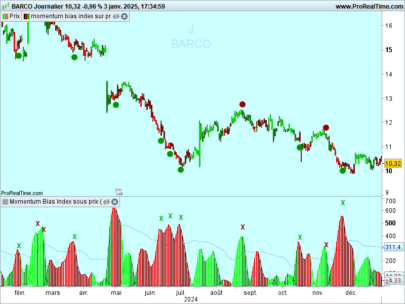

This is a derivative of John Carter’s “TTM Squeeze” volatility indicator, as discussed in his book “Mastering the Trade” (chapter 11).

Black (or white) crosses on the midline show that the market just entered a squeeze ( Bollinger Bands are with in Keltner Channel). This signifies low volatility , market preparing itself for an explosive move (up or down). Gray crosses signify “Squeeze release”.

Mr.Carter suggests waiting till the first gray after a black cross, and taking a position in the direction of the momentum (for ex., if momentum value is above zero, go long). Exit the position when the momentum changes (increase or decrease — signified by a color change). My (limited) experience with this shows, an additional indicator like ADX / WaveTrend, is needed to not miss good entry points. Also, Mr.Carter uses simple momentum indicator , while I have used a different method (linreg based) to plot the histogram.

More info:

– Book: Mastering The Trade by John F Carter

(Description from the original author of this indicator LazyBear, all credits go to him).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 |

//PRC_SqueezeMomentumIndicator | indicator //23.04.2020 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted from Pinescript version // --- settings length = 20 //BB Length mult = 2.0 //BB MultFactor lengthKC= 20 //KC Length multKC = 1.5 //KC MultFactor useTrueRange = 1 //0=false;1=true Use TrueRange (KC) // --- end of settings // Calculate BB source = customclose basis = average[length](source) dev = multKC * std[length](source) upperBB = basis + dev lowerBB = basis - dev // Calculate KC ma = average[lengthKC](source) if useTrueRange then irange = tr else irange = (high - low) endif rangema = average[lengthKC](irange) upperKC = ma + rangema * multKC lowerKC = ma - rangema * multKC sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC) sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC) noSqz = (sqzOn = 0) and (sqzOff = 0) data = source - (highest[lengthKC](high)+lowest[lengthKC](low)+average[lengthKC](close))/3 val = linearregression[lengthKC](data) //histogram color if val>0 then if val>val[1] then r=0 g=255 else r=0 g=139 endif else if val<val[1] then r=255 g=0 else r=128 g=0 endif endif //squeeze color if noSqz then sr=0 sg=0 sb=255 elsif sqzOn then sr=0 sg=0 sb=0 else sr=138 sg=138 sb=138 endif drawtext("✚",barindex,0,dialog,standard,20) coloured(sr,sg,sb) return 0 coloured(sr,sg,sb) style (histogram,2), val coloured(r,g,0) style(histogram,4) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour Nicolas,

Merci pour votre formidable travail de codage et de partage.

Je n’ai pas trouvé le moyen de vous contacter directement, alors je me permets de le faire à travers ce commentaire.

Je me forme depuis peu (2 ans) à la bourse et au trading et débute dans l’apprentissage du code via PRT.

Pas mal d’indicateurs que j’ai utilisés mais, je constate que rien ne remplace une bonne stratégie.

Quels livres ou formations sur les stratégies de trading me recommanderiez-vous ‘(en FR & EN)?

Merci d’avance pour le retour.

Nicolas and readers, a warning:

the code in prc_squeezemomentumindicator.itf is *not* the same as the one shown in the verbose explanation.

The .itf file contains several errors.

Not at all, we have tested it and it is the right file that contains the same code as the one described in this post. I feel that you have imported another file instead? There is another squeeze momentum indicator in the library.

@nicolas ,if in want to “call” this indicator, which values i have to write down?

Nicolas,

I downloaded the .itf it again. This time the .itf version is different from the one I downloaded earlier this morning.

