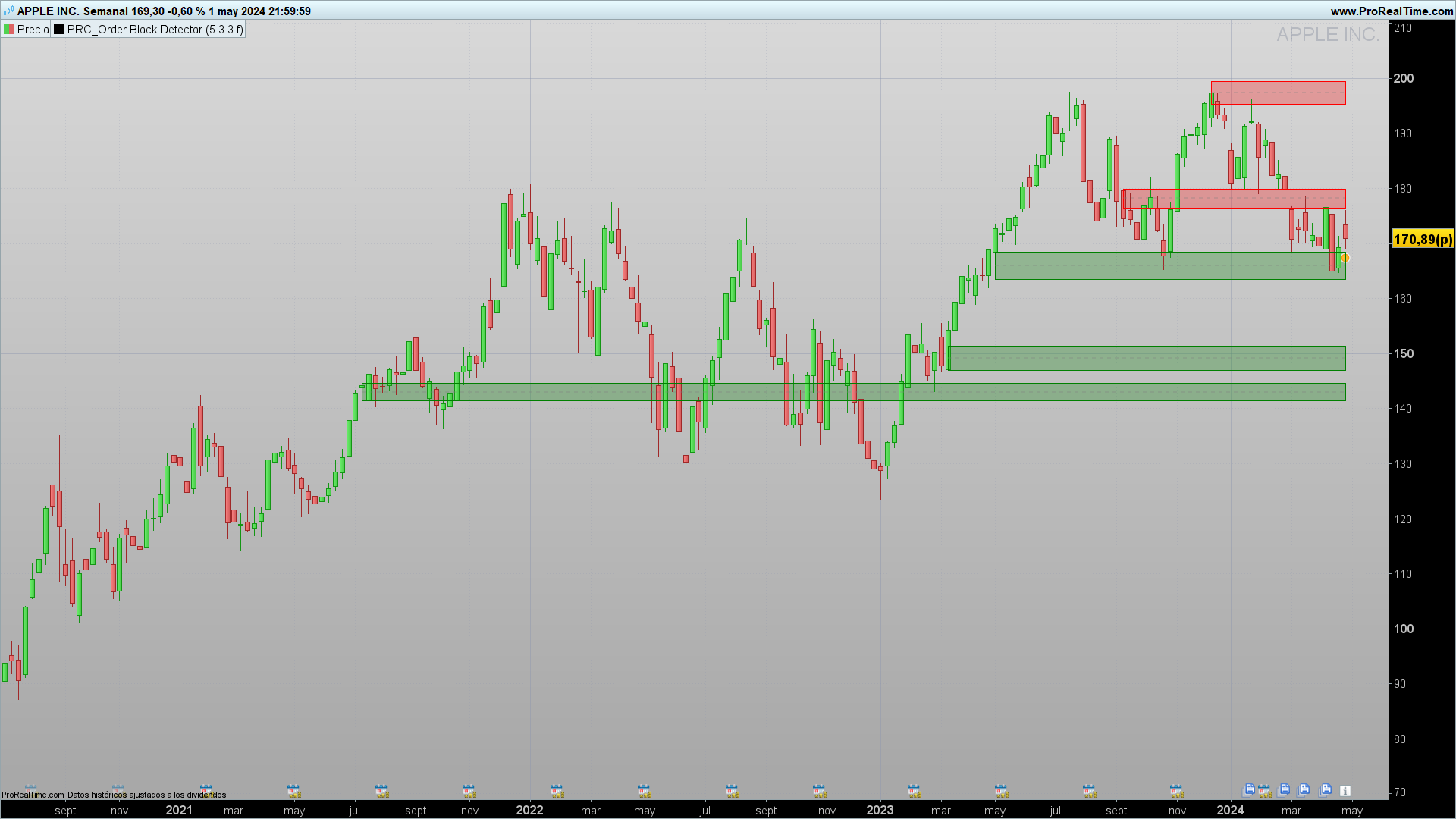

Order Blocks are critical concepts in technical analysis that help traders identify key areas where major market players have conducted significant buying or selling activities. These order blocks represent price levels at which there has been significant consolidation by institutional operators before a substantial price change. Identifying these can be crucial for determining efficient entry and exit points.

