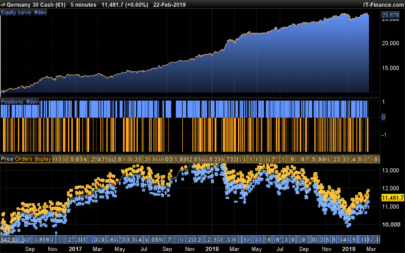

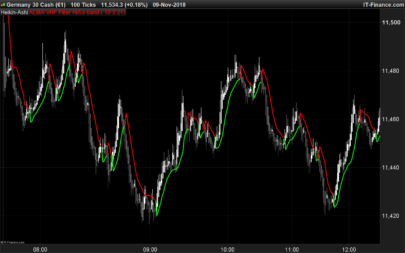

This indicator is an attempt of scalping strategy by crossing the mean high or low weigthed price over a short “n” period. This 2 lines represent the black “trench” on screenshots attached.

When signal line (white one) crossing the buy trigger one (dotted green one) a buy signal should occur and vice-versa for a sell signal (when crossing the dotted red one). I add an option to draw the white signal line as the close price value of the high/low ones if they are respectively above or below the trench’ buy or sell lines trigger.

The yellow green and red brick lines serve as stoploss.

The indicator can be use alone with no price chart as its values are derivated from it, of course if you dont mind about candlesticks informations.

I think enter/exit trades should occur very quickly, as it were designed for scalping trading purpose. I didn’t have much time to test it for a long period, so here it is as a concept indicator, despite that, it does have sense.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

//parameters : // n = 10 // useHL = true (boolean) o=summation[n](open) hh=summation[n](high) ll=summation[n](low) cc=summation[n](close) sumH = ((o+hh+cc)/(3*n)) sumL = ((o+ll+cc)/(3*n)) slH = highest[n/2](high) slL = lowest[n/2](low) if(useHL) THEN if(high>sumH) THEN price = high ELSIF (low<sumL) THEN price = low ELSE price = close ENDIF ENDIF if(NOT useHL) THEN price = close ENDIF RETURN sumH as "BUY trigger", sumL as "SELL trigger", slH as "SELL stoploss", slL as "BUY stoploss", price as "price" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour

Problème de paramétrage !

//parameters :

// n = 10n = 10 c\'est ok

// useHL = true (boolean)

useHL = true (boolean) la erreur ?

Merci si possible de me communiquer le paramétrage exactCordialement

Il suffit de télécharger le fichier ITF et de l’importer dans votre plateforme. Dans ce cas vous n’aurez pas de problème de paramétrage 🙂

Une variable “boolean” est une variable vrai/faux, soit 1/0.

ok merci pour la rapidité de la réponse

cordialement

vu ça fonctionne me reste qu’a attribuer les couleurs

Merci pour l’indicateur

J’ai l’impression qu’un truc cloche. Les triggers sont systémtiqement paralle et au milieu des stoploss ?

Tout va bien. J’avais mal lu