But it still contains an error. You declare a mult variable:

//mult = 2.0 //BB MultFactor

and do not use it in the code.

in this case, change the line 18 with:

dev = mult * std[length](source)

HI, Nicolas thanks very much for this indicator. Any possibility of making a screener for this to get a signal when the first grey cross and first histogram up or down close. to get a signal?

Yes that’s possible.

This indicator is not picking up in automated program when the value crosses over or under zero

it should

That’s great!! do you have any plans on making the screener? I did try to make the screener for this.. it’s really really complicated for me and failed big time 🙂

Hi Nicolas, thank you very much for your suggestions.

What does dark grey7red columns mean? It’s meaning an uptrend (dark red) and a downtrend (dark grey)…is it right?

Thank you very much

bye for now

Michele

yes, a reversal of the current trend.

length = 20 //BB Length

mult = 2.0 //BB MultFactor

lengthKC= 20 //KC Length

multKC = 1.5 //KC MultFactor

useTrueRange = 1 //0=false;1=true Use TrueRange (KC)

// — end of settings

// Calculate BB

source = customclose

basis = average[length](source)

dev = multKC * std[length](source)

upperBB = basis + dev

lowerBB = basis – dev

// Calculate KC

ma = average[lengthKC](source)

if useTrueRange then

irange = tr

else

irange = (high – low)

endif

rangema = average[lengthKC](irange)

upperKC = ma + rangema * multKC

lowerKC = ma – rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB upperKC)

noSqz = (sqzOn = 0) and (sqzOff = 0)

data = source – (highest[lengthKC](high)+lowest[lengthKC](low)+average[lengthKC](close))/3

val = linearregression[lengthKC](data)

Result = 0

if val>0 then

if val>val[1] then

Result = 9

endif

else

if val<val[1] then

Result = 3

endif

endif

SCREENER[result] (result AS "SqueezeMI")

Didnt work for me, would love to have this as a screener!

Ciao Nicolas, complimenti per gli screener che condividi con noi sono il top!

Volevo chiederti se potevi creare uno screener che trovava le azioni con i fondamentali migliori.

Grazie.

Good morning I’m new on the forum and on the platform. First of all thanks for the work done with this indicator. I’ve a question, how can I do a Proback test with this indicator? Many Thanks

Hallo FVtrading,

if I understand you question correctly, and you want to use this indicator, do the following: download file as attached above Filename : prc_squeezemomentumindicator.itf , read eventual manual, clicking on the link above “How to import ITF files into ProRealTime platform?”, go to your PRT environment, and click on Import at the Indicators, then select the downloaded file, and it will be attached to your indicators and ready to run if selected. Success

My point is that on the book Carter says that “Once the first gray dot appears after a series of black dots, I go long if the histogram is above zero”. My problem is that If I try to do the backtest on Prorealtime , I see that I should use the graphic condition but I’m not able to translate this input “first gray and Histogram below zero” in a codniton to backtest. Many thanks

Hello Nicolas, I am new for trading, Could you please tell me if TTM squzee works on Tradingview OR MT4, How do I download it, I have basic knowledge in computers, Thank You Nicolas

All codes here are made to be used with Prorealtime trading platform, open a free account on http://www.prorealtime.com

Bonjour Nicolas, Merci pour votre travail de codage et de partage. J’ai bien télécharger votre indicateur et fais la modification qui produisait une erreur sur la ligne 18 avec:

dev = mult * std [longueur] (source)

Cependant votre indicateur ne s’affiche toujours pas dans mes graphes.

Désolé.

Cordialement

not working the same thing as xtian saying?

I need to calculate this in excel. Is it posible ? how ?

Ask on an Excel website?!

HOLA NICOLAS, TENGO LA ULTIMA VERSION ACTUALIZADA DEL INDICADOR TTM SQUEEZE PRO EN LA VERSION TRADING VIEW , PUEDES TRADUCIRLA PARA PRO REAL TIME????