Discovering Market Ranges with the Range Detector Indicator

The ability to accurately identify market ranges can provide a significant advantage when trading. Whether for strategies that benefit from market volatility or those that capitalize on periods of consolidation, understanding when and how these ranges form is crucial. The “Range Detector” emerges as an essential tool specifically designed to highlight these critical periods in a visual and accessible manner.

How the Range Detector Works

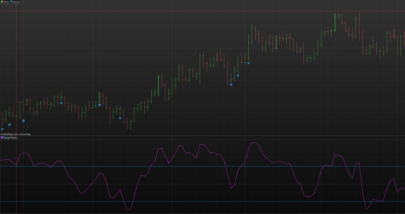

The mechanics behind the “Range Detector” are based on a clever combination of standard technical indicators and specific mathematical calculations. It uses the Average True Range (ATR), a well-established indicator that measures market volatility, along with a moving average of the closing price, to identify and visually mark price ranges on a chart.

The heart of the indicator lies in its ability to calculate the difference between the current closing price and a moving average, comparing it afterward with the ATR adjusted by a multiplicative factor. This approach allows the “Range Detector” to outline boxes that enclose periods where the price consolidates within a range defined by these parameters. When the closing price deviates significantly beyond the adjusted ATR, it is interpreted as a range expansion, triggering a change in the visual representation of the indicator.

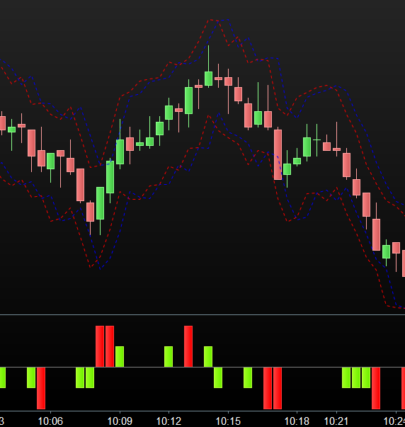

Through this method, the “Range Detector” not only signals the presence of a consolidation range but also provides visual cues about price expansion, which may be a precursor to a significant market movement. The use of colors in the boxes drawn by the indicator offers a quick and clear interpretation: a box of a specific color can indicate consolidation, while a change to another color signals an expansion or range breakout.

Indicator Parameters

A distinctive feature of the “Range Detector” is its flexibility, granted by the possibility to adjust its parameters. This allows traders to adapt the indicator to different markets and trading styles. The adjustable parameters include:

length: Defines the minimum range length to detect. This parameter determines the number of bars used to calculate the moving average, allowing the trader to focus on longer or shorter duration ranges according to their strategy.

mult: Adjusts the width of the boxes in relation to the ATR, modifying the indicator’s sensitivity to market volatility. A larger multiplier expands the range needed for an expansion to be considered, while a smaller value makes it more sensitive to small movements.

atrLen: Determines the length of the ATR used for volatility calculation. This parameter directly influences how the indicator perceives volatility and, therefore, how it identifies consolidation ranges.

These parameters can be adjusted to refine range detection and improve the indicator’s congruence with current market conditions or the employed trading strategy.

Interpreting the Indicator

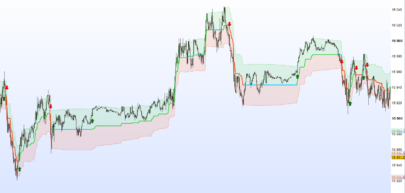

Interpreting the signals generated by the “Range Detector” is intuitive, offering a clear visualization of market consolidation and expansion periods.

Consolidation boxes: When the price remains within a range defined by the adjusted ATR, the indicator draws a box around this period. The presence of a box suggests that the market is in consolidation, which can be an indication of accumulation or distribution before a significant movement.

Color change in the boxes: A change in the color of the boxes indicates a transition from consolidation to range expansion or vice versa. This change can signal the start of a new trend or the breakout of a range, offering an opportunity to adjust positions or seek entries.

The “Range Detector” is particularly useful for identifying those critical moments where the market is about to make a decisive move, allowing traders to anticipate and react to possible breakouts or trend reversals.

Practical Applications of the Range Detector

The “Range Detector” is not only a technical analysis tool for identifying consolidation and expansion ranges but also provides a solid foundation upon which effective trading strategies can be built. Here are some practical applications.

Breakout trading:

By identifying a consolidation period using the indicator’s boxes, traders can prepare to enter a position at the moment of the breakout. An expansion of the range, indicated by the color change in the boxes, may signal the optimal moment to execute a trade.