Theory of Order Blocks

An Order Block is essentially an accumulation of buy or sell orders that occur within a compact price range and can signal future price direction. These blocks are primarily categorized into two types:

- Bullish Order Block: Forms after a downward movement, indicating an area where prices may be undervalued and where buyers might start to dominate.

- Bearish Order Block: Develops after an upward movement and suggests an area where prices might be overvalued, attracting sellers.

The formation of these blocks indicates a pause before the market makes a significant move, making them strategic points for trading operations. There are several methodologies to calculate Order Blocks:

- Volume-based pivots: Identify blocks where there is a significant increase in volume, suggesting an accumulation of orders.

- Price-based pivots: Use price extremes to identify zones where the price has reacted strongly, suggesting a possible order accumulation.

- Combination of volume and price: Analyzes both changes in volume and price for a more robust signal.

In the provided code, a volume-based pivot approach is used, where a peak in volume coinciding with a price direction change indicates the formation of an Order Block.

Indicator Configuration

The Order Block Detector indicator uses several settings to identify and visualize these important market levels:

- length: Defines the number of bars to consider to identify a volume peak or trough, essential for determining an “Order Block”.

- bullextlast and bearextlast: Set the number of bullish or bearish blocks to display, respectively.

- mitigation: Decides whether the block is evaluated by the closing price or by the wick’s extreme, affecting the accuracy of the detected block.

Code of the Indicator

The code for ProRealTime facilitates the automatic implementation of the Order Block Detector. The script is designed to analyze market data and highlight areas where Order Blocks may be forming. It uses a combination of volume and price comparisons to detect these critical levels.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 |

//----------------------------------------------------------------------// //PRC_Order Block Detector //version = 0 //30.04.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //----------------------------------------------------------------------// //-----Settings---------------------------------------------------------// length = 5 //Volume Pivot Length bullextlast = 3 //Bullish OB bearextlast = 3 //Bearish OB mitigation = 0 //0=Wick 1=Close //----------------------------------------------------------------------// //-----Global elements--------------------------------------------------// n=barindex upper = highest[length](high) lower = lowest[length](low) if mitigation then targetbull = lowest[length](close) targetbear = highest[length](close) else targetbull = lower targetbear = upper endif if high[length] > upper then os = 0 elsif low[length] < lower then os = 1 else os = os[1] endif //----------------------------------------------------------------------// //-----Pivot Points - Volume--------------------------------------------// if volume < volume[length] and highest[length](volume)<volume[length] and volume[length]>highest[length](volume)[length+1] then $phvol[t+1]=volume[length] $phvolx[t+1]=barindex[length] t=t+1 endif phv = $phvol[t] //----------------------------------------------------------------------// //-----Get bullish/bearish order blocks coordinates---------------------// //-----Bullish OB if isset($phvol[t]) and phv<>phv[1] and os=1 then $bulltop[m+1] = (high[length]+low[length])/2 $bullbtm[m+1] = low[length] $bullavg[m+1] = ((high[length]+low[length])/2+low[length])/2 $bullleft[m+1] = barindex-length $bullob[m+1] = low[length] m=m+1 endif //-----Bearish OB if isset($phvol[t]) and phv<>phv[1] and os=0 then $beartop[r+1] = high[length] $bearbtm[r+1] = (high[length]+low[length])/2 $bearavg[r+1] = ((high[length]+low[length])/2+high[length])/2 $bearleft[r+1] = barindex-length $bearob[r+1] = high[length] r=r+1 endif //----------------------------------------------------------------------// //-----Remove mitigated order blocks------------------------------------// if islastbarupdate then //-----Set only last x Bullish OB not mitigated t=0 for i=m downto 0 do if targetbull > $bullbtm[i] then $bullishTOP[T+1] = $bulltop[i] $bullishBOT[T+1] = $bullbtm[i] $bullishAVG[T+1] = $bullavg[i] $bullishLEFT[T+1] = $bullleft[i] t=t+1 drawrectangle($bullishLEFT[t],$bullishTOP[t],barindex,$bullishBOT[t])coloured("green")fillcolor("green",70) drawsegment($bullishLEFT[t],$bullishAVG[t],barindex,$bullishAVG[t]) coloured("grey",70)style(dottedline,2) if t >= bullextlast then break endif endif next //-----Set only last x Bearish OB not mitigated k=0 for j=r downto 0 do if targetbear < $beartop[j] then $bearishtop[k+1]=$beartop[j] $bearishbot[k+1]=$bearbtm[j] $bearishavg[k+1]=$bearavg[j] $bearishleft[k+1]=$bearleft[j] k=k+1 drawrectangle($bearishleft[k],$bearishtop[k],barindex,$bearishbot[k])coloured("red")fillcolor("red",70) drawsegment($bearishleft[k],$bearishavg[k],barindex,$bearishavg[k]) coloured("grey",70)style(dottedline,2) if k >= bearextlast then break endif endif next endif //----------------------------------------------------------------------// return |

