This indicator was developed by Dennis Meyers and introduced in his article “The Japanese Yen, Recursed”, published in the December 1998 issue of Technical Analysis of Stocks and Commodities magazine. According to Meyers, this method requires a small number of historical data of the estimated price and the price at present (today) in order to forecast the price in the future (tomorrow).

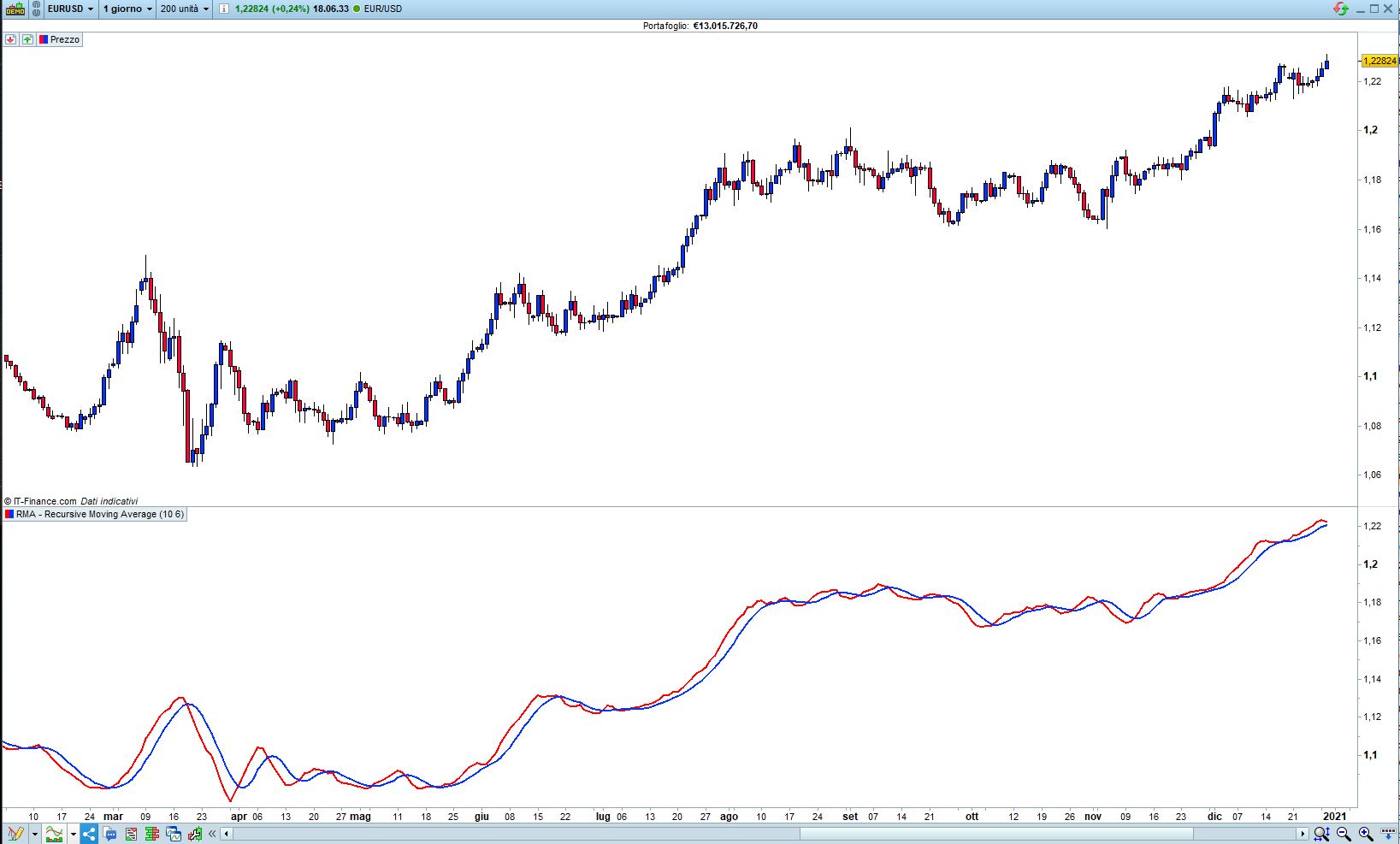

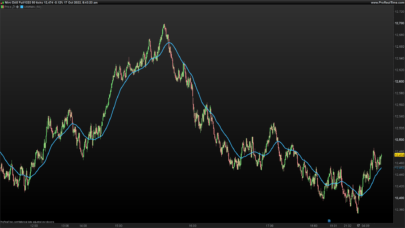

Dennis Meyers suggests creating a simple trend oscillator (the ”tosc”), that represents the difference between the Recursive Moving Trend Average and an Exponential Moving Average (EMA), both using one and the same period. He suggests examining the price series and searching for changes, which exceed the normal noise fluctuations. This signals the beginning of a potential bull or bear trend.

Following a request on the Italian Forum (https://www.prorealcode.com/topic/media-mobile-ricorsiva/), I coded this type of Moving Average.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 |

// RMA - Recursive Moving Average // // https://www.prorealcode.com/topic/media-mobile-ricorsiva/#post-155638 // //N = 10 //RMA Periods //P = 6 //Smoothing Periods N = max(1,min(999,N)) P = max(1,min(999,P)) Rma = 0 FOR i = N-1 DOWNTO 0 j = N - i Rma = Rma + (summation[j](close[i]) / j) NEXT Rma = Rma / N Avg = average[P,0](Rma) RETURN Rma as "Rma", Avg as "Average RMA" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials