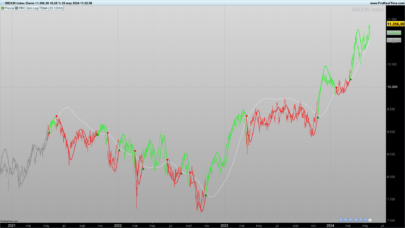

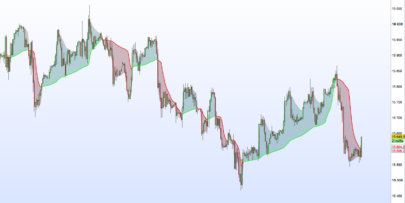

Compound Ratio Weighted Average (CoRa_Wave) is a moving average where the weights increase in a “logarithmically linear” way – from the furthest point in the data to the current point – the formula to calculate these weights work in a similar way to how “compound ratio” works – you start with an initial amount, then add a consistent “ratio of the cumulative prior sum” each period until you reach the end amount. The result is, the “step ratio” between the weights is consistent – This is not the case with linear-weights moving average ( WMA ), or EMA

– for example, if you consider a Weighted Moving Average ( WMA ) of length 5, the weights will be (from the furthest point towards the most current) 1, 2, 3, 4, 5 — we can see that the ratio between these weights are inconsistent. in fact, the ratio between the 2 furthest points is 2:1, but the ratio between the most recent points is 5:4 — the ratio is inconsistent, and in fact, more recent points are not getting the best weights they should/can get to counter-act the lag effect. Using the Compound ratio approach addresses that point.

a key advantage here is that we can significantly reduce the “tail weight” – which is “relatively” large in other MAs and would be main cause for lag – giving more weights to the most recent data points – and in a way that is consistent, reliable and easy to “code”

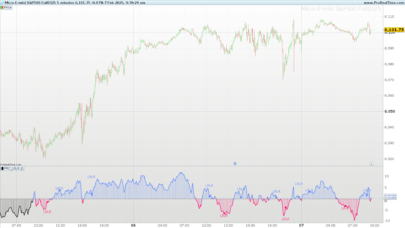

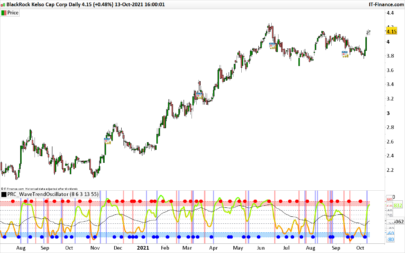

– the outcome is, a moving average line that suffers very little lag regardless of the length, and that can be relied on to track the price movements and swings closely.

other features:

===============

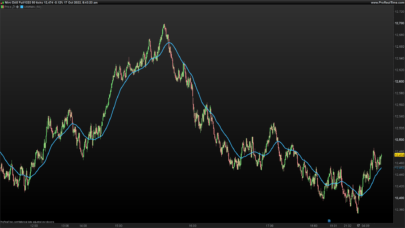

– An accelerator, or multiplier, has been added to further increase the “aggressiveness” of the moving average line, giving even more weights to the more recent points – the multiplier will have more effect between 1 and 5, then will have a diminishing effect after that – note that a multiplier of 0 (which effectively causes a comp. ratio of 0 to be applied) will produce a Simple Moving Average line 🙂

– We also added the ability to use an “automatic smoothing” mechanism, that user can over-ride by manually choosing how much smoothing is used. This gives more flexibility to how we can leverage this Moving Average in our charting.

– User can also select the Resolution and Source price for the CoRa_Wave. by default, they will be set to “same as chart” and hlc3

(description from author RedKTrader, all credits go to him).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 |

//PRC_Adjustible CoRa_Wave | indicator //20.03.2023 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //author: RedKTrader // --- settings length = 20 //length rmulti = 2.0 //Comp Ratio Multiplier smooth = 1 //Auto Smoothing mansmooth = 1 //Manual Smoothing // --- end of settings data = customclose if barindex>length then if smooth then s = max(round(sqrt(length)),1) else s = mansmooth endif source = data StartWt = 0.01 EndWt = length r = pow((EndWt / StartWt),(1 / (length - 1))) - 1 base = 1 + r * rmulti numerator = 0.0 denom = 0.0 cweight = 0.0 for i = 0 to length -1 cweight = StartWt * pow(base,(length - i)) numerator = numerator + source[i] * cweight denom = denom + cweight next coraraw = numerator / denom // ====================================================================== == corawave = weightedaverage[s](coraraw) coraup = corawave > corawave[1] if coraup then colorr=0 colorg=255 colorb=225 else colorr=255 colorg=152 colorb=0 endif endif return corawave as "Adjustible CoRa_Wave" coloured(colorr,colorg,colorb) style(line,3) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bel outil si on ne se tape pas sur les doigts avec !

Comment ajoute-on une image avec le commentaire ?

Bons trades à tous