Interpretation of Results

Interpreting detected Order Blocks is straightforward: a bullish block suggests a potential support area and an entry point for long positions, while a bearish block indicates resistance and an entry point for short positions. The trader should observe these blocks in conjunction with other technical analysis signals to validate and strengthen trading decisions.

Conclusions

Order Blocks are powerful tools for any technical trading arsenal. Their correct identification and analysis can provide traders with a significant advantage, offering entry and exit points based on the historical activity of the market’s most influential operators. With practice and integration of this indicator, traders can significantly improve their accuracy and operational efficiency.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Scusa, mi sembra molto simile al precedente indicatore postato da te “Demand/Supply Zone” , oppure sono diversi e io non capisco la differenza.

Grazie

Una differenza importante è che questo indicatore calcola i blocchi in base ai punti di rotazione del volume.

E quindi dovrebbe essere più preciso nell’indicare le zone?

No, semplicemente diverso

Estimado Iván, gracias por publicar estos indicadores, ¡gran trabajo! Dos indicadores que realmente echo de menos de TradingView son: Chandelier Exit de Alex Orekhov y Nadaraya-Watson Envelope de LuxAlgo. Incluyo los códigos por si te gustaría programarlos en PRT, ¡gracias!

//………………………………………………………………………………………………………………..//

//@version=5

// Copyright (c) 2019-present, Alex Orekhov (everget)

// Chandelier Exit script may be freely distributed under the terms of the GPL-3.0 license.

indicator(‘Chandelier Exit’, shorttitle=’CE’, overlay=true)

var string calcGroup = ‘Calculation’

length = input.int(title=’ATR Period’, defval=22, group=calcGroup)

mult = input.float(title=’ATR Multiplier’, step=0.1, defval=3.0, group=calcGroup)

useClose = input.bool(title=’Use Close Price for Extremums’, defval=true, group=calcGroup)

var string visualGroup = ‘Visuals’

showLabels = input.bool(title=’Show Buy/Sell Labels’, defval=true, group=visualGroup)

highlightState = input.bool(title=’Highlight State’, defval=true, group=visualGroup)

var string alertGroup = ‘Alerts’

awaitBarConfirmation = input.bool(title=”Await Bar Confirmation”, defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) – atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] shortStopPrev ? 1 : close math.exp(-(math.pow(x, 2)/(h * h * 2)))

//—————————————————————————–}

//Append lines

//—————————————————————————–{

n = bar_index

var ln = array.new_line(0)

if barstate.isfirst and repaint

for i = 0 to 499

array.push(ln,line.new(na,na,na,na))