Trading within the range:

In addition to preparing for breakouts, the “Range Detector” also offers the opportunity to trade the rebounds within a consolidated range. When the price touches one of the edges of the consolidation box, traders may consider opening a position in the direction of the opposite edge of the range, anticipating a possible turn.

Risk management:

The “Range Detector” can help set more precise stop-loss levels, placing them just outside the consolidation box. This reduces the likelihood of being prematurely stopped out in volatile markets.

Entry optimization:

Traders can use the indicator to fine-tune their entry points, waiting for a confirmation of consolidation or expansion before committing to a position.

These are just some of the multiple ways in which the “Range Detector” can enrich any trader’s toolbox, offering a clear and reasoned perspective for making more informed trading decisions.

Indicator Code in ProBuilder

The “Range Detector” indicator is based on the analysis of market volatility and the detection of consolidation ranges. Below is the basic code outline in ProBuilder, ready to be customized and implemented in ProRealTime:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 |

//------------------------------------------------------------------------// //PRC_Range Detector //version = 0 //09.04.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //------------------------------------------------------------------------// defparam drawonlastbaronly=true //-----Inputs-------------------------------------------------------------// length=20//Minimum Range Length mult=1//Range Width atrLen=500//ATR Length //------------------------------------------------------------------------// //-----Moving average and ATR definition----------------------------------// n=barindex atr=averagetruerange[atrlen](close)*mult ma=average[length,0](close) //-----Check range--------------------------------------------------------// count=0 for j=0 to length-1 do if abs(close[j]-ma) > atr then count=count+1 else count=count endif next //-----Box definition-----------------------------------------------------// if count=0 and count[1]<>count then //Test for overlap and change coordinates if n[length] <= $boxright[x] then maxi = max(ma+atr,$boxtop[x]) mini = min(ma-atr,$boxbot[x]) //Box new coordinates $boxtop[x]=maxi $boxbot[x]=mini $boxright[x]=n //Line new coordinates avg=(maxi+mini)/2 $levely1[x]=avg $levelx2[x]=n $levely2[x]=avg //backgroundcolor("Blue",50) else maxi=ma+atr mini=ma-atr //Set new box $boxtop[x+1]=maxi $boxbot[x+1]=mini $boxright[x+1]=n $boxleft[x+1]=n[length] //Set new level $levely1[x+1]=ma $levelx2[x+1]=n $levely2[x+1]=ma $levelx1[x+1]=n[length] //Set color $rbox[x+1]=33 $gbox[x+1]=87 $bbox[x+1]=243 //Highligth first occurrence backgroundcolor("grey",50) $start[x+1]=n //Set new value for x x=x+1 endif elsif count=0 then //Extend the box $boxright[x]=n $levelx2[x]=n endif //------------------------------------------------------------------------// //-----Color Boxes--------------------------------------------------------// if close > $boxtop[x] then $rbox[x]=8 $gbox[x]=153 $bbox[x]=119 elsif close < $boxbot[x] then $rbox[x]=242 $gbox[x]=54 $bbox[x]=69 endif //------------------------------------------------------------------------// //-----Draw previous Boxes and Levels-------------------------------------// for i=0 to x-1 do drawrectangle($boxleft[i],$boxbot[i],$boxright[i],$boxtop[i])fillcolor($rbox[i],$gbox[i],$bbox[i],50)coloured($rbox[i],$gbox[i],$bbox[i],0) //-----Medium Levels---------------------------------------------------// drawsegment($levelx1[i],$levely1[i],$levelx2[i],$levely2[i])coloured($rbox[i],$gbox[i],$bbox[i],80)style(dottedline,2) //-----Top and Bottom Levels-------------------------------------------// drawsegment($levelx1[i],$boxbot[i],$start[i+1],$boxbot[i])coloured($rbox[i],$gbox[i],$bbox[i],80) drawsegment($levelx1[i],$boxtop[i],$start[i+1],$boxtop[i])coloured($rbox[i],$gbox[i],$bbox[i],80) next //------------------------------------------------------------------------// //-----Color last Box----------------------------------------------------// if close > $boxtop[x] then r=8 g=153 b=119 elsif close < $boxbot[x] then r=242 g=54 b=69 else r=33 g=87 b=243 endif //------------------------------------------------------------------------// //-----Draw last Box and Levels-------------------------------------------// drawrectangle($boxleft[x],$boxbot[x],$boxright[x],$boxtop[x])fillcolor(r,g,b,50)coloured(r,g,b,0) //-----Medium Levels---------------------------------------------------// drawsegment($levelx1[x],$levely1[x],barindex,$levely2[x])coloured($rbox[x],$gbox[x],$bbox[x],80)style(dottedline,2) //-----Top and Bottom Levels----------------------------------------------// drawsegment($levelx1[x],$boxbot[x],barindex,$boxbot[x])coloured($rbox[x],$gbox[x],$bbox[x],80) drawsegment($levelx1[x],$boxtop[x],barindex,$boxtop[x])coloured($rbox[x],$gbox[x],$bbox[x],80) //------------------------------------------------------------------------// return |

This code is a basis upon which adjustments can be made, such as modifying the parameters length, mult, and atrLen to suit different strategies and trading preferences.

