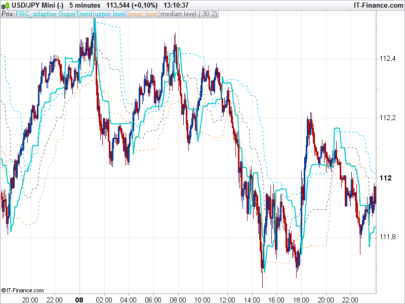

A precise picture of the short-term price swings is basic to understanding the market direction. The Clear method is an effective way to identify and visualize short-term price swings. The method benefits the individual trader because it is simple, objective, requires no calculation, and has no delay.

This indicator is the implementation of the swing line indicator presented in Ron Black’s article in this issue (“Getting Clear With Short-Term Swings”).

Code converted from TradeStation programming language by a request in the English forum.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 |

//PRC_SwingLine Ron Black | indicator //20.09.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge if upsw=1 then if high>hH then hH=high endif if low>hL then hL=low endif if high<hL then upsw=0 lL=low lH=high endif endif if upsw=0 then if low<lL then lL=low endif if high<lH then lH=high endif if low>lH then upsw=1 hH=high hL=low endif endif if upsw=1 then swingline=hL r=0 g=255 b=255 else swingline=lH r=255 g=0 b=255 endif return swingline coloured(r,g,b) style(line,2) as "Swing Line" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Nicolas, ho realizzato un screener dall’indicatore swingline ron-black, che allego. Vorrei però intercettare il cambiamento di swing da ribassista a rialzista, al cambiamento di posizione. Invece lo screener mi restituisce tutti i titoli che al momento sono in fase rialzista. Ho provato a mettere un supertrend per limitare i risultati ma non sono ancora soddisfatto. E’ possibile, a tuo parere, avere una soluzione che trovi i titoli che hanno cambiato swing nella barra precedente alla ricerca dell screener?

//PRC_SwingLine Ron Black | screener al rialzo

//20.09.2017

//Nicolas @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

if upsw=1 then

if high>hH then

hH=high

endif

if low>hL then

hL=low

endif

if high<hL then

upsw=0

lL=low

lH=high

endif

endif

if upsw=0 then

if low<lL then

lL=low

endif

if highlH then

upsw=1

hH=high

hL=low

endif

endif

if upsw=1 then

swingline=hL

else

swingline=lH

endif

indicator1=Supertrend[3,10]

cond1 = (close > indicator1[1])

screener [swingline=hL AND cond1]

Bonjour,

Ajouter une moyenne au code c’est bien aussi :

// SLRB SwingLine Ron Black PRC indicator 20.09.2017

//Nicolas @ http://www.prorealcode.com Sharing ProRealTime knowledge

if upsw=1 then

if high>hH then

hH=high

endif

if low>hL then

hL=low

endif

if high<hL then

upsw=0

lL=low

lH=high

endif

endif

if upsw=0 then

if low<lL then

lL=low

endif

if highlH then

upsw=1

hH=high

hL=low

endif

endif

if upsw=1 then

swingline=hL

r=255

g=228

b=196

else

swingline=lH

r=255

g=0

b=55

endif

maSL = average [p,m](swingline)

return maSL coloured (r,g,b) as ” maSwingLine ” , customclose as ” customeclose SLRB ” // swingline coloured(r,g,b) style(line,3) as “Swing Line” ,

// Variables :

// p = 20 entier

// m = Matype = pondérée

Grazie Supertiti, provo questo tuo codice con la media pesata!

Questo è il codice completo, perché mancavano delle righe di codice, nella versione di Supertiti. Ho anche cambiato i colori.

// SLRB SwingLine Ron Black PRC indicator modified Supertiti 20.09.2017

//Nicolas @ http://www.prorealcode.com Sharing ProRealTime knowledge

if upsw=1 then

if high>hH then

hH=high

endif

if low>hL then

hL=low

endif

if high<hL then

upsw=0

lL=low

lH=high

endif

endif

if upsw=0 then

if low<lL then

lL=low

endif

if highlH then

upsw=1

hH=high

hL=low

endif

endif

if upsw=1 then

swingline=hL

r=0

g=0

b=255

else

swingline=lH

r=255

g=0

b=0

endif

maSL = average [p,m](swingline)

return maSL coloured (r,g,b) as ” maSwingLine ” , customclose as ” customeclose SLRB ”

// swingline coloured(r,g,b) style(line,3) as “Swing Line” ,

// Variables :

// p = 20 entier

// m = Matype = pondérée

Hi Nicolas, could this indicator be used on forex?

Sure,why not? 🙂

Hi Nicolas,

the Swing Line Indicator translate by You seems to be good.

I thought that it can be used into a screener, simply replacing the “swingline” output variable with the “upsw” as output variable.