//—————————————————————————–}

//End point method

//—————————————————————————–{

var coefs = array.new_float(0)

var den = 0.

if barstate.isfirst and not repaint

for i = 0 to 499

w = gauss(i, h)

coefs.push(w)

den := coefs.sum()

out = 0.

if not repaint

for i = 0 to 499

out += src[i] * coefs.get(i)

out /= den

mae = ta.sma(math.abs(src – out), 499) * mult

upper = out + mae

lower = out – mae

//—————————————————————————–}

//Compute and display NWE

//—————————————————————————–{

float y2 = na

float y1 = na

nwe = array.new(0)

if barstate.islast and repaint

sae = 0.

//Compute and set NWE point

for i = 0 to math.min(499,n – 1)

sum = 0.

sumw = 0.

//Compute weighted mean

for j = 0 to math.min(499,n – 1)

w = gauss(i – j, h)

sum += src[j] * w

sumw += w

y2 := sum / sumw

sae += math.abs(src[i] – y2)

nwe.push(y2)

sae := sae / math.min(499,n – 1) * mult

for i = 0 to math.min(499,n – 1)

if i%2

line.new(n-i+1, y1 + sae, n-i, nwe.get(i) + sae, color = upCss)

line.new(n-i+1, y1 – sae, n-i, nwe.get(i) – sae, color = dnCss)

if src[i] > nwe.get(i) + sae and src[i+1] < nwe.get(i) + sae

label.new(n-i, src[i], '▼', color = color(na), style = label.style_label_down, textcolor = dnCss, textalign = text.align_center)

if src[i] nwe.get(i) – sae

label.new(n-i, src[i], ‘▲’, color = color(na), style = label.style_label_up, textcolor = upCss, textalign = text.align_center)

y1 := nwe.get(i)

//—————————————————————————–}

//Dashboard

//—————————————————————————–{

var tb = table.new(position.top_right, 1, 1

, bgcolor = #1e222d

, border_color = #373a46

, border_width = 1

, frame_color = #373a46

, frame_width = 1)

if repaint

tb.cell(0, 0, ‘Repainting Mode Enabled’, text_color = color.white, text_size = size.small)

//—————————————————————————–}

//Plot

//—————————————————————————–}

plot(repaint ? na : out + mae, ‘Upper’, upCss)

plot(repaint ? na : out – mae, ‘Lower’, dnCss)

//Crossing Arrows

plotshape(ta.crossunder(close, out – mae) ? low : na, “Crossunder”, shape.labelup, location.absolute, color(na), 0 , text = ‘▲’, textcolor = upCss, size = size.tiny)

plotshape(ta.crossover(close, out + mae) ? high : na, “Crossover”, shape.labeldown, location.absolute, color(na), 0 , text = ‘▼’, textcolor = dnCss, size = size.tiny)

//—————————————————————————–}

Hola

Claro, no hay problema pero necesito que lo hagas a través de aquí: https://www.prorealcode.com/free-code-conversion/

Si puedes compartir una imagen del indicador sería de gran ayuda

Félicitation Yvan.

Cet indicateur est le plus intéressant et le plus pertinent que j’ai vu depuis longtemps. Il apporte une information précieuse sur la probabilité de réussite au moment de placer un trade short ou long. Il a une capabilité de prédiction sur l’évolution d’un cours bien meilleure que bien d’autres indicateur.

