The percentage price oscillator (PPO) is a technical momentum indicator that shows the relationship between two moving averages. To calculate the PPO, subtract the 26-period exponential moving average (EMA) from the 12-period EMA, and then divide this difference by the 26-period EMA. The result is then multiplied by 100. The indicator tells the trader where the short-term average is relative to the longer-term average.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 |

//Percentage Price Oscillator - PPO // //The percentage price oscillator (PPO) is a technical momentum indicator that shows the relationship between two moving averages. To calculate the PPO, subtract the 26-period exponential moving average (EMA) from the 12-period EMA, and then divide this difference by the 26-period EMA. The result is then multiplied by 100. The indicator tells the trader where the short-term average is relative to the longer-term average. // // Here is the PPO calculation: ((12-day EMA - 26-day EMA) / 26-day EMA) x 100 // // https://www.investopedia.com/terms/p/ppo.asp // http://www.traderpedia.it/wiki/index.php/Price_oscillator_(DOA) // SlowP = 26 //Periods of Slow Average FastP = 12 //Periods of Fast Average AvgType = 1 //Average Type (0=sma, 1=ema, 2=wma,...) Percentage = 1 //1=calculate Percentage 0=no percentage // DEFPARAM CalculateOnLastBars = 1000 SlowP = max(1,min(999,SlowP)) //1 - 999 FastP = max(1,min(999,FastP)) //1 - 999 AvgType = max(0,min(6,AvgType)) //0 - 6 Percentage = max(0,min(1,Percentage)) //1=Percentage 0=NO Percentage SlowAvg = Average[SlowP,AvgType](close) FastAvg = Average[FastP,AvgType](close) Difference = FastAvg - SlowAvg IF Percentage THEN Difference = (Difference / SlowAvg) * 100 ENDIF RETURN Difference,0 |

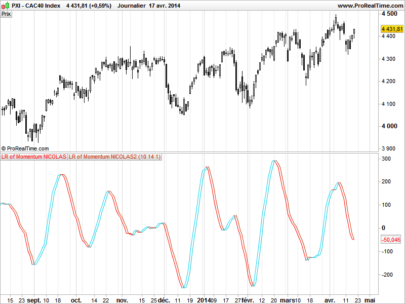

I am also attaching the MACD type version (it is very similar):

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

//Percentage Price Oscillator - PPO (with Histogram) // //The percentage price oscillator (PPO) is a technical momentum indicator that shows the relationship between two moving averages. To calculate the PPO, subtract the 26-period exponential moving average (EMA) from the 12-period EMA, and then divide this difference by the 26-period EMA. The result is then multiplied by 100. The indicator tells the trader where the short-term average is relative to the longer-term average. // // Here is the PPO calculation: ((12-day EMA - 26-day EMA) / 26-day EMA) x 100 // // https://www.investopedia.com/terms/p/ppo.asp // http://www.traderpedia.it/wiki/index.php/Price_oscillator_(DOA) // https://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:price_oscillators_ppo // http://www.forexwiki.it/PPO // SlowP = 26 //Periods of Slow Average FastP = 12 //Periods of Fast Average AvgType = 1 //Average Type (0=sma, 1=ema, 2=wma,...) Percentage = 1 //1=calculate Percentage 0=no percentage SignalP = 9 //Periods of Signal Average // DEFPARAM CalculateOnLastBars = 1000 SlowP = max(1,min(999,SlowP)) //1 - 999 FastP = max(1,min(999,FastP)) //1 - 999 AvgType = max(0,min(6,AvgType)) //0 - 6 Percentage = max(0,min(1,Percentage)) //1=Percentage 0=NO Percentage SignalP = max(1,min(999,FastP)) //1 - 999 SlowAvg = Average[SlowP,AvgType](close) FastAvg = Average[FastP,AvgType](close) Ppo = FastAvg - SlowAvg IF Percentage THEN Ppo = (Ppo / SlowAvg) * 100 ENDIF SignalLine = Average[SignalP,AvgType](Ppo) Histo = Ppo - SignalLine RETURN Ppo AS "Ppo",SignalLine AS "Signal",Histo AS "Histogram",0 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Haven’t been on this forum for ages! Just logged in to see what is happening and since this caught my eye I decided to quickly write it into a strategy 🙂

For some reason, the Add PRT Code doesn’t work so here is the unformatted code:

//EURUSD 1Hr

Defparam cumulateorders = False

possize = 1

SlowP = 26 //Periods of Slow Average

FastP = 12 //Periods of Fast Average

AvgType = 1 //Average Type (0=sma, 1=ema, 2=wma,…)

Percentage = 1 //1=calculate Percentage 0=no percentage

SignalP = 9 //Periods of Signal Average

//

SlowP = max(1,min(999,SlowP)) //1 – 999

FastP = max(1,min(999,FastP)) //1 – 999

AvgType = max(0,min(6,AvgType)) //0 – 6

Percentage = max(0,min(1,Percentage)) //1=Percentage 0=NO Percentage

SignalP = max(1,min(999,FastP)) //1 – 999

SlowAvg = Average[SlowP,AvgType](close)

FastAvg = Average[FastP,AvgType](close)

ppo = FastAvg – SlowAvg

IF Percentage THEN

ppo = (ppo / SlowAvg) * 100

ENDIF

SignalLine = Average[SignalP,AvgType](ppo)

Histo = Ppo – SignalLine

If longonmarket and histo < 0 or ppo 0 or ppo > SignalLine Then

Exitshort at market

EndIf

If ppo > 0 and signalLine SignalLine Then

If shortonmarket Then

Exitshort at market

EndIf

Buy possize contract at market

ElsIf ppo 0 and ppo < SignalLine Then

If longonmarket Then

Sell at market

EndIf

Sellshort possize contract at market

EndIf

Welcome back Juanji, why don’t you post your strategy in the ProOrder support, it’s a better place to talk about strategies and improve them.

