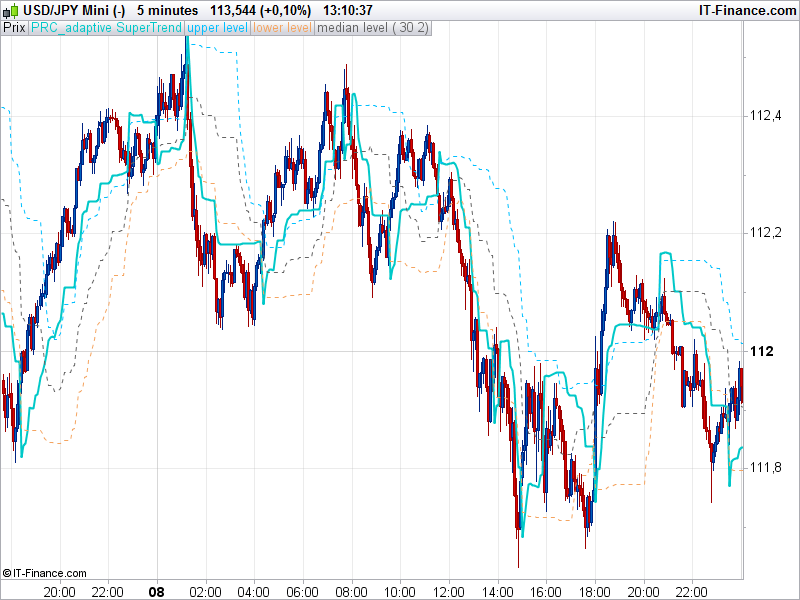

New SuperTrend indicator version made of adaptive periods with comparison made from the coefficient of determination / average of the least squares.

The adaptive formula makes the SuperTrend more reactive to the little fluctuation of the market while still doing what it is supposed to do: be a trend following indicator.

Another great idea of this indicator is to draw “floating levels” above or below the SuperTrend which are calculated with percentage of the highest and lowest values of the SuperTrend within the last Y “flLookBack” periods. These floating levels could act as filter to detect / prevent false trend reverse.

The adaptive function code of this indicator can be use in many other indicators and new original concept, I suppose I’ll post more of them into the library in the future days/weeks.

Another indicator made of this kind of adaptive periods if the r-squared adaptive exponential moving average already posted in the prorealtime code library here.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 |

//PRC_adaptive SuperTrend (r-square method) | indicator //10.02.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- parameters // Period = 20 // mult = 2 // --- Data = customclose //Period = 20 SumX = 0 SumXX = 0 SumXY = 0 SumYY = 0 SumY = 0 if barindex>Period then // adaptive r-squared periods for k=0 to period-1 do tprice = Data[k] SumX = SumX+(k+1) SumXX = SumXX+((k+1)*(k+1)) SumXY = SumXY+((k+1)*tprice) SumYY = SumYY+(tprice*tprice) SumY = SumY+tprice next Q1 = SumXY - SumX*SumY/period Q2 = SumXX - SumX*SumX/period Q3 = SumYY - SumY*SumY/period iRsq=((Q1*Q1)/(Q2*Q3)) avg = supertrend[mult,round(Period+Period*(iRsq-0.25))] //floating levels flLookBack = 25 // Floating levels lookback period flLevelUp = 90 // Floating levels up level % flLevelDown = 10 // Floating levels down level % mini = lowest[flLookBack](avg) maxi = highest[flLookBack](avg) rrange = maxi-mini flu = mini+flLevelUp*rrange/100.0 fld = mini+flLevelDown*rrange/100.0 flm = mini+0.5*rrange endif RETURN avg coloured(0,200,200) STYLE(line,2), flu coloured(0,191,255) STYLE(dottedline,1) as "upper level", fld coloured(244,164,96) STYLE(dottedline,1) as "lower level", flm coloured(100,100,100) STYLE(dottedline,1) as "median level" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Nicolas,

Thanks for your indicator

Why donc you not use the r2 function of PRT who will be simplier and faster ?

Have a nice day

Zilliq

It would has been easier, but this adaptive function is not mine, it’s a translation from MT4 code, like the other one of adaptive EMA, I gave the link in the post.

Ok Nicolas, il didn’t know it was a translation of a mt4 code (May be indicate it in your text)

Something who could be more interesting if to you use the same idea but with the Hurst exponent (correlate more with the trend than the r2 who correlate with LR). It exists on mt4 not on prt if I remember.

http://www.greattradingsystems.com/indicators/hurst-exponent-indicator-for-mt4/

Have a nice sunday and thanks

Zilliq

It’s not the case in this one you’re right.

Ciao Nicolas,

nel codice c’è un errore di sintassi, allego screenshot. Non sono pratico di codice e non riesco a risolverlo.

Ti ringrazio per aver pubblicato l’indicatore e per la correzione che cortesemente vorrai effettuare.

Un saluto

Leonardo

Este indicador sólo funcionará para Prorealtime v10.3 y superior.

gracias 😉

What is the use of this indicator ? When I use in my supertrend systems, with comparable parameters für period and mult, it starts wildly bouncing around the price. I get enormous and very fast fluctuations that destroy any trend following capabilities. On the other hand, when the parameter mult is increased enough to stop these fluctuations for most of the time, I see no advantage to the normal supertrend. Usually, it is not a good idea to change the period length within a supertrend while it is being calculated. The reason is that the size of ATR, with which the supertrend is calculated, varies with the period length. So, when you compare a supertrend, say with period 8 and with period 10 and the same mutiplier mult, in one case the supertrend may be above the price and in the other case below the price. When the periods are constantly changed, you will get a supertrend that bounces around the price instead of showing clear uninterrupted trends.

That’s why there is no color on this version of the supertrend instead of the normal one. Even if price is jumping above or below the supertrend, it doesn’t mean that the trend is actually changing, percentile floating levels “could act as filter to detect / prevent false trend reverse.” . This indicator is a concept: use correlation with a r-squared line to adapt the period of the indicator, it results in a supertrend more versatile, but also change the way we are using it usually, I totally agree. Thanks for your feedback!

There is no colour ? May be not for Englishmen on this normal version. Thanks for your feedback from Avesnes-les-Aubert ! It’s only 76 kilometers away from Lille. Still, from time to time, I learn valuable things from your website. Thank you !

Sorry? What do you mean?

Have you ever made any Franc with trading ? I guess, not. Maybe I should change business and tell people what they like to hear. Sorry ? Regards to Prorealtime.

Everything here is free, I do not sell anything and “tell people what they like to hear”, I’m sorry you are thinking that. There are many more other websites where you could make this kind of remark but I don’t think it is really adapted here, because I spent all days answering any kind of questions on forums and code for free any queries to help people without asking nothing. I encourage no one to use my code or whatever others made by people who are willing to share their work with the community. If you can’t stand what you read here, please move on to another place. I still don’t have understood your comment about the place where I live and work.. Anyway, I have no time for trolls but I’m pleased you “still learn valuable things from your website”.

Is there such a thing as a free lunch ?

Thanks Nicolas for this great work! I would like to understand the math behind it in order to convert it to Python code.

Sorry I have no time to provide assistance for python programmers. Have a good day.