Felicitaciones Ivan, este indicador me parece muy útil y mucho más rápido que las zonas de oferta y demanda publicadas en el pasado en PRT. Estoy intentando usarlo para crear una estrategia automática de entrada y salida, pero no puedo entender en la barra actual si estoy cerca de un bloque rojo (posible cierre corto o largo) o cerca de una banda verde (posible cierre largo o corto). ¿Podrías crear una estrategia de entrada sobre esta base, para que luego cada uno pueda añadir otros filtros de entrada según su propia filosofía? ¡¡¡Gracias de antemano!!! Franco

Congratulations Ivan, this indicator seems to me to be very useful and much quicker than the offer and demand areas published in the past on PRT. I’m trying to use it to create an automatic entry and exit strategy, but I can’t read it in the actual bar if I’m looking for a red block (possible short or wide lock) or looking for a green band (possible wide or short lock). Could we create an entry strategy on this basis, so that at some point one can add other entry filters according to one’s philosophy? ¡¡¡Thanks in advance!!! Franco

Hi Ivan …GREAT! thank you

Hello Ivan, thank you for your good work, is it possible to create a sceener to find actions with close inside the green or red bock?

Hi! Yes it’s possible. I will add this to my list of tasks to do 🙂

finaly the screener could be something like this for green blocks but it probably could be better

//////

length = 5 //Volume Pivot Length

bullextlast = 3 //Bullish OB

mitigation = 0 //0=Wick 1=Close

//———————————————————————-//

//—–Global elements————————————————–//

upper = highest[length](high)

lower = lowest[length](low)

if mitigation then

targetbull = lowest[length](close)

else

targetbull = lower

endif

if high[length] > upper then

os = 0

elsif low[length] < lower then

os = 1

else

os = os[1]

endif

//———————————————————————-//

//—–Pivot Points – Volume——————————————–//

if volume < volume[length] and highest[length](volume)highest[length](volume)[length+1] then

$phvol[t+1]=volume[length]

$phvolx[t+1]=barindex[length]

t=t+1

endif

phv = $phvol[t]

//———————————————————————-//

//—–Get bullish/bearish order blocks coordinates———————//

//—–Bullish OB

if isset($phvol[t]) and phvphv[1] and os=1 then

$bulltop[m+1] = (high[length]+low[length])/2

$bullbtm[m+1] = low[length]

$bullavg[m+1] = ((high[length]+low[length])/2+low[length])/2

$bullleft[m+1] = barindex-length

$bullob[m+1] = low[length]

m=m+1

endif

//—–Remove mitigated order blocks————————————//

if islastbarupdate then

//—–Set only last x Bullish OB not mitigated

t=0

inside = 0

zone = 0

for i=m downto 0 do

if targetbull > $bullbtm[i] then

$bullishTOP[T+1] = $bulltop[i]

$bullishBOT[T+1] = $bullbtm[i]

$bullishAVG[T+1] = $bullavg[i]

$bullishLEFT[T+1] = $bullleft[i]

t=t+1

Zone = 1

if close > min($bullishTOP [t],$bullishBOT[T]) and close = bullextlast then

break

endif

endif

next

endif

//———————————————————————-//

screener [Zone = 1 and inside = 1]

the support and resistance colors become darker and darker with the time, could you please change that and make it fixed and even better if it is light colors

Hi. You can change colors in lines 75,76,91,92

Ciao Ivan, ti faccio ancora una domanda e precisamente “Quanti blocchi visualizzare per avere una corretta indicazione”

Grazie

Buongiorno.

In genere lavoro con la configurazione predefinita, 3 supporti e 3 resistenze, anche se è vero che a volte ne servono di più.

Gracias por su valiosa aportacion

Holá Ivan! Complimenti per l´indicatore! Secondo te con la nuova V12 avendo ora a disposizione Volume profile, POC, VA e Cumulative Volume Delta, si potrebbe creare un indicatore tipo “Order Flow”? Grazie

Grazie! In realtà, anche se gli indicatori di cui parli sono presenti nella nuova versione, non possiamo utilizzarli nel codice.

Se volessimo farlo, dovremmo programmarlo noi stessi.

Infatti, il Volume profile, il POC, le VA il CVD sono finalmente disponibili su PRT V12. Secondo te, sarebbe possibile programmare (anche pagando :)) un indicatore tipo Order Flow? Grazie M