Hi all,

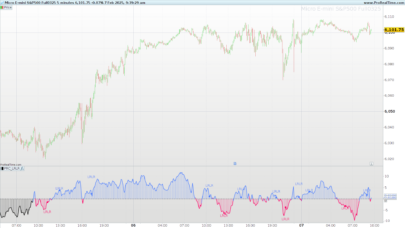

I create and indicator that highlighted the moment previous to a crossing SMA and the moment afterwards. What is called “Golden Cross” and “Death Cross”

The indicator is very simple but an be very usefully for an automatic strategy. Because it shows in real time the moment where is inevitable the crossing of two Simple Moving Average and the moment afterwards.

How it can be used? well I can imagine an strategy using it as a filter for Higher Time Frame or multi crossing of SMA in different time frame.

Hope you like it.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 |

period001 = 50 period = 100 WMA001=weightedaverage[period001](close) WwMA001=weightedaverage[period001](WMA001) SMA002=average[period002](close) //Crossing areas definiton CrossingBULL=0 IF WMA001 > SMA002 and WwMA001 < SMA002 then CrossingBULL=1 ENDIF CrossingBEAR=0 IF WMA001 < SMA002 and WwMA001 > SMA002 then CrossingBEAR=1 ENDIF Return CrossingBULL COLOURED(0,150,0) STYLE(histogram,2) as "Crossing Bull", CrossingBEAR COLOURED(200,0,0) STYLE(histogram,2) as "Crossing Bear", 0 as "cero" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Leo

Line 2 period = 100 // => period002 right ?

Yeah. Inputs are period001 and period002. Strange… I think the post were edited. Anyway

i think must check the code

Period001 and period002 are the inputs of the variables. When I update the code the fisrt two lines where not there. so you can delete them or directly import the ITF file.

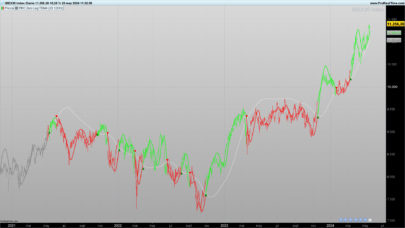

By the way I create a very interesting strategy that look very nice even in walkforward test ( just tested in AUD/USD in 5min timeframe)

DEFPARAM PRELOADBARS=1000

//Period001= //from 10 to 40 step 10

//Period002= //from 120 to 300 step 30

//Period003= //from 10 to 40 step 10

//Period004= //from 120 to 300 step 30

//Pentry= // from 7 to 28 step 7

//Kp= //from 1 to 2 step 0.5

WMA001=weightedaverage[period001](close)

WwMA001=weightedaverage[period001](WMA001)

SMA002=average[period002](close)

//Crossing areas definiton

CrossingBULL1=0

IF WMA001 > SMA002 and WwMA001 < SMA002 then

CrossingBULL1=1

ENDIF

CrossingBEAR1=0

IF WMA001 SMA002 then

CrossingBEAR1=1

ENDIF

timeframe(1 hour, default)

//Crossing areas definiton

WMA003=weightedaverage[period003](close)

WwMA003=weightedaverage[period003](WMA003)

SMA004=average[period004](close)

CrossingBULL2=0

IF WMA003 > SMA004 and WwMA003 < SMA004 then

CrossingBULL2=1

ENDIF

CrossingBEAR2=0

IF WMA003 SMA004 then

CrossingBEAR2=1

ENDIF

timeframe(default)

ONCE PXentry=round(0.6*Pentry)

highest1=highest[Pentry](high)

IF highest1 = highest1[PXentry] then

Re1=highest1

ENDIF

IF high > Re1 then

Re1=high

ENDIF

lowest1=lowest[Pentry](low)

IF lowest1 = lowest1[PXentry] then

S1=lowest1

ENDIF

If low 3 and hour<22 and DayOfWeek<=5 then

// Bedingungen zum Einstieg in Long-Positionen

IF NOT LongOnMarket AND CrossingBULL1=1 and CrossingBULL2=1 THEN

stoploss=(close – S1)/pipsize +2*pipsize

BUY 1 CONTRACTS AT MARKET

SET STOP PLOSS stoploss

SET TARGET PPROFIT Kp*stoploss

ENDIF

// Bedingungen zum Ausstieg von Long-Positionen

If LongOnMarket AND CrossingBEAR1=1 THEN

SELL AT MARKET

ENDIF

// Bedingungen zum Einstieg in Short-Positionen

IF NOT ShortOnMarket AND CrossingBEAR1=1 and CrossingBEAR2=1 THEN

stoploss=(Re1-close)/pipsize + 2*pipsize

SELLSHORT 1 CONTRACTS AT MARKET

SET STOP PLOSS stoploss

SET TARGET PPROFIT Kp*stoploss

ENDIF

// Bedingungen zum Ausstieg aus Short-Positionen

IF ShortOnMarket AND CrossingBULL1=1 THEN

EXITSHORT AT MARKET

ENDIF

ENDIF

Hi Leo, can you explain how the strategy works? I don’t know how to program and so it’s not easy for me to understand it by reading the code. THANKS!

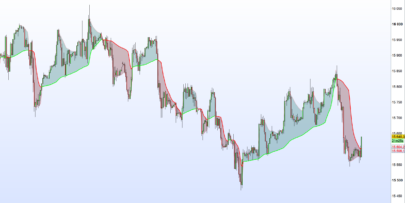

Two SMA are crossing in a time frame (5min) while another 2 SMA are crossing in a higher Time Frame (1hour) stop loss is set to next support resistace.

Thanks Leo!

Hi Leo

something is missing in the strategy above because it does not work at all as it is

I don’t know, I just copy paste the strategy. The optimisation of the values I wrote them in the code: line 3 to 8

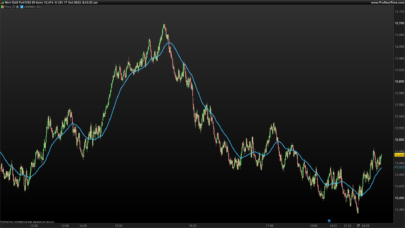

hello Leo I’m spending time on your strategy code. do you agree to try to include this code (see ITF file) and try to make it work. I don’t know how to do it alone yet. thank you. it is surely necessary to remove MMperiode from my code too …

//version a: ajout filtre MM

defparam cumulateorders=false

// — paramètres

taille = 1 //taille de contrat pour les prises de position

active3Bougies = 1 //active ou non une suite de 3 bougies consécutives cul plate ou non (1 = OUI / 0 = NON)

culPlat = 100 //cul plat en pourcentage (taille de la meche en % de taille global)

MMperiode = 20 //période de la moyenne mobile (filtre pour prises de position)

// — fin des paramètres

avg = average[MMperiode](close)

xClose = (open+high+low+close)/4

IF BarIndex=0 THEN

xOpen = open

xHigh = high

xLow = low

ELSe

xOpen = (xOpen[1] + xClose[1])/2

xHigh = Max(Max(high, xOpen), xClose)

xLow = Min(Min(low, xOpen), xClose)

ENDIF

irange = xhigh-xlow

red = xclose<xopen and ((xhigh-xopen)/irange)xopen and ((xopen-xlow)/irange)<=(100-culplat)/100

if active3Bougies then

redcons = summation[3](red)=3

greencons = summation[3](green)=3

else

redcons = red

greencons = green

endif

if not onmarket and redcons and xcloseavg then

buy taille contract at market

endif

//graph (xhigh-xopen)/irange

//graph greencons coloured(0,255,0)