Then, it can be built a new screener that gives the ticker which shows a change from 0 to 1 or from 1 to 0, simply comparing current candle with the previous one.

I added code for Your review, if You like.

Ciao

Hi Nicolas,

Just to confirm, h=previous high and H =todays high, l=previous low and L=Todays low?? Just wanted to place the formula in excel and trying to get my head around writing it.

Thanks

Matt

hH = highest high lH = lowest high etc..

Hi Nicolas, Can you assist me with writing this in excel? I’m missing something, because l’m not getting the specified numbers in that chart to match. Mainly around selecting the high & low.

Thanks

Matt

You can ask for other platforms coding through the programming services: https://www.prorealcode.com/trading-programming-services/

Hi Nicolas, (me again)

Can you please clarify the following.

maOpen=(maOpen[1]*(MAperiod-1)+Open)/MAPeriod

maClose=(maClose[1]*(MAperiod-1)+Close)/MAPeriod

maLow=(maLow[1]*(MAperiod-1)+Low)/MAPeriod

maHigh=(maHigh[1]*(MAperiod-1)+High)/MAPeriod

I’m trying to understand where/what these figures are derived from.

Starting from O,H,L,C figures. maOpen(1) (what does the (1) signify, and is Maperiod -1 essentially the setting “maperiod less1?

trying to match the numbers on PRT.

Can you please help with this one?

Thanks

Matt

It seems to be very interesting! Can somebody better explain how they are created? Given my limited knowledge of programming language I failed to give me a precise idea of how it functions.

Bonjour

Merci pour ce travail, par contre, un petit bug dans le code de Supertiti à la ligne 23 mais sûrement corrigé de vous-même . if high< lH then (mine de rien on essaie de suivre…) le ''<'' avait disparu.

Is it possible to create a binary indicator for this indicator? What?

Should be possible but what do you think of precisely?

I would like the indicator to +1 when swing line is light blue, and opposite -1 when the swing line is purple.

Just add the r and g variables to the return instruction and you’ll get the information of the current color (r or g would be equal to 255 if the actual trend is bearish or bullish, otherwise it would be equal to 0):

return swingline coloured(r,g,b) style(line,2) as “Swing Line”, r, g

Thanks but I did not succeed. Can someone help me?

//PRC_SwingLine Ron Black | indicator

//20.09.2017

//Nicolas @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

if upsw=1 then

if high>hH then

hH=high

endif

if low>hL then

hL=low

endif

if high<hL then

upsw=0

lL=low

lH=high

endif

endif

if upsw=0 then

if low<lL then

lL=low

endif

if highlH then

upsw=1

hH=high

hL=low

endif

endif

if upsw=1 then

swingline=hL

r=0

g=255

b=255

swup=1

swdwn=0

else

swingline=lH

r=255

g=0

b=255

swup=0

swdwn=-1

endif

return swingline coloured(r,g,b) style(line,2) as “Swing Line”,swup,swdwn

Bonjour,

Je n’arrive pas à faire fonctionner cet indicateur?

Quel est le bon code dans sa totalité?

Merci

Il suffit de le télécharger, de l’importer et de l’appliquer sur le graphique du prix.

Nicolas…loving this indicator that you have created!!! Thanks for sharing with everyone! I’m not a profectional indicator’s builder…can you please, when you have time, insert a link here of this indicator (your original version with no MM) but with the signal for long/short enter indicated with the bars below the graphic…green to buy and red to sell…like the one you created for the divergences…I know that someone already asked for it and you have answered him, but following that instructions I’m not able to modify it correctly…if it is not a disturb!

Thanks so much!

And another request…don’t hate me:)….how can I indicated, inside a TS, to go long only if this indicator is setting in long way(coloured blu) or short if it indicates to go short(coloured pink)?

Thanks again

Sorry but I don’t understand what you are talking about the “original version with no MM” ?

I’m reffering to the first code you posted here…after that, someone has add a ponderate average (sorry…in italian called media mobile MM) but I don’t need it… I would like that you can modify for me the original code indicator you posted:)…

Thanks

Hi Nicholas, congratulations always for your work and sharing.

I wanted to ask if with the ron black indicator you can program a trading system.

Thank you

Please post your code request in a specific topic in the ProOrder forum, thank you.

Hi,

I get this error:

“Errore di sintassi: Linea 48, carattere 27 Uno dei seguenti caratteri sarebbe più appropriato di “r”: – a color value (0 – 255)”

how can I solve it?

thank you

Your PRT version is inferior to 10.3? So the code in its default state is not compatible. A solution is to delete all references to variables r,g and b in the code.

Hi Nicolas

Hope all is well your side, do you have a specific strategy for the MFT Swing Line indicator Alert?

No I don’t, try to make it on your own, or ask in forums (follow the posting rules please).