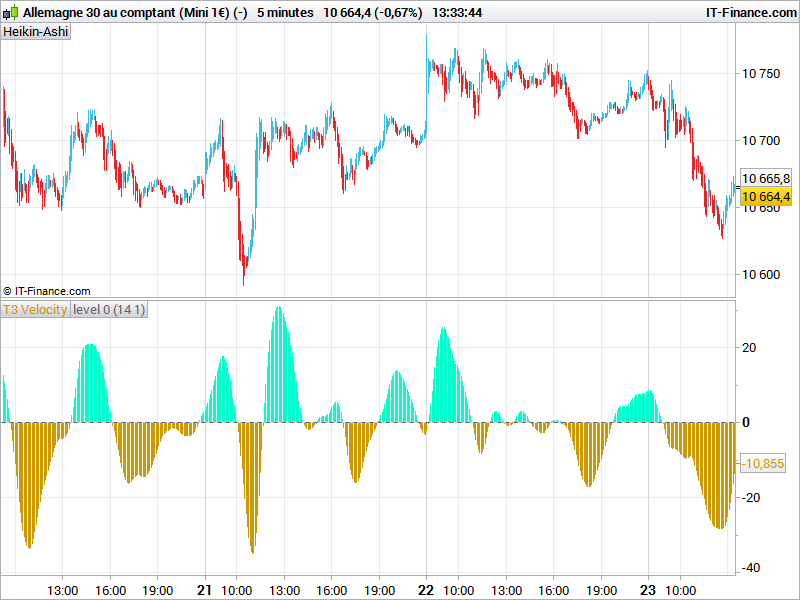

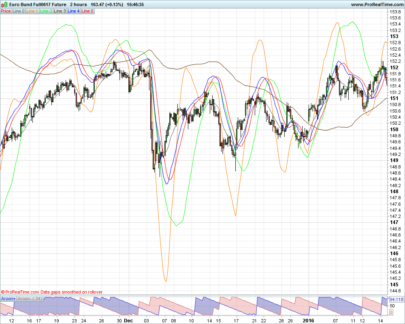

This technical indicator is a kind of rate of change oscillator made of 2 T3 moving average. It compares the momentum of the 2 curves between the current and the previous period. The first curve is calculated upon the period and the complete factor (“vFactor” parameter) and the second one with an half of this factor.

It results a smoothed oscillator that can be traded almost like a MACD. An optional signal line could be added to give clear entries when the oscillator cross it.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 |

//PRC_T2 Velocity | indicator //23.11.2016 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted and adapted from Metatrader5 version // --- parameters //period= 14 //vfactor=1.0 Data=customclose x1=(exponentialaverage[period](Data))*(1+vfactor) x2=(exponentialaverage[period](exponentialaverage[period](Data)))*vfactor gd=x1-x2 x11=(exponentialaverage[period](gd))*(1+vfactor) x21=(exponentialaverage[period](exponentialaverage[period](gd)))*vfactor gd1=x11-x21 x12=(exponentialaverage[period](gd1))*(1+vfactor) x22=(exponentialaverage[period](exponentialaverage[period](gd1)))*vfactor first=x12-x22 y1=(exponentialaverage[period](Data))*(1+vfactor/2) y2=(exponentialaverage[period](exponentialaverage[period](Data)))*vfactor/2 ygd=y1-y2 y11=(exponentialaverage[period](ygd))*(1+vfactor/2) y21=(exponentialaverage[period](exponentialaverage[period](ygd)))*vfactor/2 ygd1=y11-y21 y12=(exponentialaverage[period](ygd1))*(1+vfactor/2) y22=(exponentialaverage[period](exponentialaverage[period](ygd1)))*vfactor/2 second=y12-y22 S = first - second[1] return S as "T3 Velocity", 0 as "level 0" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

i’ll give it a try and we’ll see 😉

thanks anyway

Hello

please can you tell me for which timeframe can be used this Velocity?

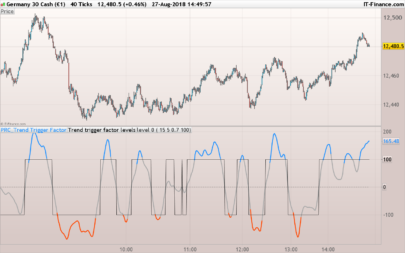

Any timeframe, you can adjust the 2 parameters “period” and “vfactor” for any instrument and timeframe. This indicator is calculated upon the difference of 2 T3 moving average, so it’s “universal” to any market circumstances.

For daily timeframe what do you suggest?

Excuse Mr Nicolas what it means to T3? I could explain what is vfactor

I’m sorry what is your question? Do you want to know what is the purpose of the vfactor coefficient?

I would like to know the purpose of the coefficient v factor but also know the meaning of the term T3. Thank you

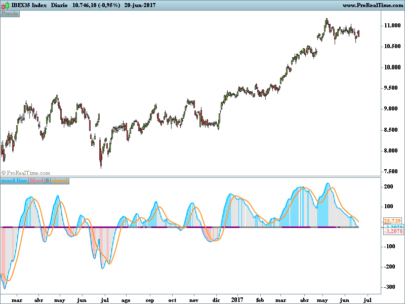

The T3 moving average is described in the January, 1998 issue of S&C, p.57, “Smoothing Techniques for More Accurate Signals”, its author is Tim Tillson. The vfactor is volume factor, which determines how hot the moving average’s response to linear trends will be. The author advises to use v=0.7.