Thank you.

Nicolas, I am trying to replicate Price Oscillator of PRC (PO NOT PPO) using manual programing to make sure i have it correct. I thought I had it correct but a comparison backtest of the two has very different results. Can you please define the calculation for PRC PriceOscillator as i clearly have something wrong below and PRC does not specify the calculation.

xClose = Close

AvgType = Average // weightedAverage //ExponentialAverage //

Fastp = A

Slowp = B

TriggerAve = C

ShortAvg = Average[Fastp,AvgType](xClose)

LongAvg = Average[Slowp,AvgType](xClose)

PPO = ShortAvg – LongAvg

PPO = PriceOscillator[A,B](Xclose)

Trigger = Average[C](PPO)

Hi, I am not Nicolas.

Where is the formula of the Oscillator you want to code?

It’s just the difference of two averages:

PO = Fast Moving Average – Slow Moving Average

Robertogozzi, I agree with it being the difference of the two MA’s, however when i compare that to “PriceOscillator[A,B](Xclose)” in PRT it get different backrest results. Thus my question is, what is the code for “PriceOscillator[A,B](Xclose)” so that i can compare why the results are different.

Thanks for your help.

Sorry, I can’t find any built-in PPO in PRT, so I cannot tell.

Look up Price Oscillator, that is the prebuilt in am referring to, PO not PPO.

I have plotted 4 similar indicators on mty chart: PPO, PO (built-in), MACD (built-in) and APO, all with a 12-period fast MA and a 26-period slow MA, all with the same type of moving average, EMA, applied to CLOSE.

They all show the same result. It can’t be any different since it’s the same expression in all of them!

The only difference can only be spotted when using different types of Moving Averages.

If you still have issues I suggest that you start a new topic in the ProBuilder support so that we can attach pics.

Do you mind looking at my code to see if i ma doing something wrong?

xClose = Close

AvgType = Average

Fastp = A

Slowp = B

ShortAvg = Average[Fastp,AvgType](xClose)

LongAvg = Average[Slowp,AvgType](xClose)

PO = ShortAvg – LongAvg

When I code this, i get a different back test than using the standard PO from PRT.

AvgType = 1 //0 to 8, but is usually o=sma or 1=ema

This is the only thing that may cause an error.

Ah ha. I will check that and report back. Thank you.

Robertogozzi,

I have backtested the two following PriceOscillator code, which I thought would result in the same returns, alas they do not. Do you have any insights? I will say that using WeightedAverage is closer to the built in PriceOscillator, yet still not the same. Of course using the same parameters and time period. Do you have any insights as to why this would happen?

ShortAvg = WeightedAverage[A] (Close)

LongAvg = WeightedAverage[B] (Close)

PO = ShortAvg – LongAvg

PO = PriceOscillator[A,B](Close)

Trigger = Average[C](PO)

Please post the full working code, otherwiose I can’t replicate it.

Tellme what you compared it to.

Code below. Comparison is to PRT standard PO which is // out.

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

DEFPARAM FLATBEFORE = 093000

DEFPARAM FlatAfter = 154500

capital = 100000 + strategyprofit

Equity = capital / close

myCurrentProfit = STRATEGYPROFIT

ShortAvg = Average[22] (close)

LongAvg = Average[7] (close)

PO = (ShortAvg – LongAvg)

//PO = PriceOscillator[22,7](Close)

Trigger = Average[2](PO)

// Draw indicator

Graph PO COLOURED(34,139,3) AS “SBFO PO”

Graph Trigger COLOURED(225,0,0) AS “Trigger”

// Conditions to enter long positions

IF NOT LongOnMarket AND PO Crosses Over Trigger THEN

BUY Equity SHARES AT MARKET

ENDIF

// Conditions to exit long positions

If LongOnMarket AND PO Crosses Under Trigger THEN

SELL AT MARKET

ENDIF

//

//Conditions to enter short positions

IF NOT ShortOnMarket AND PO Crosses Under Trigger THEN

Sellshort Equity SHARES AT MARKET

ENDIF

Firstly you need to make the correct calculation, you need to swap 22 and 7.

Secondly PRT’s POI uses to return a percentage, so you need to replace the calculation with:

PO = (ShortAvg – LongAvg) / LongAvg * 100

Sorry, i did forget to change the 7/22, I have run it both ways.

PRT is calculating PPO and not PO, that make sense now.

Thanks. Have a fantastic weekend.

I believe there is an error in line 23 of the MACD version. It points to the FastP. Should be SignalP I think….