Conclusion

The “Range Detector” indicator represents a powerful and versatile technical analysis tool, capable of providing significant insights into market dynamics. By integrating it into their trading strategy, traders can better leverage market opportunities, manage risk more effectively, and make trading decisions with greater confidence. Its flexibility and the visual clarity it offers make it a very interesting complement.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour Ivan,

Merci pour cet indicateur.

Je l’ai importé en utilisant le fichier ITF, mais une erreur s’affiche lorsque je tente de l’ouvrir sur un graphique.

Le message me dit que l’expression NEXT serait plus appropriée qu’un nom de variable et une une fois l’éditeur de code ouvert, le problème commence sur la ligne 85 (fillcolor est souligné).

Merci par avance.

Bonjour,

J’ai modifié le code ainsi:

ligne 85 suppression de “”fillcolor($rbox[i],$gbox[i],$bbox[i],50)”

ajout de la ligne 86 avec “colorbetween($boxbot[i],$boxtop[i],$rbox[i],$gbox[i],$bbox[i],50)”

ligne 110 suppression de “fillcolor(r,g,b,50)”

ajout de la ligne 111 avec “colorbetween($boxbot[x],$boxtop[x],r,g,b,50)”

Est-ce qu’un programmeur confirmé pourrait me confirmer que c’est correct svp? Merci.

J’utilise le bouton “Insert PRT code”, mais j’ai du louper quelque chose car le résultat ressemble à un simple copié/collé.

Pas grave!

funktioniert nicht

Hi!

Just copy and paste in a new indicator. I’ve done an it works. Try with EURUSD, EURJPY, DOW, AAPL,… it works

Re,

Message identique d’erreur même en faisant comme tu le suggères.

Le problème pourrait-il venir de la version de PRT? J’utilise encore la V11.

Merci.

Yes… I think that’s the problem.

was bedeutet rotes Kästchen und was bedeutet blaues Kästchen. hat die Farbe eine Bedeutung? Der Code funktioniert jetzt.

L’indicateur fonctionne très bien de mon côté et je le trouve très pertinent. @Iván je vais créer un post sur le forum. J’aimerais creuser la possibilité de créer une alerte basé sur les bandes hautes/basses.

Bonjour à tous,

en regardant le graphe joint, cet indicateur a l’air intéressant : est-ce que certains l’utilisent et si oui sur quel time frame ? en outre, comme j’utilise déjà des couleurs en back-ground de mes graphes, comment changer la couleur de remplissage des boîtes (peut-être dans “color boxes” ?

merci.

Perfect!!

Hi! You should change $rbox, $gbox and $bbox variables. Also r,g,b for last box.

Thanks Ivan.

Ivan, I just want to say you.. very very great job!!!! Thank you so much for this indicator! Fantastic.

Bonjour ivan,

J’utilise l’indicateur en UT 15 mn et je souhaite le dupliquer en UT 3mn ou 1 mn.

J’

As tu une idée ?

merci

TIMEFRAME(15minutes) apparemment ne fonctionne pas

Bonjour

Je ne comprends pas bien le problème. L’indicateur fonctionne dans n’importe quelle saisonnalité.

OUI je le sais, il fonctionne dans toutes les unités de temps. Mais je souhaite utiliser l’indicateur UT 15 mn en UT3mn ou UT1mn.

Autrement dit je duplique l’indicateur 15mn grâce à TIMEFRAME(15minutes) mais celà ne fonctionne pas pour cet

//————————————————————————//

//PRC_Range Detector

//version = 0

//09.04.24

//Iván González @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

TIMEFRAME(15minutes)

//————————————————————————//

defparam drawonlastbaronly=true

//—–Inputs————————————————————-//

//length=20//Minimum Range Length

//mult=1//Range Width

//atrLen=500//ATR Length

//————————————————————————//

//—–Moving average and ATR definition———————————-//

n=barindex

atr=averagetruerange[atrlen](close)*mult

ma=average[length,0](close)

//—–Check range——————————————————–//

indicateur