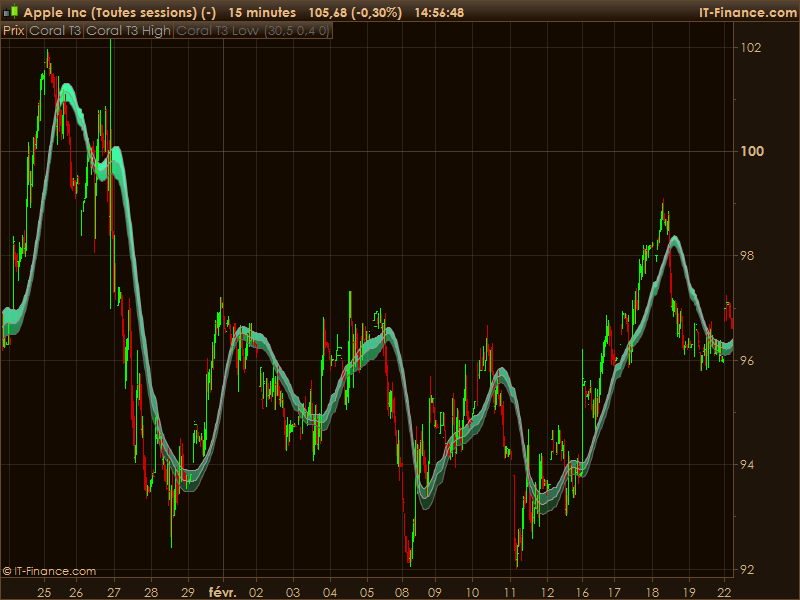

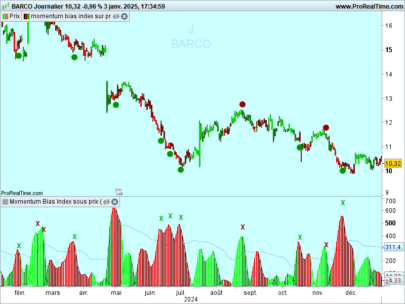

Indicator from the Kevins archive, seems made with different kind of exponential moving average with different calculation over time and coefficient. Quite looking good on intraday chart for trend filtering. I didnt play enough with the parameters to get a better idea but it seems ok to post here in the library. Dont really know from where came the code ..

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 |

//********************Required Variables // // Period float 30.5 // Hot float .4 // shift 0 // This code is used at your own risk. It was written by one of our members, Andy Thomas so thanks to him for providing it // // //********************** e1 = ExponentialAverage[Period](close) e2 = ExponentialAverage[Period](e1) e3 = ExponentialAverage[Period](e2) e4 = ExponentialAverage[Period](e3) e5 = ExponentialAverage[Period](e4) e6= ExponentialAverage[Period](e5) b = Hot b2 = b * b b3 = b * b * b c1 = -(b * b * b) c2 = 3 * b2 + 3 * b3 c3 = -6 * b2 - 3 * b - 3 * b3 c4 = 1 + 3 * b + b3 + 3 * b2 ret = c1 * e6 + c2 * e5 + c3 * e4 + c4 * e3 //////////////////////// he1 = ExponentialAverage[Period](high) he2 = ExponentialAverage[Period](he1) he3 = ExponentialAverage[Period](he2) he4 = ExponentialAverage[Period](he3) he5 = ExponentialAverage[Period](he4) he6= ExponentialAverage[Period](he5) hb = Hot hb2 = hb *hb hb3 = hb * hb * hb hc1 = -(hb * hb * hb) hc2 = 3 * hb2 + 3 * hb3 hc3 = -6 * hb2 - 3 * hb - 3 * hb3 hc4 = 1 + 3 * hb + hb3 + 3 * hb2 hret = hc1 * he6 + hc2 * he5 + hc3 * he4 + hc4 * he3 ////////////////// le1 = ExponentialAverage[Period](low) le2 = ExponentialAverage[Period](le1) le3 = ExponentialAverage[Period](le2) le4 = ExponentialAverage[Period](le3) le5 = ExponentialAverage[Period](le4) le6= ExponentialAverage[Period](le5) lb = Hot lb2 = lb * lb lb3 = lb * lb * lb lc1 = -(lb * lb * lb) lc2 = 3 * lb2 + 3 * lb3 lc3 = -6 * lb2 - 3 * lb - 3 * lb3 lc4 = 1 + 3 * lb + lb3 + 3 * lb2 lret = lc1 * le6 + lc2 * le5 + lc3 * le4 + lc4 * le3 return ret[shift] as "Coral T3",hret AS "Coral T3 High",lret AS "Coral T3 Low" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

thank you for helping the community bro!!!! i’ll try this one on forex next week

Be careful THV coral is already based on T3 😉

Zilliq

Hola. Cómo hago para poner este indicador, de manera que aparezca en el precio? Gracias de antemano.