Hi Nicolas,

please let me know buy and sell signal are when the velocity across “0” line?

thanks

Yes this is how it should be understood.

Grazie Nicolas

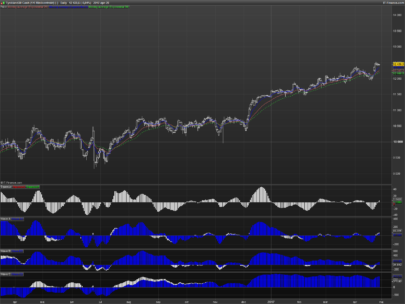

Hello Nicolas wanted to ask you a few things, I tried to change its T3 indicator putting in the same table T3 with several periods but I saw that the result is not the same as the single one that I have called period2 with 30 setting has a different path from ‘original more than 30 times that you see below (see photo), could you tell me where I’m wrong. And also I wanted to ask how can I do to color differently the three indicators and how scripted text (such as photos) with drawtest command. Thank you and good day//Tracy

period=2

vfactor=.7

Data=customclose

x1=(exponentialaverage[period](Data))*(1+vfactor)

x2=(exponentialaverage[period](exponentialaverage[period](Data)))*vfactor

gd=x1-x2

x11=(exponentialaverage[period](gd))*(1+vfactor)

x21=(exponentialaverage[period](exponentialaverage[period](gd)))*vfactor

gd1=x11-x21

x12=(exponentialaverage[period](gd1))*(1+vfactor)

x22=(exponentialaverage[period](exponentialaverage[period](gd1)))*vfactor

first=x12-x22

y1=(exponentialaverage[period](Data))*(1+vfactor/2)

y2=(exponentialaverage[period](exponentialaverage[period](Data)))*vfactor/2

ygd=y1-y2

y11=(exponentialaverage[period](ygd))*(1+vfactor/2)

y21=(exponentialaverage[period](exponentialaverage[period](ygd)))*vfactor/2

ygd1=y11-y21

y12=(exponentialaverage[period](ygd1))*(1+vfactor/2)

y22=(exponentialaverage[period](exponentialaverage[period](ygd1)))*vfactor/2

second=y12-y22

S = first - second[1]

//T+2

period1=4

vfactor1=0.7

x10=(exponentialaverage[period1](Data))*(1+vfactor1)

x20=(exponentialaverage[period1](exponentialaverage[period1](Data)))*vfactor1

gd2=x10-x20

x110=(exponentialaverage[period1](gd2))*(1+vfactor1)

x210=(exponentialaverage[period1](exponentialaverage[period1](gd2)))*vfactor1

gd20=x110-x210

x120=(exponentialaverage[period1](gd20))*(1+vfactor1)

x220=(exponentialaverage[period1](exponentialaverage[period1](gd20)))*vfactor1

first=x120-x220

y10=(exponentialaverage[period1](Data))*(1+vfactor1/2)

y20=(exponentialaverage[period1](exponentialaverage[period1](Data)))*vfactor1/2

ygd2=y10-y20

y110=(exponentialaverage[period1](ygd2))*(1+vfactor1/2)

y210=(exponentialaverage[period1](exponentialaverage[period1](ygd2)))*vfactor1/2

ygd20=y110-y210

y120=(exponentialaverage[period1](ygd20))*(1+vfactor1/2)

y220=(exponentialaverage[period1](exponentialaverage[period1](ygd20)))*vfactor1/2

second=y120-y220

S1 = first - second[1]

//T+3

period2=30

vfactor2=.7

x100=(exponentialaverage[period2](Data))*(1+vfactor2)

x200=(exponentialaverage[period2](exponentialaverage[period2](Data)))*vfactor2

gd=x100-x200

x1100=(exponentialaverage[period2](gd))*(1+vfactor2)

x2100=(exponentialaverage[period2](exponentialaverage[period](gd)))*vfactor2

gd1=x1100-x2100

x1200=(exponentialaverage[period2](gd1))*(1+vfactor2)

x2200=(exponentialaverage[period2](exponentialaverage[period2](gd1)))*vfactor2

first=x1200-x2200

y100=(exponentialaverage[period2](Data))*(1+vfactor2/2)

y200=(exponentialaverage[period2](exponentialaverage[period2](Data)))*vfactor2/2

ygd=y100-y200

y1100=(exponentialaverage[period2](ygd))*(1+vfactor2/2)

y2100=(exponentialaverage[period2](exponentialaverage[period2](ygd)))*vfactor2/2

ygd1=y1100-y2100

y1200=(exponentialaverage[period2](ygd1))*(1+vfactor2/2)

y2200=(exponentialaverage[period2](exponentialaverage[period2](ygd1)))*vfactor2/2

second=y1200-y2200

S2 = first - second[1]

DRAWTEXT (\"Tracy\", x1, y1) COLOURED (0,0, 255)

return S2 coloured (256,0,0), S as \"Tracy\", 0 as \"level 0\" ,S1 as \"T+2\", 0 as \"level 0\" , S2 as \"T+3 \", 0 as \"level 0\"

I’m sorry but I can not insert image!

As you can do to set a marker directly in the price property page and then view it such as moving averages, because I add with the button “add marker” in property price and then see it in the description on the list but do not see it in the chart

It may be a good idea to discuss this in the forum instead. Please open a new topic in probuilder support.

Hi, is this more or less the same as the TTM Squeeze indicator (john carter)